🤔 Edito 🤔

🎮 The 14th edition of Paris Games Week just finished after three days of staging an event that featured a new identity, transforming from a traditional gaming expo into a full-blown pop culture festival. PGW was produced by Fimalac and GL Events, the groups behind the 2024 Olympics, and their goal was to broaden the appeal beyond hardcore gamers.

The show extended late into the night for the first time, featuring concerts, comedy, and live performances at the Dôme de Paris, with appearances from stars like Squeezie, Bigflo & Oli, and a live “Werewolves of Thiercelieux” show hosted by Fary. Influencers and streamers took center stage, too, with over 800 creators engaging fans in tournaments and meetups.

In part, this was about spectacle. But in France, video games are also big business. And over the past couple of years, that business has been hurting.

France has 600 studios developing 1000 games right now. The French video game industry is Europe's third-largest market by revenue. In 2025, 40.2 million French people (approximately 70% of the population) identified as video game players, a record driven primarily by adults, according to the Syndicat des Editeurs de Logiciels de Loisirs (SELL). This figure has grown substantially from 38.3 million in 2024 and continues climbing toward projections of 47.5 million by 2027.

France's video game market generated €5.7 billion in revenue in 2024. But that represented a 5.8% decline from 2023's record-breaking €6.0 billion, reflecting broader economic pressures affecting French consumer spending, including inflation, and political uncertainty.

It's not just France. The global video game industry has experienced an unprecedented wave of layoffs, with more than 14,600 jobs eliminated worldwide in 2024, up from 10,700 in 2023 as pandemic-fueled sales subsided.

In March 2025, struggling French studio Ubisoft announced a partnership with Chinese tech giant Tencent to establish a new gaming subsidiary, with Tencent investing €1.16 billion for a 25% stake in a unit housing Ubisoft's premier franchises including, Assassin's Creed, Far Cry, and Rainbow Six. Analysts predicted the company faced potential privatization and dismantling in 2025.

Here's how bad things have been: Earlier this year, the French Union of Video Game Workers (STJV) called for its first-ever strike to “stop all ongoing layoff plans” this winter.

And so, this is an industry badly in need of a shot in the arm. Paris Games Week was designed to deliver one.

For the first time, it included Paris Game Biz 2025, a B2B component held October 28-29, that brought together 175 participants from 70 video game studios across 10 countries, to facilitate meetings between developers, publishers, and investors. This professional networking platform addressed industry restructuring and investment needs directly.

The business event was also a chance to remind politicians of the need for ongoing support. In France, video games enjoy an official cultural recognition by the government at the same level as painting and theater. French studios benefit from a tax credit of 30% (capped at €6M) on production expenses for games designed in France. The National Center for Cinema and Moving Image (CNC) also manages a €5 million video game fund that offers grants up to €100,000.

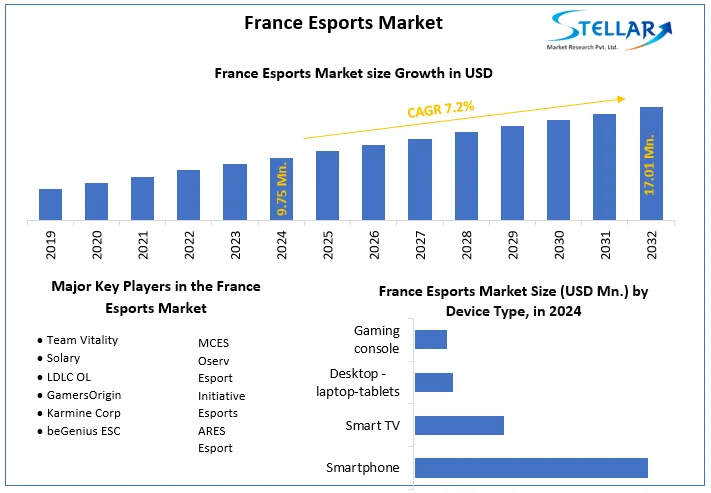

France's esports sector also benefits from government recognition. The government launched a National Esports Strategy in January 2023, which includes esports visas, grassroots development, and ecosystem structuring. In January 2024, the government reduced VAT on esports event tickets from 20% to 5.5%. France's esports market is valued at €47.5 million in 2024 and is projected to reach €258.3 million by 2035, growing at a CAGR of 16.64%, according to Stellar Research.

Inside the main expo, the CNC and SELL teamed up to create a new "Pavillon Game France," which featured video games made in the homeland to give them additional exposure. The hope is to create a greater awareness internationally that France is a video game stronghold.

