A quick flashback: where we were heading into 2025

Globally, 2024 was not a banner year for venture capital. After the post-pandemic highs of 2021 and the ensuing sharp correction of 2022, the market settled into a slower, more selective rhythm.

According to PitchBook’s 2024 European funding “Hot or not” report, deal value was down 7% in Europe and 15% in France.

Despite this, heading into 2025, the French VCs we questioned were broadly optimistic. Optimism levels hovered around 7–8 out of 10, with many investors convinced that the worst of the correction was behind them.

So… how did that optimism fare when confronted with reality?

2025 in practice: fewer startup deals, bigger cheques, shakier ground

In many respects, 2025 proved just as rocky as 2024, if not more so.

As PitchBook dryly noted in its 2025 European VC outlook, “French startups have endured a difficult year, with political turbulence creating uncertainty for private market investors. Cuts to government budgets for innovation, as well as reduced tax breaks and subsidies, have further limited growth.”

Political instability dragged on at home (two prime ministers, three governments, a hung parliament…), while abroad, geopolitical tensions intensified, doing little to reassure private market investors.

The numbers tell a similar story. According to EY’s Baromètre du Capital-Risque, in 2025, French startups raised around €7.4bn across roughly 618 deals, down about 5% in value and 15% in deal count year on year, a decline broadly in line with 2024. Strip out Mistral AI’s €1.7bn mega-round, however, and the picture would look significantly bleaker.

Deal flow also continued to thin at the early stages. Reports show a marked drop in seed and Series A activity, while capital is increasingly concentrated in fewer, larger late-stage rounds. France also lost its position as Europe’s second-largest VC market by deal value to Germany.

