👋 Inside this week's edition:

👀 As cyber risk becomes a systemic threat to European businesses, Stoïk is scaling a tightly integrated model combining insurance, prevention, and incident response. The startup just announced a €20 million funding round it hopes will cement its position as the would-be CISO of Europe.

Chris O'Brien + Helen O'Reilly-Durand

On May 7-8, Malta will transform into the main meeting point for Europe’s most ambitious founders and investors as we host the 12th edition of the EU-Startups Summit. The event will gather around 2,500 founders, startup enthusiasts, corporates, angel investors, VCs, and media from across Europe – all united by a focus on startups with global ambitions.

We’ll have two stages, great networking opportunities, workshops, a buzzing exhibition hall, and a super exciting Pitch Competition featuring 15 most promising early-stage startups from across Europe! Each finalist will have three minutes to pitch their idea on the main stage in front of a large audience of investors, media, and startup enthusiasts, followed by questions from our panel of high-profile VC judges.

⛰️ Davos Mania ⛰️

⛰️ Maddyness reports that French Tech’s Davos adventure was a blur of handshakes, side rooms, and lofty promises, made all the more surreal by Emmanuel Macron’s last-minute arrival and a brief presidential pep talk between two flights. “Hold on!" Macron told French entrepreneurs at the World Economic Forum gathering at a shindig at a Capgemini event. “Redouble your energy and have the spirit of conquest; the government is on your side.” For the lucky few startups selected, Davos delivered an intense networking jackpot, where a single day could mean chatting with Yann LeCun, bumping into CEOs, and finally meeting that elusive supplier. But the buzz was tempered by heavy geopolitical weather, with Donald Trump’s appearance freezing some conversations and reminding everyone how fragile global deal-making can be.

⛰️ Bpifrance CEO Nicolas Dufourcq decided diplomacy was overrated and labeled Donald Trump an “overgrown child” in need of calming down after his bombastic Davos performance. Speaking on French TV, Dufourcq urged Europe not to panic in the face of Trump’s tantrum-style negotiating tactics, from Greenland fantasies to tariff threats. His prescription: stay cool, stop acting like scared kids, and remember who’s actually throwing the toys out of the pram. If things spiral, he says, the EU has its own “bazooka” of trade retaliation ready to deploy. It’s a refreshingly blunt take—and one that Trump, famously thin-skinned, is unlikely to frame on the Oval Office wall. | Maddyness

⛰️ French AI darling Mistral says it expects to smash through the €1 billion revenue mark in 2026, a symbolic milestone that cements its status as Europe’s top homegrown AI contender. CEO Arthur Mensch, in an interview with Bloomberg TV, made the projection from Davos, while casually noting that the company will likely spend just as much on chips and infrastructure, because in AI, profit is still very much optional. Fresh off a €1.7 billion funding round valuing it at €11.7 billion, Mistral looks impressive by European standards, even if that revenue is likely the employee snack budget for OpenAI and Anthropic. | Le Monde, Bloomberg TV

Tech Talk

🎮❌ Ubisoft’s stock got absolutely obliterated, plunging more than 30% in a single day after the French video game giant warned investors to brace for a roughly €1 billion operating loss in 2025–2026. The company also admitted it will burn hundreds of millions in cash and won’t see positive free cash flow again until 2029, essentially a multi-year timeout for making new games. This latest wipeout is just another chapter in a brutal saga: the share price is already down over 90% since 2021. Adding insult to injury, the much-hyped Assassin’s Creed Shadows is underperforming badly, suggesting that even Ubisoft’s most reliable franchise isn’t saving the day. Investors, unsurprisingly, are hitting “exit game” with enthusiasm. La Tribune

✂️🏗️ France 2030 may be heading for… 2029. Under mounting budget pressure, the government is weighing a potential €1bn cut to the flagship €54bn France 2030 investment plan, originally designed to back industry, AI, robotics, and deeptech. While officials insist nothing is final, and hope to tap unused funds, the signal is clear: even sacred cows get trimmed. For startups counting on public co-funding, the message is sobering: strategic ambition now comes with tighter purse strings. | Les Echos

🇪🇺💰 Paris and Berlin want Europe to stop exporting its champions. France and Germany are pushing for deep reforms to better fund European scale-ups, from redirecting pension savings toward venture capital to creating a long-discussed “28th legal regime” for startups. The goal is to keep fast-growing tech companies from fleeing to the US capital markets. Yet another reminder that Europe’s real bottleneck isn’t talent, but late-stage money. | Les Echos

