👋 Inside this week's edition:

👀 A French nuclear startup backed by the state and industry giants burned through €90 million, only to collapse days after a last-minute rescue deal fell apart in court. This is the story of NAAREA’s rise and fall, and what its failure reveals about the brutal mismatch between startup timelines, government ambition, and next-generation nuclear tech.

Chris O'Brien + Helen O'Reilly-Durand

On May 7-8, Malta will transform into the main meeting point for Europe’s most ambitious founders and investors as we host the 12th edition of the EU-Startups Summit. The event will gather around 2,500 founders, startup enthusiasts, corporates, angel investors, VCs, and media from across Europe – all united by a focus on startups with global ambitions.

We’ll have two stages, great networking opportunities, workshops, a buzzing exhibition hall, and a super exciting Pitch Competition featuring 15 most promising early-stage startups from across Europe! Each finalist will have three minutes to pitch their idea on the main stage in front of a large audience of investors, media, and startup enthusiasts, followed by questions from our panel of high-profile VC judges.

Tech Talk

🛡️🇪🇺 France has a new cybersecurity strategy. Unveiled in Bordeaux by digital minister Anne Le Hénanff, the 2026–2030 plan promises to turn France into a “top-tier cyber power” by training more talent, hardening defenses, and scaring off hackers. The strategy leans heavily on resilience, with a national cyber “one-stop shop,” EU-mandated minimum security standards for 15,000 entities, and a prevention campaign modeled (optimistically) on road safety ads. Local governments and election candidates are flagged as prime targets ahead of municipal elections, with a clear message: don’t be naïve, enable two-factor authentication, and stop using terrible passwords. There’s also talk of labels for SMEs, European cyber sovereignty, and international cyber solidarity, because no strategy is complete without buzzwords. As for funding? Weellllllllll...investments are promised, numbers are not forthcoming in these budget strained time. Apparently, cybersecurity, like everything else, must survive France’s budget reality check. | France Info, Minister of the Economy,

🤖🇫🇷 As digital sovereignty rhetoric heats up, French SaaS and cloud alternatives are finally seeing real demand. Jamespot, a long-standing French collaborative software player, reports growing interest from CAC 40 groups looking to reduce Microsoft dependence. Cloud exit plans are now openly discussed, albeit on multi-year timelines, while US hyperscalers rush to rebrand “sovereign” offerings. The race is on between genuine autonomy and cleverly wrapped dependency. | Les Echos

🖥️🇺🇸 Capgemini is squirming under scrutiny over a U.S. ICE contract that’s “not in execution”...for now. According to the French IT giant, its American subsidiary paused work due to legal challenges and internal review. Still, public filings show the contract included ID and tracking tools for foreign nationals, plus hotline management for crime victims. | Le Monde

🧪💶 Paris-based VC daphni just closed its Blue fund at €260m, above target and in under nine months. The mission-driven firm is doubling down on science-first deeptech, backing startups spun out of Europe’s top research institutions, from INRIA to Institut Curie. Nine investments are already live, spanning green chemistry, brain-machine interfaces, fertility tech, and immunotherapy. The bet is that Europe’s vast scientific output has been chronically underfunded at the “lab-to-market” stage and that patient capital can turn IP into impact. With ESG-linked carry and a plan to back ~40 companies, daphni is positioning deep science as both investable and essential. | Tech.Eu, EU Startups

❤️💉 French medtech is pulsing. HighLife’s minimally invasive mitral valve system just got CE marking, while Bordeaux-based FineHeart raised €83M to scale its wireless cardiac pump. CorWave’s fish-inspired heart assist reached human trials in Australia, and consolidators like Carvolix are combining forces to take on the €23B valve replacement market. French heart innovation is going global, all without skipping a beat. | Les Echos

🌱⚠️ Meanwhile, if MedTech is up on the up, funding for green industrial startups in France has halved in two years, dropping to €1.5bn in 2025, with deal count nearly cut in half. Political uncertainty, regulatory stop-and-go, and reduced France 2030 budgets are now blamed more than tech risk. Investors are still writing big cheques, but mainly for mature energy projects, leaving early-stage industrial climate tech struggling to scale. | Les Echos

🌱🏠 Paris’ Climate House is making plans to firmly plant its flag in Bordeaux. The 600 m² hub will mirror its Paris sibling, gathering entrepreneurs, researchers, artists, and investors to prototype green and social innovations. Co-founders (“cofos”) are now Bordeaux-bound, and the stage is set for civic-tech meets climate-tech, with hopes to expand to Nantes, Lyon, and Marseille next. | Maddyness