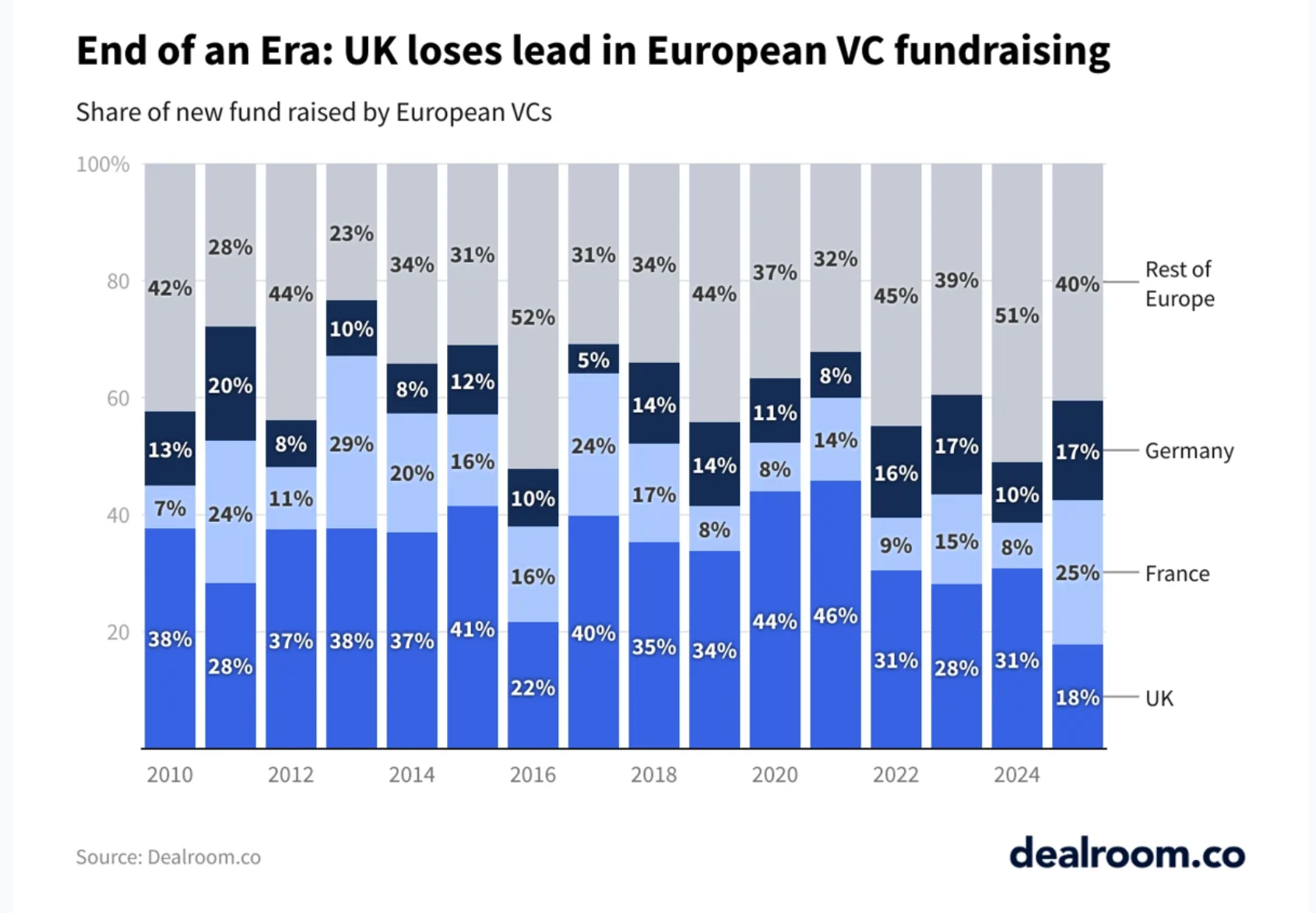

And yet, if French startup funding remained subdued, French VC fundraising told a brighter story, in particular when compared to Europe.

Fewer funds, fatter vehicles

VC fundraising was undeniably down across Europe in 2025 — though just how bad it looks depends on where you look.

PitchBook, whose methodology only takes into account closed funds, described 2025 as “the weakest showing in the past decade”, with fundraising down close to 50%, ending the year at €12bn across 148 vehicles.

Dealroom, which includes both closed and open funds, offered a more nuanced view, estimating the decline at around 27%, with €20.7bn raised across 255 vehicles.

Back in France, however, VC fundraising amounts, according to Dealroom, increased intriguingly by 154%, for a comparatively small increase in new funds (+7 compared to 2024), placing France ahead of the UK for the first time ever.

When asked to interpret this, French VCs largely converge on the same explanation: concentration.

“What we’re seeing is capital concentration across the entire stack,” explained Paul Moriou, Partner at Serena. “LPs are concentrating commitments into fewer managers, managers are raising larger funds, and capital is flowing into fewer companies, particularly in AI-driven markets where scale matters early.”

Alison Imbert at Partech sees this as a sign of ecosystem maturity: “LPs increasingly expect validated performance rather than promise… we’re seeing more and more LPs concentrate their commitments in the top quartile (or even top decile) of their existing VC portfolios.”

Other VC partners, like Breega’s François Paulus, underline how the launch of mega-funds such as Cathay (€1B), Sofinnova (€650M) or Jolt (€600M) skewed 2025 fundraising figures. He also pointed out that elongated fundraising cycles mean that funds launched in late 2023 or 2024 only reached first or final close in 2025 - creating the illusion of a sudden spike. He agreed too that in volatile times, LPs are more inclined to back established names, mechanically pushing average fund sizes upwards.

Elaia’s Alexis Frentz sums it up with what he calls the “IBM effect”: in uncertain environments, investors gravitate toward safe, established brands.

For Wind’s Xavier Gury, this evolution is also structural. The arrival of fewer later-stage French funds writing larger cheques makes sense, he argues, “in a market where there is a clear financing gap to bridge between Series A funds and growth stage capital”.