🥊💻 Good news if your 2026 bingo card included Paris startup campus fight. Paris mayoral hopeful Emmanuel Grégoire is betting big on tech credibility by proposing a second Station F that he's dubbing “Station IA” (which, dude, I totally hope you know it's gotta be 'Station AI' if you want to have any street cred outside of French La La land...). Grégoire is making the proposal the centerpiece of his campaign to make Paris the capital of “AI for the common good.” Planned for Porte de la Chapelle, the hub would mix startup incubation, public-sector datasets, training programs, and civic-minded AI experimentation, all while pointedly positioning itself as the anti–Silicon Valley. Which, the director of the current Station F, one Roxanne Varza, was like, hey, that's totally flattering and all, but maybe one Station F is enough? "However, we are not sure that it is what the ecosystem needs. We believe that it would be more beneficial to reinforce existing ecosystem players. Plus, where are you going to find another Xavier? 🤗," she wrote on LinkedIn. | Maddyness

👓🤯 Someone apparently forgot to tell French startup Lynx and CEO Stan Larroque that VR/AR is dead. The company is back with the Lynx-R2, a beefed-up mixed-reality headset aimed squarely at enterprises and prosumers who still believe AR glasses might finally matter.

With a wider field of view, sharper displays, a faster Snapdragon chip, and an unusually open-source philosophy, R2 positions itself as the serious, sovereign alternative to Meta’s wobbling Reality Labs. Its timing is notable: as Big Tech cuts staff and hype cycles wobble, the AR/VR market is suddenly buzzing again with niche but real use cases—from surgery and logistics to mobile office work and gaming. Still, the industry’s decade-long curse remains: great demos, unclear mass demand, and the persistent social risk of looking ridiculous in public. Lynx is betting that B2B credibility, AI agents, and “not being Meta” might finally break the spell. | Road To VR, LinkedIn, Twitter

🌍💰African tech funding rebounded strongly in 2025, with startups raising a combined US$4.1 billion in equity and debt, marking the ecosystem’s best year since 2022, according to Partech’s latest Africa Tech VC report. The standout trend was debt financing, which hit a record US$1.6 billion and now represents 41% of total capital raised, while equity funding proved resilient at US$2.4 billion, supported by a recovery at Series A and B. Kenya led the continent in total funding, driven largely by large debt rounds, while South Africa reclaimed leadership in equity funding and deal count for the first time since 2017. The report also highlights a meaningful diversification beyond fintech, with cleantech, healthtech, and enterprise each surpassing US$200 million in equity funding. Based partly on confidential disclosures covering nearly half of all deals, the data points to a more mature, balanced, and increasingly self-directed African tech ecosystem. | Partech

🍏📱 Apple 1 – Adtech 0 (for now). France’s judiciary has declined to force Apple to suspend App Tracking Transparency (ATT), despite mounting pressure from advertisers and publishers who see the system as a market distortion. Introduced in 2021 under the banner of user privacy, ATT requires explicit consent before apps can track users, a move that reshaped mobile advertising economics overnight. While antitrust authorities continue to circle, the Paris court has granted Apple a reprieve, allowing the mechanism to stay in place. Privacy sells, ads suffer, and the legal clock keeps ticking. | Les Echos

⚛️⚖️ Nuclear dreams don’t always melt down quietly. French nuclear startup Naarea, once a poster child of the State-backed SMR/AMR push, has just been forcibly taken over by Polish-Luxembourg group Eneris — despite Eneris trying to walk away at the very last minute. France’s commercial court stepped in, ordering the takeover to preserve around 100 jobs, brushing aside Eneris’ late procedural U-turn. Founded in 2020, Naarea was developing mini molten-salt reactors designed to reuse spent uranium and decarbonize the industry. A reminder that in deeptech, sovereignty, jobs and justice sometimes outweigh investor hesitation. | Maddyness