French Digital and AI Minister Anne Le Henanff popped by the expo on Thursday afternoon to demonstrate her suppor, and pledge to protect the various tax incentives and financial supports from her budget-cutting colleagues. “The French video game is a sector of excellence. I will be vigilant on all the discussions that will take place in the coming days, but I trust parliamentarians to defend our system,” she told Le Figaro.

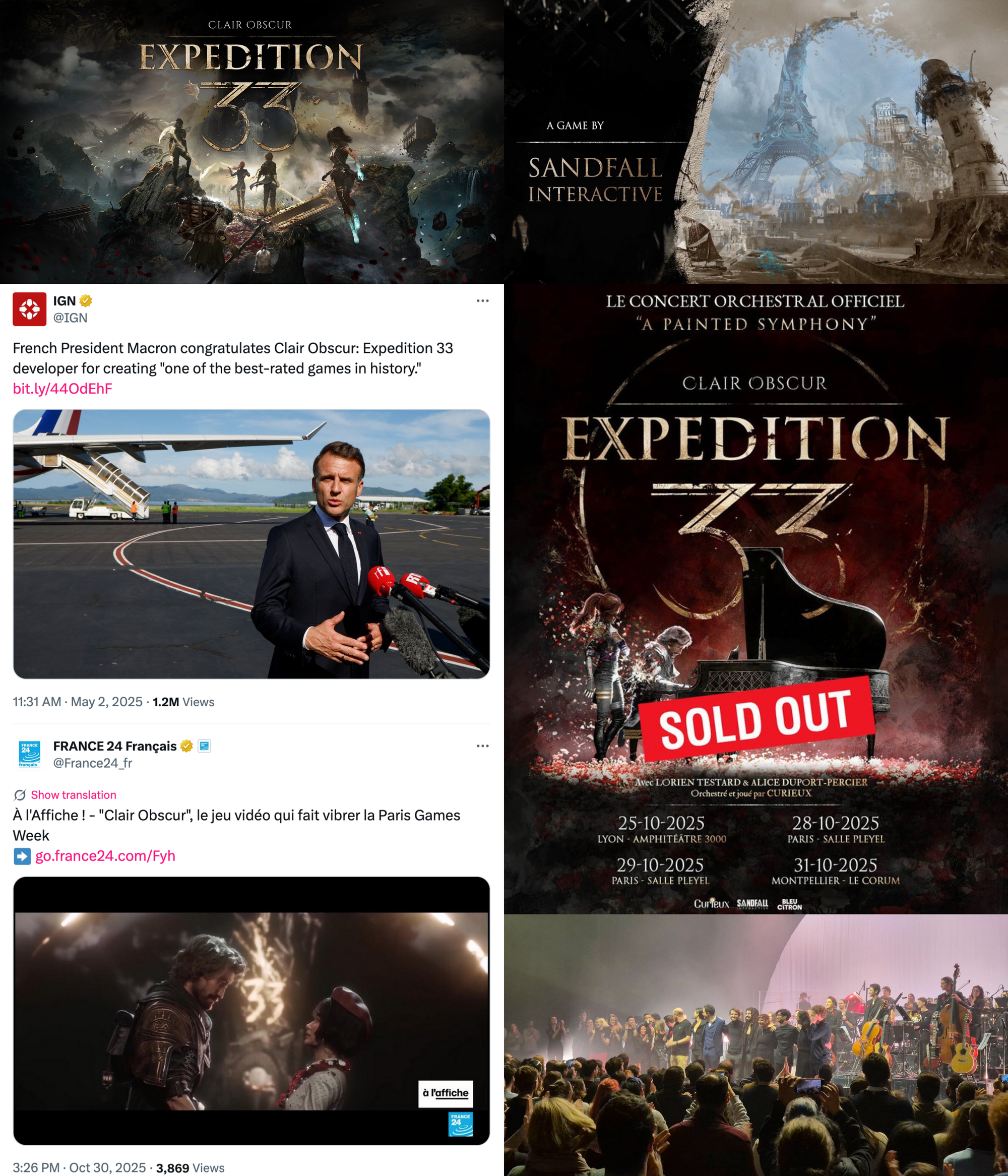

Amid this anxiety, however, there has been a welcome beacon of hope. At PGW last week, the spotlight belonged to a standout phenomenon: Clair Obscur: Expédition 33. With over 5 million copies sold in six months, the title from Montpellier’s Sandfall Interactive has exploded this year into a global cultural phenomenon.

