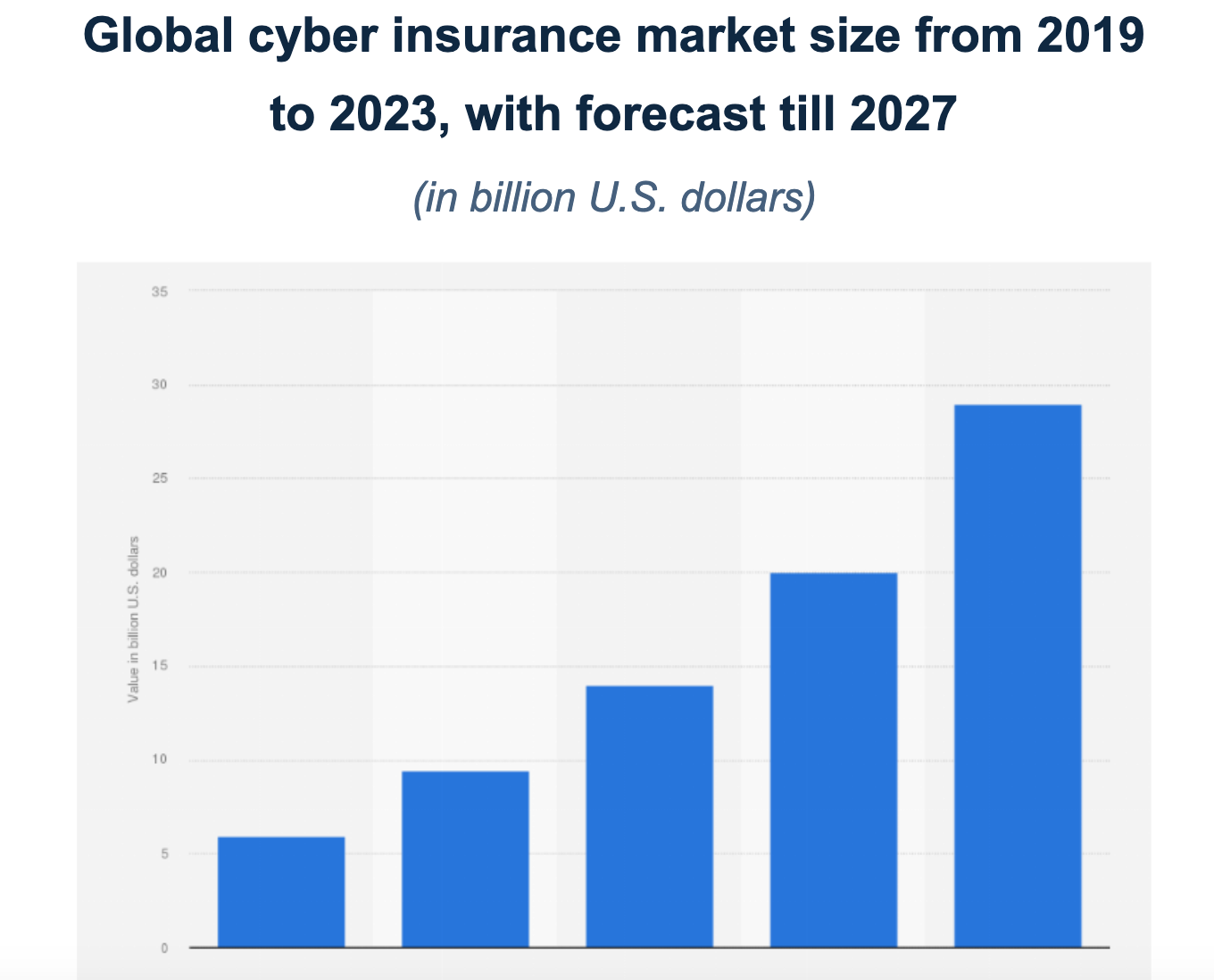

Cyber risk is no longer an abstract boardroom concern. It is operational, financial, and for many companies, existential. According to Statista (Nov 2025), the global cyber insurance market is expected to reach $29 billion by 2027, driven by rising attack volumes, accelerating digitalisation, and growing regulatory pressure.

In France, nearly seven out of ten companies reported having cyber insurance in 2023, yet a growing number are hesitating to renew their policies, citing rising prices and shrinking coverage. A paradox, perhaps - until you consider that cyber risk is now widely considered the single biggest business risk worldwide.

This widening gap between risk exposure and usable protection is precisely where Stoïk has chosen to play.

An Insurtech Built for the Forgotten Middle

Founded in 2021 by Jules Veyrat, Alexandre Andreini, Nicolas Sayer, and Philippe Mangematin, Stoïk positions itself as a European cyber insurance specialist for companies with revenues of up to €1 billion - but with products explicitly designed for SMEs and mid-sized businesses.