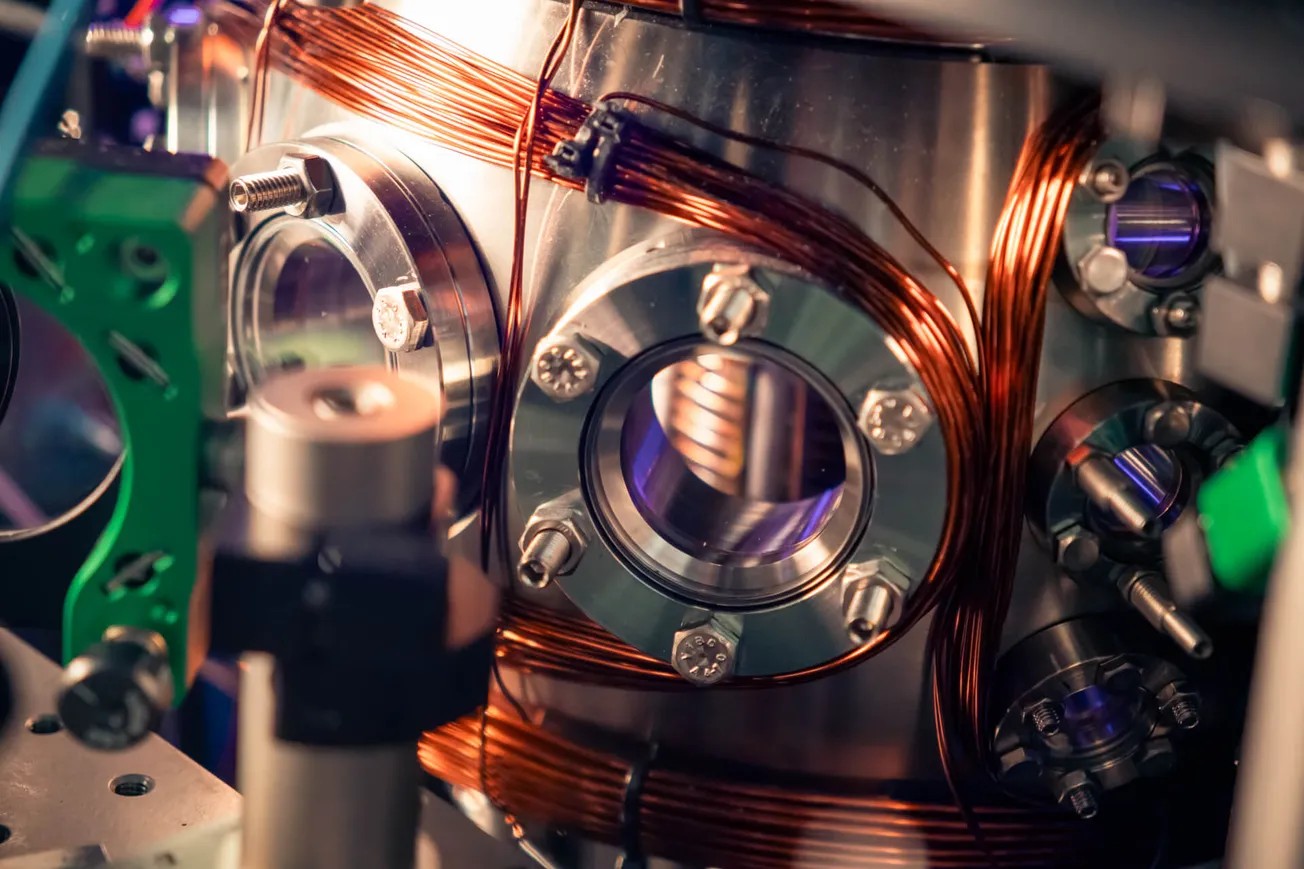

🧠🔐 France has quantum talent. Switzerland has the cheque book. Grenoble-based Quobly, a quantum computing startup born out of CEA–CNRS research, has entered exclusive talks to join Swiss cybersecurity group SealSQ in a deal that could reach $200 million. The first step: a $40m recapitalization, with majority control in sight. But first up: approval is needed by the French Ministry of the Economy. Quobly’s silicon-based approach promises cheaper, scalable quantum machines, neatly slotting into SealSQ’s “post-quantum security” ambitions. A familiar story: world-class French science, global buyers, and strategic tech once again under Bercy’s microscope. | Les Echos