Set in a dark, Belle Époque–inspired world, the people of Lumière are cursed by the annual Gommage: a mysterious artist called the Paintress paints a number, and everyone of that age vanishes. The volunteers of Expedition 33 set out to cross the mainland and end the Paintress’s cycle. It’s a turn-based RPG with real-time inputs (parries, dodges) and a deliberately interpretive ending. The game’s characters and settings are unapologetically French, and fans came to PGW decked out in their favorite French clothing in tribute to their chosen characters.

The game has garnered several awards, and the soundtrack topped Billboard’s Classical and Classical Crossover charts. At PGW, a symphony concert of the soundtrack was performed before a sold-out crowd. It is this kind of breakthrough that France's video game industry hopes heralds an artistic and commercial revival of its fortunes.

🚀 The French Tech Journal is proud to announce our participation in Adopt AI - Grand Palais, the business sequel to the AI Action Summit and its influential AI business summit. Adopt AI will take place November 25 & 26, 2025, at the Grand Palais, Paris.

We're offering a 10% discount on regular and VIP tickets.👇

Over three days, Adopt AI will feature high-profile international speakers sharing visionary insights about how AI is transforming industries through case studies and expert-led sessions. The event will draw 25,000+ participants for hands-on discussions that drive real adoption.

🚨 What can you expect?

🎤 500+ speakers

🎯 Multiple conference stages with visionary keynotes and masterclasses

🏛 An inspiring CEO Stage featuring iconic global leaders in AI and business

🤝 250+ exhibitors from all sectors

🔍 Concrete AI use cases across industries

👉 An Adopt AI pass gets you full access to AI for Health, AI for Finance, AI for Industry, AI for Luxury, AI for Travel, AI for Sport, AI for the Planet, AI for Retail.

👼 Angry Angels 👼

France Angels, the national federation of business angels, warns that Article 3 of France’s 2026 Finance Bill risks undermining the country’s early-stage innovation ecosystem. In an open letter to legislators and politicians, the group is pushing back against the introduction of a new tax on financial holdings. The group argues that the measure’s complexity, particularly around valuing illiquid startup shares and distinguishing between direct and indirect holdings, would add significant administrative burdens and deter individuals from investing through common holding structures such as SPVs and SIBAs.

🪖 Getting Defensive 🪖

🎖️ Bpifrance hosted the first edition of European Defense Week last week, which brought together 400 organizations to talk about the business of defense, including investors and startups. The event included the announcement of the Defense Angels European Network (DAEN), which is adopting the model of the French Défense Angels, founded in 2022 to address limited defense innovation funding and advocate for increased private investment. In a report released by Bpifrance, there is widespread interest among companies that want to tap into the defense market, but many hurdles.