“Cyber risk is massive for SMEs, yet most products were historically built for large enterprises,” explains Jules Veyrat, CEO and co-founder. “What struck us early on was how many companies simply disappear after a cyberattack - and how little we hear about them.”

Rather than treating insurance and cybersecurity as separate verticals, Stoïk made an early structural decision: combine the two.

A 360-Degree Model: Insurance Meets Cyber Operations

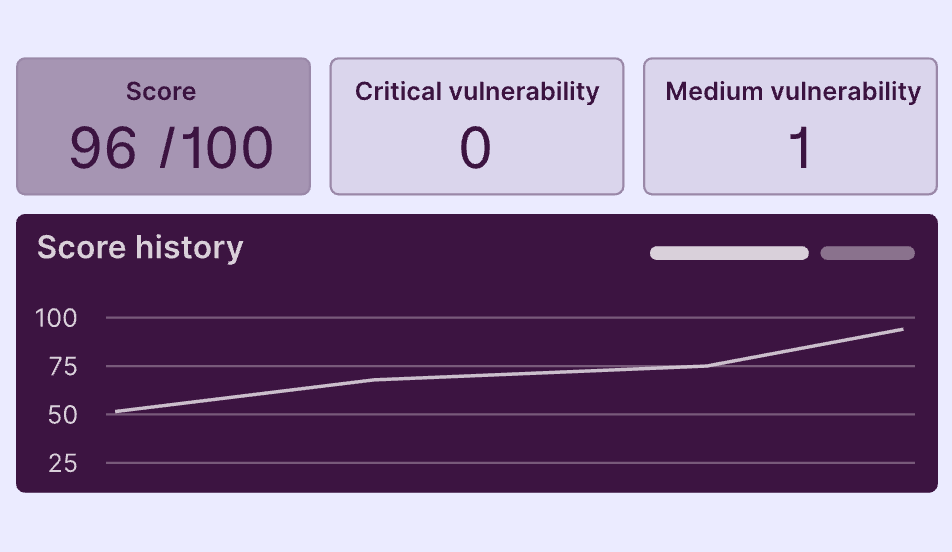

Stoïk’s offering is built around an integrated, AI-powered model that combines cyber insurance, proactive risk prevention, threat detection, and in-house incident response, available 24/7.

In practical terms, companies are protected across four core scenarios:

- Immediate access to a dedicated emergency hotline in the event of an incident;

- Coverage for business interruption losses following a cyberattack;

- Protection against business fraud, such as fraudulent supplier payments;

- Liability coverage if stolen client data leads to legal action.

“Our ambition is not just to reimburse losses,” said Veyrat. “It’s to help companies survive an attack - before, during, and after it happens.”

Increasingly, this model is supported by proprietary AI agents, which strengthen Stoïk’s prevention, detection,, and response capabilities across its portfolio.

Rapid European Expansion - by Design

Less than five years after its creation, Stoïk has posted striking growth: over 10,000 companies insured, nearly €50 million in gross written premiums in 2025, year-on-year growth exceeding 200%, and operations in six European countries: France, Germany, Spain, Belgium, Austria, and Luxembourg.

With more than 10,000 insured companies across Europe, Stoïk is building a real-time view of the cyber threat landscape.

“The most common attacks we see today are business email fraud and ransomware,” Veyrat notes. “Email-based fraud is exploding, largely because AI has made social engineering far more convincing. Ransomware attacks are less frequent because they still require advanced human IT skills, but when they happen they are extremely destructive.”

In both cases, speed of response often determines whether a company recovers or doesn’t.

Building a network of brokers

Another defining feature of Stoïk’s strategy is its fully intermediated distribution model. The company works with more than 2,000 insurance brokers, who recommend Stoïk’s policies to their clients.

“We chose to work with networks of brokers instead of going it alone as they are trusted partners for businesses. For us, they’re also a powerful scaling lever,” said Veyrat.