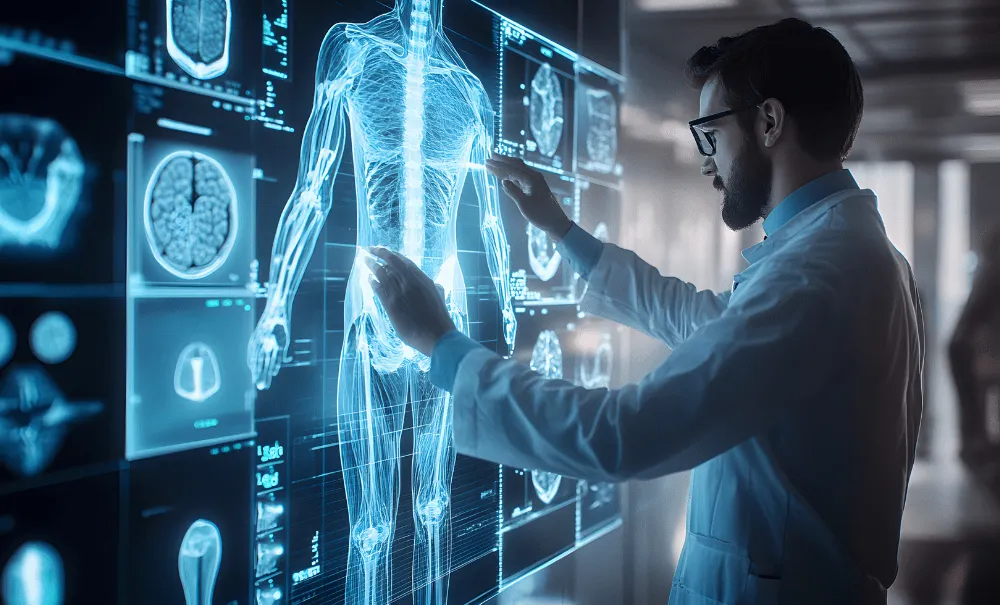

Becoming Europe’s "CISO”: How Stoïk Plans to Use Its €20M Series C

Founded in 2021 by Jules Veyrat, Alexandre Andreini, Nicolas Sayer, and Philippe Mangematin, Stoïk positions itself as a European cyber insurance specialist for companies with revenues of up to €1 billion, but with products explicitly designed for SMEs and mid-sized businesses.

“Cyber risk is massive for SMEs, yet most products were historically built for large enterprises,” explains Jules Veyrat, CEO and co-founder. “What struck us early on was how many companies simply disappear after a cyberattack and how little we hear about them.”

Rather than treating insurance and cybersecurity as separate verticals, Stoïk made an early structural decision: combine the two.

💸 Top Funding Deals 💸

📇 Company: Pennylane

🏷️ Sectors: Fintech, AI & Machine Learning

🔍 Description: Pennylane is a unified financial and accounting operating system designed for accounting firms and their SME clients. The platform combines accounting production, financial management, electronic invoicing, and integrated financial services, with a strong focus on collaboration between accountants and business leaders. Founded in 2020, Pennylane positions itself as a sovereign, product-led alternative to legacy accounting software, increasingly powered by AI.

💻 Website: Pennylane

📍 HQ City: Paris

🧗 Round: Growth

💰 Amount Raised: €175M

🏦 Investors: TCV, Blackstone Growth, Sequoia Capital, DST Global, CapitalG, Meritech Capital

👨💼👩💼 Founders: Arthur Waller (CEO)

🗞️ News: Pennylane has secured a €175M funding round led by TCV, with participation from Blackstone Growth and all major historical investors. The round was completed with limited dilution and under a strict governance charter guaranteeing founder control, no price increases, and continuity of product strategy. The company is experiencing growth well above initial forecasts, serving more than 6,000 accounting firms and 800,000 businesses, with a team of 1,000 employees and near-term profitability. The funding is primarily strategic, aimed at securing long-term independence, accelerating AI-driven product development, and anticipating consolidation in the European accounting and fintech software market—particularly in light of the upcoming mandatory electronic invoicing reforms. Capital will be deployed across four main priorities: building an AI-powered analytical copilot for accountants, localizing the product for European expansion, starting with Germany, scaling infrastructure for electronic invoicing as an approved platform, and expanding embedded financial services such as payments and real-time cash management. Pennylane aims to establish itself as the European leader in financial and accounting operating systems for SMEs and their advisors.

📇 Company: ErVimmune

🏷️ Sectors: HealthTech & BioTech

🔍 Description: ErVimmune is a Lyon-based immuno-oncology biotech developing off-the-shelf cancer vaccines and cell therapies targeting so-called “cold tumors” that do not respond to current immunotherapies. The company leverages proprietary antigen discovery based on human endogenous retroviruses (HERVs) to create shared, non-personalised vaccines designed for broad patient populations. Its lead candidate, ErVac01, targets major unmet needs, including triple-negative breast cancer (TNBC) and ovarian cancer.

💻 Website: ErVimmune

📍 HQ City: Lyon

🧗 Round: Series A

💰 Amount Raised: €17 million

🏦 Investors: Seventure Partners, SPRIM Global Investments, Bpifrance, France 2030

👨💼👩💼 Founders & Leadership: Prof. Stéphane Depil, MD, PhD, Nathalie Donne, EMBA CEO, Eric Halioua – Executive Chairman (appointed alongside the Series A)

🗞️ News: ErVimmune announced the first closing of its €17M Series A to advance its lead cancer vaccine ErVac01 into first-in-human clinical trials. Founded in 2019 as a spin-off from Centre Léon Bérard, the company focuses on HERV-derived tumor antigens that mimic viral proteins, making them highly visible to the immune system. Unlike personalised therapies, ErVac01 is designed as a ready-to-use vaccine covering the majority of global HLA alleles (>95% in Europe, >80% in Asia). The funding will support clinical development in TNBC and ovarian cancer, strengthen governance, and validate ErVimmune’s broader HERV-based therapeutic platform. The round remains open to additional investors as the company enters a pivotal clinical and value-creation phase within a strong European oncology funding environment. | EU Startups

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