🧀 Government Cheese 🧀

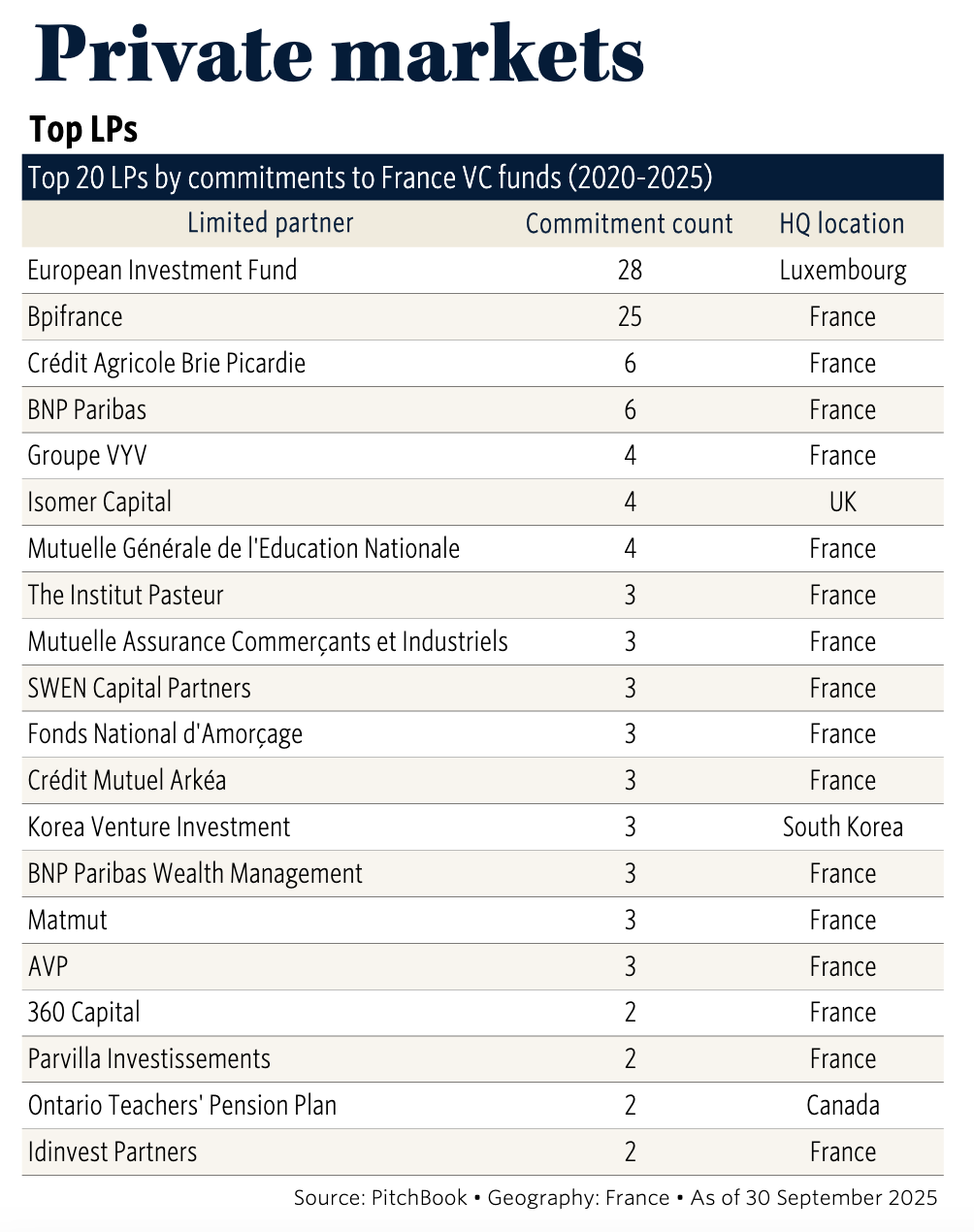

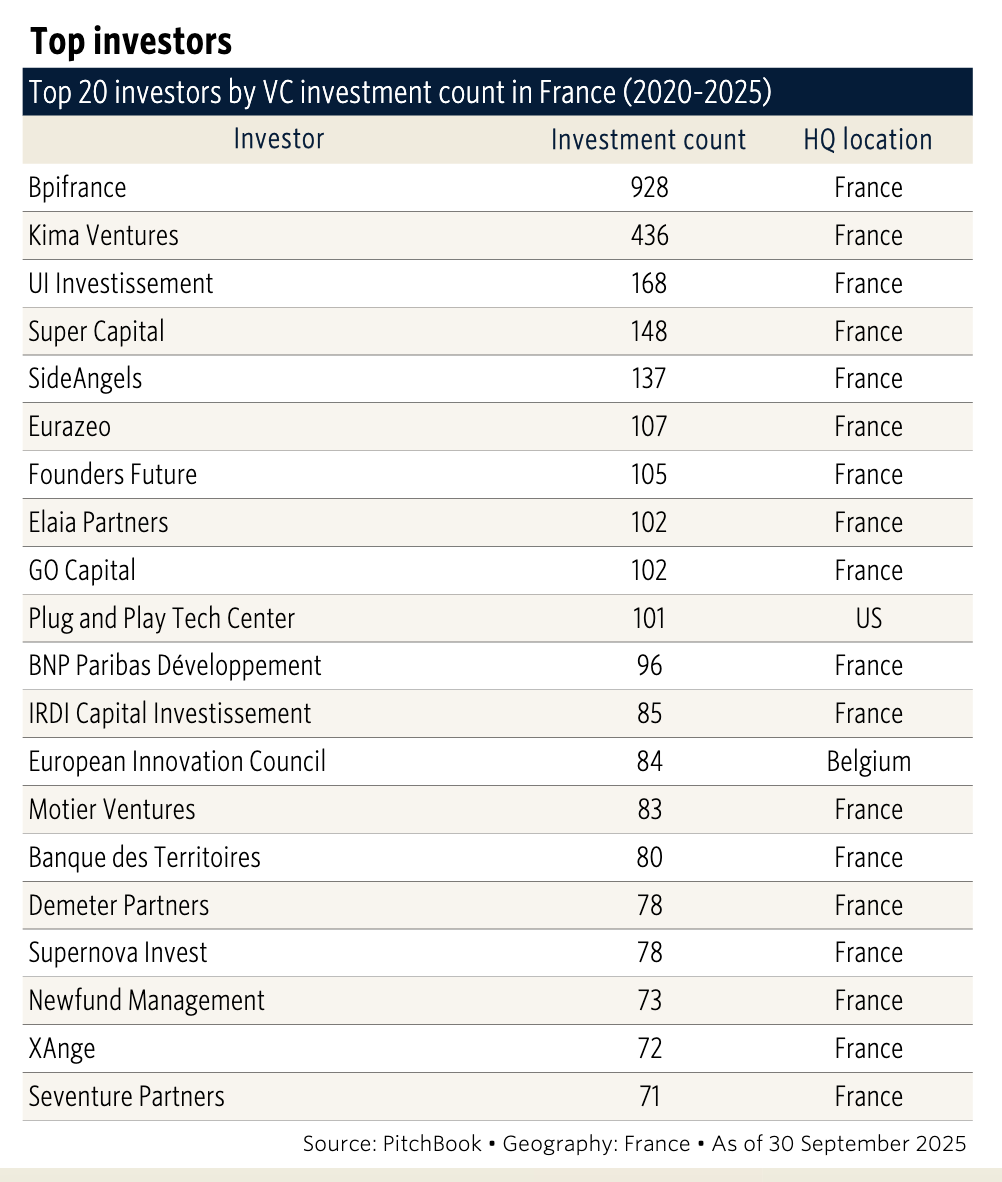

The Pitchbook Q3 2025 France Market Snapshot offers us a periodic reminder of the weighty role that the government plays in France's startup ecosystem, at both the French and European levels.

Want to reach an audience of more than 30,000 readers each month? The French Tech Journal is the leading English-language media platform covering France's dynamic tech ecosystem. With 31,000 + engaged readers across key global markets and consistently high engagement rates, our sponsorships provide unparalleled access to decision-makers in French tech.

