Deep Dives — AI

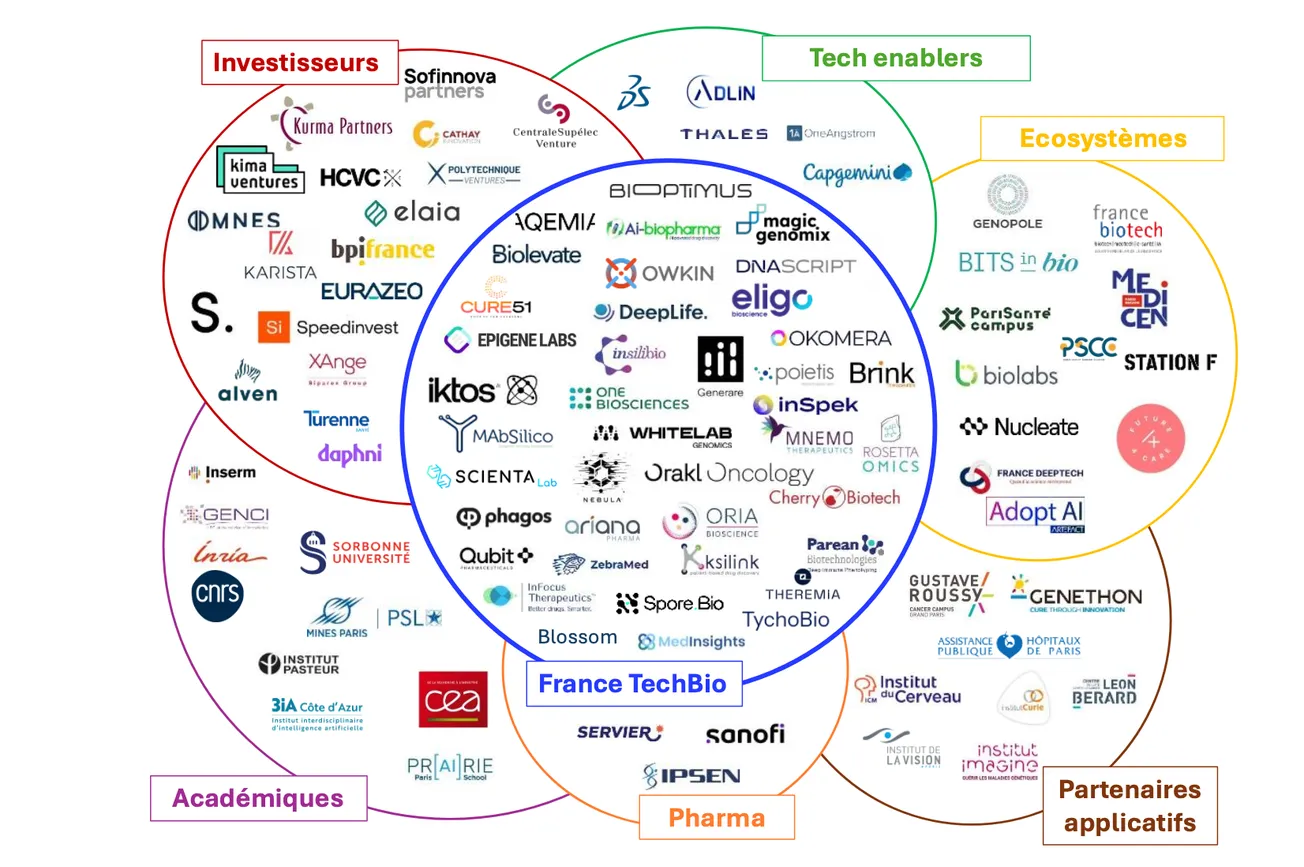

Mapping French TechBio: 40 Companies Mixing Biology, Data, and AI

A comprehensive mapping by France Biotech and France Deeptech identifies 40 companies operating at the intersection of biology and breakthrough technology, and argues that France could become a global leader in this emerging field.