Iris’s Managing Partner JD Nitlech frames the shift bluntly with a warning note: “On the surface, the market looks active again… But underneath, the system is far more fragile than it appears.”

The result? Larger vehicles…and less room for error.

What stayed hot - and what surprised

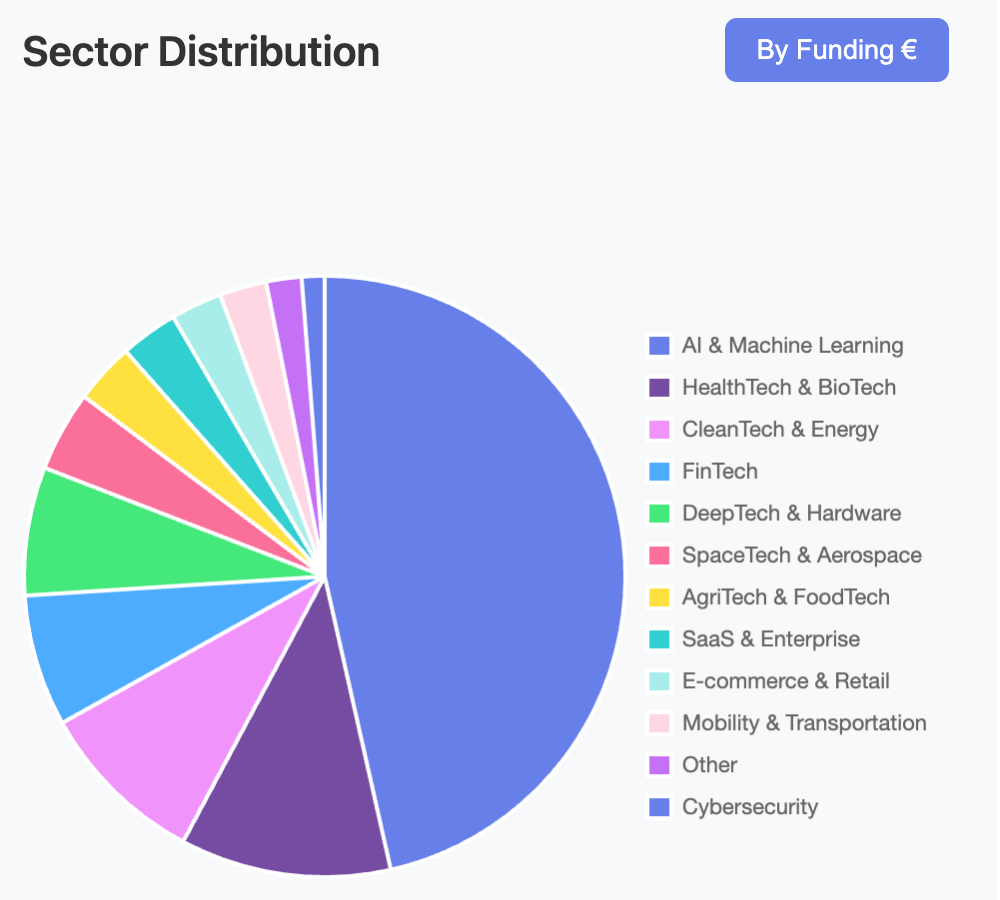

Back in early 2025, French VCs were bullish on AI, climate tech, and cybersecurity. For the most part, that thesis held.

AI remained, in the words of more than one investor, “incontournable.” It dominated deal value and powered the year’s largest rounds. Climate tech and cybersecurity also saw sustained interest.

The French Tech Journal’s brand-new funding database shows that AI deals accounted for almost half (48%) of all French funding deals in 2025. Healthtech followed (11%), then Clean Tech & Energy, while cybersecurity ticked up more modestly (+1% of all French deals), despite rising enterprise and sovereign risk concerns.

What few predicted at the start of the year, however, was the speed at which defence and sovereignty would move centre stage.