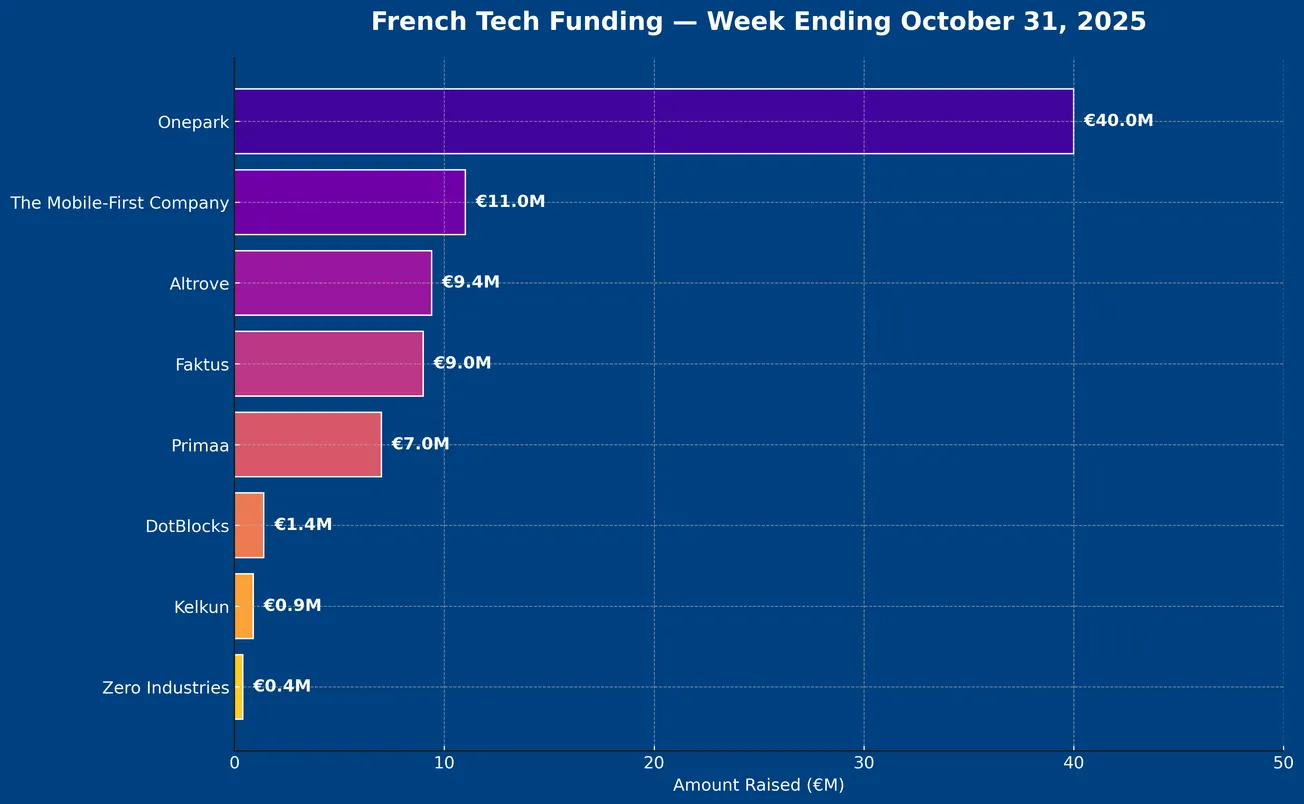

💸 Weekly Funding Recap: October 31

🏆 Key Highlights

- Total Raised (Equity): €79.1 million

- Number of Companies: 8

- Average Round Size: ~€9.9 million

- Dominant City: Paris — 6 of 8 deals

- Top Deal: 🥇 Onepark (€40M) — Mobility & Smart Parking

🧬 Sector Diversity

🚗 Mobility & Smart Cities

- Onepark (€40M) — European leader in online parking and B2B fleet management solutions.

- Kelkun (€0.9M) — Trusted digital marketplace connecting verified artisans and clients in the construction sector.

💻 AI & Software

- The Mobile-First Company (€11M) — Building a mobile-native AI SaaS suite for SMBs.

- DotBlocks (€1.4M) — Democratizing industrial simulation with cloud-based tools.

⚙️ Deeptech & Industrial Innovation

- Altrove (€9.4M) — AI-designed sustainable materials to replace rare earths and critical metals.

- Zero Industries (€0.4M) — GPS-free drone navigation for defense applications.

💳 Fintech

- Faktus (€9M) — Neobank for the construction sector combining project-based financing and AI risk analysis.

🧠 Medtech & Health AI

- Primaa (€7M) — AI diagnostics for histology and cancer detection (breast and skin).

🔥🔥🔥🔥

📇 Company: Onepark

🔍 Description: French mobility and smart parking platform enabling users to book parking spaces online in over 3,500 locations across Europe. Onepark connects drivers with hotels, airports, and private operators to optimize underused parking capacity, combining convenience with urban efficiency.

💻 Website: https://www.onepark.co

📍 HQ City: Paris, France

🧗 Round: Growth / Series C

💰 Amount Raised: €40 million

🏦 Investors: TotalEnergies (new strategic investor), Keolis, ADP (Aéroports de Paris), Accor (existing investors)

👨👩 Founders: David Vanden Born, Gilles Latouche

🗞️ News: Onepark raised €40 million in fresh capital led by TotalEnergies, which also entered into a strategic partnership allowing its 2.3 million Fleet card users to access Onepark’s parking services. Existing shareholders Keolis, ADP, and Accor also reinvested. The deal aims to double Onepark’s revenue to €60 million and expand its user base to 5 million. The company will use the funding to accelerate its B2B solution Flow, explore potential acquisitions, and solidify its position as a European leader in digital parking and mobility services. | Maddyness

📇 Company: The Mobile-First Company

🔍 Description: Paris-based startup building an AI-powered mobile software suite for small business teams. Its flagship product, Allo, is an AI-driven phone system designed for SMBs, featuring an AI receptionist, smart call summaries, intelligent routing, voicemail transcription, and seamless CRM integrations. Unlike traditional VoIP systems, Allo operates entirely on mobile devices, eliminating the need for complex IT infrastructure. The company follows a modular “One Problem, One App” approach, with upcoming products Due (AI invoicing) and Claim (expense management).

💻 Website: http://themobilefirstcompany.com/

📍 HQ City: Paris, France

🧗 Round: Seed

💰 Amount Raised: $12 million

🏦 Investors: Base10 Partners (lead), Lightspeed Venture Partners

👨👩 Founders: Jérémy Goillot (CEO, ex-Head of Growth at Spendesk) and Franco Pinto (CTO)

🗞️ News: The funding will support the expansion of The Mobile-First Company’s AI-driven suite globally, with a focus on the U.S. market, where Allo is experiencing 50% month-over-month growth. The startup aims to build simple, fast, and accessible software for small business owners traditionally underserved by enterprise SaaS, positioning itself as a mobile-native alternative to incumbents like RingCentral, Dialpad, Aircall, and Nextiva. | PR, Tech Funding News

📇 Company: ReGeneration

🔍 Description: Paris-based startup pioneering data-driven regenerative agriculture programs across Europe. ReGeneration helps farmers transition to sustainable practices—such as no-till farming, cover cropping, and input reduction—while quantifying and monetizing environmental benefits like carbon sequestration, biodiversity, and water quality. Its robust data platform measures real-world impact across climate, ecosystems, and farmer livelihoods, enabling the generation of high-integrity carbon credits certified by Verra (VM0042) and pending Climate, Community & Biodiversity (CCB) certification.