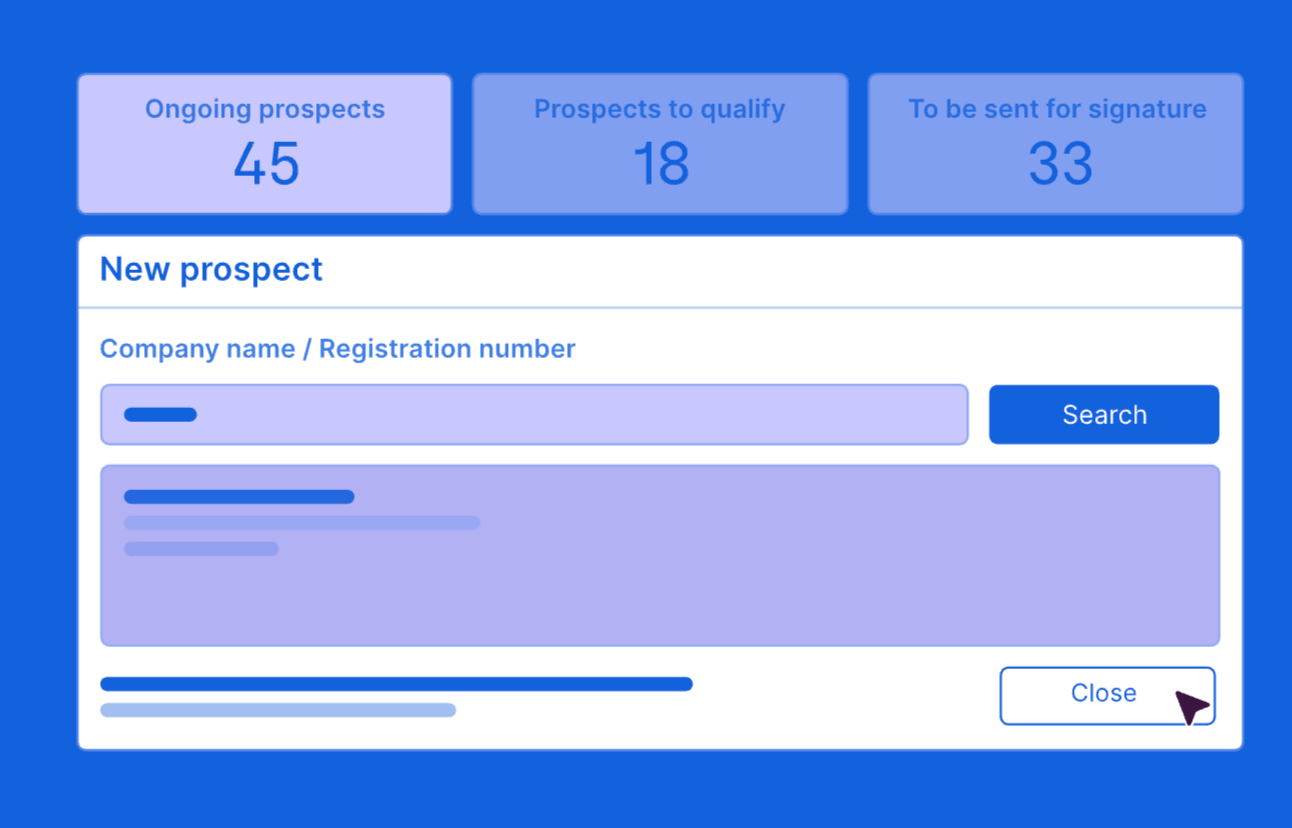

Stoïk provides brokers with a dedicated platform to generate quotes in minutes, track policies, and manage claims, while clients access a separate interface offering cybersecurity tools, monitoring capabilities and direct contact with Stoïk’s cyber experts. Brokers receive a standard industry commission, typically around 20%.

Rapid European Expansion by Design

Less than five years after its creation, Stoïk has posted striking growth: over 10,000 companies insured, nearly €50 million in gross written premiums in 2025, year-on-year growth exceeding 200%, and operations in six European countries: France, Germany, Spain, Belgium, Austria, and Luxembourg.

Germany was its first expansion market - a deliberate choice.

“The UK was already extremely crowded with US players,” said Veyrat. “Our outlook has always been European.”

Stoïk now employs around 130 people, with cybersecurity and engineering roles representing roughly 30% of the workforce.

Five Fundraises and a €20 Million Series C

Stoïk has now announced a €20 million Series C, led by Impala, the family investment company owned by the Veyrat family, alongside Opera Tech Ventures, with continued participation from Alven and Andreessen Horowitz.

“Over the past few years, we’ve built a robust business model with strong financial discipline,” said Veyrat. “Among many options, we deliberately chose a financing round calibrated to our real needs, not more.”

This latest round marks Stoïk’s fifth fundraise in just five years. It follows a €25 million round in October 2024, €8.5 million in July 2023, and €11 million in June 2022, when US venture capital firm Andreessen Horowitz entered the company’s capital, as well as an initial €3.8 million seed round in January 2022.

The Series C capital will be used to accelerate Stoïk’s European expansion, further develop its proprietary AI capabilities, and grow the team to 200 employees over the next twelve months.

Building the CISO of Europe

Stoïk’s ambition is unambiguous: to become the Chief Information Security Officer (CISO) of Europe, a trusted, continent-wide partner providing prevention, protection, and incident response at scale.

While firmly rooted in Europe for now, Veyrat doesn’t rule out a US expansion further down the line. “We’re in six countries today. We’ll see where we stand in the next three to five years.”

In the meantime, cyber risk continues to rise, and Stoïk is betting that Europe needs more than just an insurance policy to deal with it.