As geopolitical tensions hardened, defence or “dual tech” - from drones to counter-drone systems and software-led defence stacks - started to become a recurring theme across VC portfolios. Sovereignty, notably absent from last year’s responses, is now firmly on the agenda.

From buzzwords to battlegrounds: where VCs are placing their 2026 bets

If one thing is clear from French VCs’ responses, it’s that 2026 will not be about chasing surface-level trends. The language has shifted away from buzzwords and toward bottlenecks, constraints, and control points.

Across Iris, Ventech, Partech, Elaia, Breega, Serena and Wind, the same message comes through: the easy layers are crowded; the hard layers are where conviction is forming.

AI remains central, but increasingly selective. Rather than feature-level or consumer-facing applications, investors are focusing on AI infrastructure and the data layer. JD Nitlech highlights compute optimisation, data pipelines, orchestration, post-training, and observability as the areas where differentiation and pricing power now sit, as application-layer AI becomes more commoditised.

That focus on depth extends into industrial tech and physical AI. Robotics, automation, and production software emerge as key 2026 growth areas - driven less by experimentation than by necessity. Labour shortages, margin pressure, and rising energy costs are pushing industrial players toward AI and automation as tools to stay competitive. Ventech points to physical AI robotics and new materials; Elaia is actively investing in physical AI; while Breega highlights orchestration layers that can coordinate heterogeneous robot fleets and full-stack warehouse or factory solutions with guaranteed throughput.

Defence, security, and sovereignty have meanwhile moved from the periphery to the core of 2026 theses. Serena identifies drones, counter-drone systems, and software-led defence stacks as part of a structural repricing of security. Iris frames security and critical infrastructure as a direct consequence of geopolitical and sovereignty constraints shaping procurement and investment decisions. Partech extends the sovereignty theme beyond defence, arguing it will increasingly apply to AI models and infrastructure as Europe accelerates to catch up with the US.

Another recurring thread is energy and system resilience. As AI load grows and geopolitical constraints persist, Serena points to grids, flexibility, and electrification infrastructure becoming strategic. Wind is aligned stating: “There can be no AI revolution without an energy revolution,” with the firm expecting renewables to become the leading energy source by 2026.

Caution, however, is widespread. Several investors explicitly flag commoditised AI layers and subsidy-heavy industrial climate tech as areas of restraint. Breega, in particular, warns that capital-intensive projects dependent on uncertain public budgets risk stalling.

Taken together, the picture for 2026 is less about hype and more about control, resilience, and durability.

So… how optimistic are we about 2026?

Last year, optimism was almost unanimous. This year, the mood is decidedly more varied.

Some remain emphatically bullish. Partech and Elaia both clock in at 9/10 or above, buoyed by Europe’s talent pool and the long-term promise of AI-driven transformation. “European startups are now being built in Europe and scaled in the US,” noted Partech’s Alison Imbert, “with founders unafraid to move early in their journey when needed.”

Wind’s outlook sits firmly in the middle at 7.5/10. Others strike a more cautious tone. Breega rates 2026 a 6/10, citing lingering liquidity constraints. Ventech is optimistic about mid- to long-term returns (8/10), but more hesitant when it comes to short-term exits (5-7/10). Iris’s JD Nitlech lands at 5/10, warning that valuation volatility, constrained liquidity and geopolitical uncertainty are here to stay — even if the environment is becoming more “honest”.

Serena’s Paul Moriou perhaps sums it up best by refusing the scale altogether… “Periods of uncertainty and disorder are precisely when the future gets shaped, not when things are stable and incremental.”

Fasten your seatbelts

If there’s one takeaway from this year’s crystal-ball gazing, it’s this: French VC is entering a phase of concentration and conviction. Capital is harder to raise, harder to deploy, and harder to return.

The themes are clearer, the stakes higher, and the margin for error thinner.

2026 won’t be smooth. But for investors and founders willing to embrace discipline, scale - and a little courage - it may prove to be one of the most formative years yet.

Buckle up.