💻 Website: https://regeneration.eu

📍 HQ City: Paris, France

🧗 Round: Carbon Investment / Project Financing

💰 Amount Raised: €10 million

🏦 Investors: Mirova (affiliated with Natixis Investment Managers)

👨👩 Founders / Leadership: Thomas Rabant (CEO)

🗞️ News: The €10 million investment—Mirova’s first carbon investment in France—will enable ReGeneration to support around 3,400 farmers in adopting regenerative practices across 500,000 hectares in France and Belgium. Over 20 years, the project is expected to avoid or sequester 10.4 million tonnes of CO₂ equivalent, while improving soil health, biodiversity, and water resources. Farmers will receive individualized agronomic support over five years and share in revenues from high-integrity carbon credits. The partnership marks a milestone for scaling regenerative agriculture and advancing a transparent, high-impact carbon market in Europe. | PR

📇 Company: Primaa

🔍 Description: Paris-based MedTech startup developing AI-powered diagnostic software for histology and cancer detection. Primaa’s CE-marked solution Cleo Breast automates the detection and quantification of key biomarkers in breast cancer, while Cleo Skin—in the process of CE marking—targets melanoma, squamous cell carcinoma, and basal cell carcinoma. Its tools enhance diagnostic accuracy, reduce processing time, and alleviate pathologists’ workloads.

💻 Website: https://primaalab.com/

📍 HQ City: Paris, France

🧗 Round: Extended Financing Round

💰 Amount Raised: €7 million

🏦 Investors: MH Innov’–Elaia partnership fund, SWEN Capital Partners, Super Capital, and members of the Wendel family

👨👩 Founders: Fanny Sockeel (CEO & Co-founder)

🗞️ News: The new capital will accelerate Primaa’s European expansion and customer support, advance predictive AI models for disease progression and relapse risk, and support U.S. market entry through upcoming FDA certification activities. Its Cleo Breast and Cleo Skin tools are already deployed in leading French institutions such as Institut Curie, AP-HP, and Saint-Joseph Hospital. | Tech EU

📇 Company: Faktus

🔍 Description: Paris-based fintech building the first European neobank dedicated to the construction sector. Faktus provides financing solutions for craftsmen and small BTP (construction and public works) businesses traditionally underserved by banks. Its AI-powered platform analyzes invoices, contracts, and project schedules to reduce financing approval times from several weeks to just two hours. The platform also offers professional accounts with real-time cash flow tracking, invoice financing, material advances, and retention guarantees for project completion.

💻 Website: https://faktus.eu/

📍 HQ City: Paris, France

🧗 Round: Seed (Equity + Debt)

💰 Amount Raised: €9M equity (+€47M debt)

🏦 Investors: Lakestar, Foundamental (equity), Insight Investment, and Fost Capital (debt providers)

👨👩 Founders: Alexandre Pochon and Réda Kabbaj

🗞️ News: The funds will enable Faktus to finance €500 million worth of construction projects within 18 months, strengthen its national presence across France, and expand into the UK, Germany, Spain, Italy, and Portugal by 2026. Since launch, Faktus has financed over 470 projects worth €100 million—including major sites such as Roland-Garros and the French Senate—and built a 30-person team combining expertise from BNP, Qonto, Revolut, Saint-Gobain, Coface, and Mirakl. | FrenchWeb

📇 Company: Altrove

🔍 Description: Paris-based deeptech startup developing AI-designed sustainable alternatives to critical materials such as rare earths and cobalt. Altrove’s proprietary platform integrates artificial intelligence, automated synthesis, and self-learning characterization to accelerate material discovery from years to weeks. The company aims to strengthen Europe’s industrial sovereignty by reducing dependence on imported materials used in electrification and high-performance manufacturing.

💻 Website: https://www.altrove.ai

📍 HQ City: Paris, France

🧗 Round: Seed

💰 Amount Raised: $10 million

🏦 Investors: Alven (lead), Bpifrance Digital Venture, Contrarian Ventures, Emblem; existing investors Entrepreneurs First and angels including Thomas Clozel (Owkin), Julien Chaumond (Hugging Face), Thomas Plantenga (Vinted), and Michal Valko (ex-Meta)

👨👩 Founders: Thibaud Martin (CEO) and Dr. Joonatan Laulainen (CTO)

🗞️ News: The funding will be used to expand Altrove’s R&D labs, grow its technical team, and scale AI-designed materials from gram-scale to industrial production within two years. The company has already achieved breakthroughs in rare-earth-free and cobalt-free magnetic materials and non-toxic, lead-free compounds for sensors and actuators, securing over a dozen partnerships across the automotive, energy, and heavy industry sectors. | Tech EU

📇 Company: DotBlocks

🔍 Description: Paris-based startup developing a cloud platform that democratizes numerical simulation and modeling for industrial companies. DotBlocks aims to make advanced computation accessible beyond R&D teams — enabling engineers, designers, and factory staff to accelerate innovation, improve process design, and support decarbonization in heavy industries such as metallurgy, glass manufacturing, and high-temperature processes.

💻 Website: https://dotblocks.com/

📍 HQ City: Paris, France

🧗 Round: Pre-Seed

💰 Amount Raised: €1.4 million

🏦 Investors: OPRTRS Club (lead), Aglaé Ventures, Kima Ventures, Olivier Pomel (CEO of Datadog), Thibaud Elzière (co-founder of Hexa), and Renaud Boutet (ex-Product Management Director at Datadog, Venture Partner at Hedosophia)

👨👩 Founders: Kevin Lippera (CEO, ex-Saint-Gobain) and Joffrey Bluthé (ex-CEA)

🗞️ News: The funding will accelerate DotBlocks’ commercial deployment—particularly with major industrial partners like Saint-Gobain—and support the expansion of its technical teams. The startup aims to position itself as a key player in next-generation industrial simulation by making high-performance modeling tools accessible across entire organizations. | FrenchWeb, Maddyness

📇 Company: Energy&+ (subsidiary of Charwood Energy)

🔍 Description: French renewable energy company specializing in biomass-based heat solutions that help local territories decarbonize their energy consumption. Energy&+ designs and operates installations that convert local resources — such as wood chips and agricultural residues — into carbon-neutral energy for municipalities, industrial players, farmers, and private sector clients. The company supports local energy sovereignty by promoting circular economy practices and stabilizing energy costs.

💻 Website: https://charwood.energy/

📍 HQ City: Rennes, France (Charwood Energy headquarters)

🧗 Round: Participatory Loan (Crowdfunding)

💰 Amount Raised: €1 million

🏦 Investors: Crowd investors via the MiiMOSA platform

👨👩 Founders / Leadership: Adrien Haller (CEO & Founder, Charwood Energy)

🗞️ News: The €1 million participatory loan campaign on MiiMOSA was fully subscribed in just three days, reflecting strong investor confidence. The 4-year loan offers an 8% annual interest rate, backed by a 100% first-demand guarantee from Charwood Energy. The funding will accelerate Energy&+’s expansion, strengthen its industrial model, and support its territorial deployment amid 46% year-over-year revenue growth and a 127% increase in its order backlog in H1 2025.

📇 Company: Kelkun

🔍 Description: Montpellier-based startup operating a national digital platform that securely connects qualified building artisans with clients. Kelkun ensures trusted matchmaking through advanced qualification and verification technologies, aiming to simplify project management in the construction sector. The platform already counts over 4,000 verified artisans and generates 400 new projects each month.

💻 Website: https://www.kelkun.com/

📍 HQ City: Montpellier, France

🧗 Round: Extension / Bridge Round

💰 Amount Raised: €900,000

🏦 Investors: Existing shareholders

👨👩 Founders: Grégory Valency

🗞️ News: The new funding will accelerate Kelkun’s national expansion, enhance its verification and security technologies, and enable new use cases with institutional partners in the construction ecosystem. The company also plans to evolve into a broader trust-based platform serving the retail and insurance sectors, while expanding its team with 10 new hires by year-end.

📇 Company: Zero Industries

🔍 Description: Toulouse-based defense tech startup developing AI-powered navigation systems that enable drones to fly autonomously without GPS. Founded by former Instituto Superior Técnico aerospace engineering students, Zero Industries’ proprietary algorithm uses computer vision and real-time image analysis to determine drone position even when GPS signals are jammed — a major challenge in modern warfare scenarios like Ukraine. The solution replaces manual image matching with automated, intelligent navigation to enhance precision, autonomy, and safety in the field.

💻 Website: https://www.zeroindustries.eu/

📍 HQ City: Toulouse, France

🧗 Round: Pre-Seed

💰 Amount Raised: €400,000

🏦 Investors: Heartfelt_ and Project Europe

👨👩 Founders: Frederico Baptista (CEO), João Silva (CTO), and Álvaro Patrício (COO)

🗞️ News: The funding supports the development of Zero Industries’ first commercial product addressing GPS-free drone navigation within six months. Incubated at ISAE-SUPAERO, the company is strategically positioned in Europe’s leading aerospace hub and backed by European defense networks, including contacts with the UK and German armies. A seed round is planned to support industrialization and expand its mission of embedding intelligence and autonomy into existing defense systems.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