💼🧑💻 A new generation of French Tech bankers is stepping into the spotlight. Philippe Engleber, ex ministerial advisor for Tech, who has just been promoted to Managing Partner at Lazard Bank. From Lazard to Rothschild, Chausson and Clipperton, these rising figures are advising the biggest IPOs, deeptech mega-rounds, and restructurings of the moment. Their edge is deep sector expertise, closer ties to founders, and a market that now favours strategy and selectivity over pure volume. | Les Echos

🍱🌏 Too Good To Go is going east. After conquering Europe and the U.S., the anti-food-waste app is opening in Japan with local leadership and partnerships, targeting ambitious waste-reduction goals. France remains the revenue engine, with 20M downloads and 20M meals saved in 2025 alone. The startup’s mix of social impact, AI-powered logistics, and new verticals proves that fighting food waste can also be seriously profitable. | PR Newswire

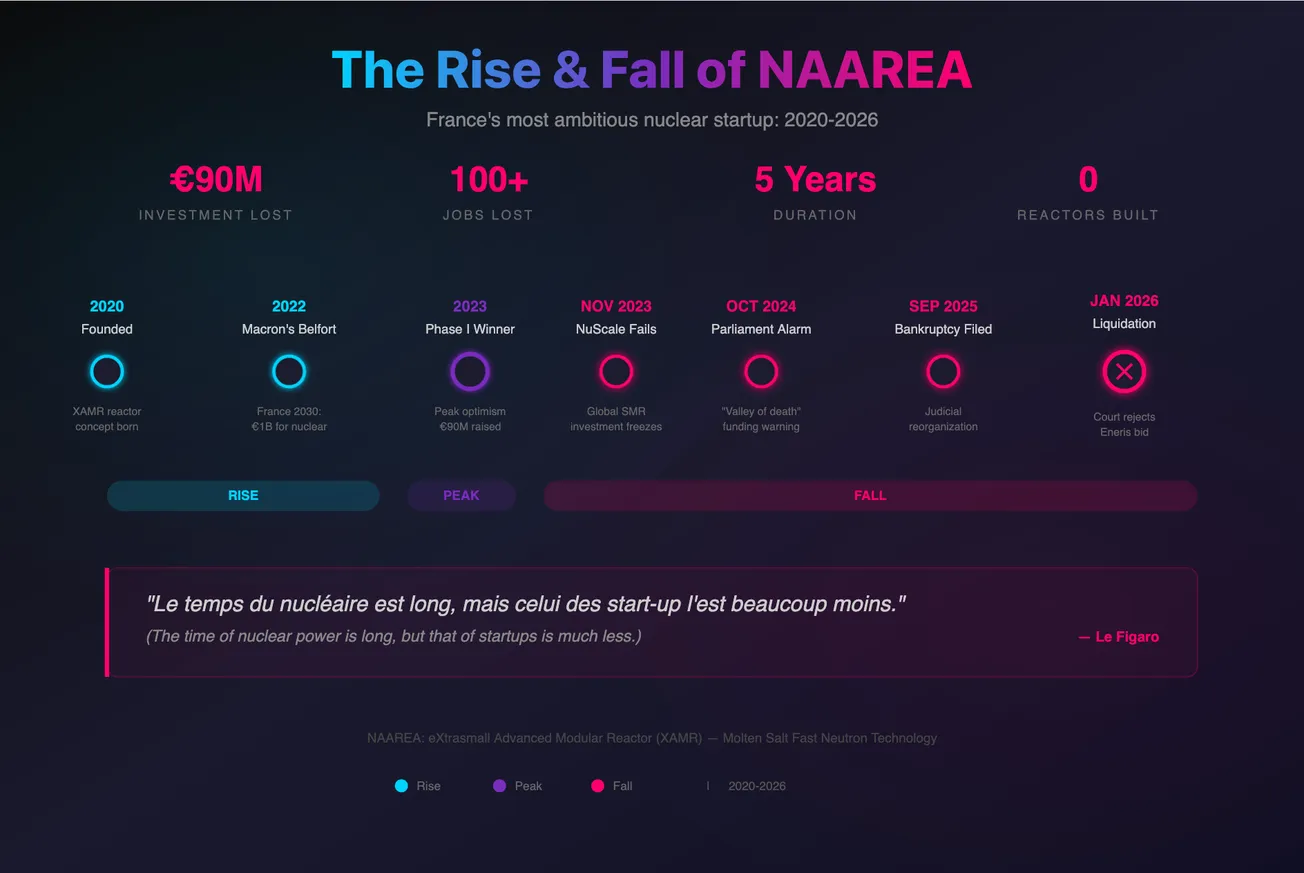

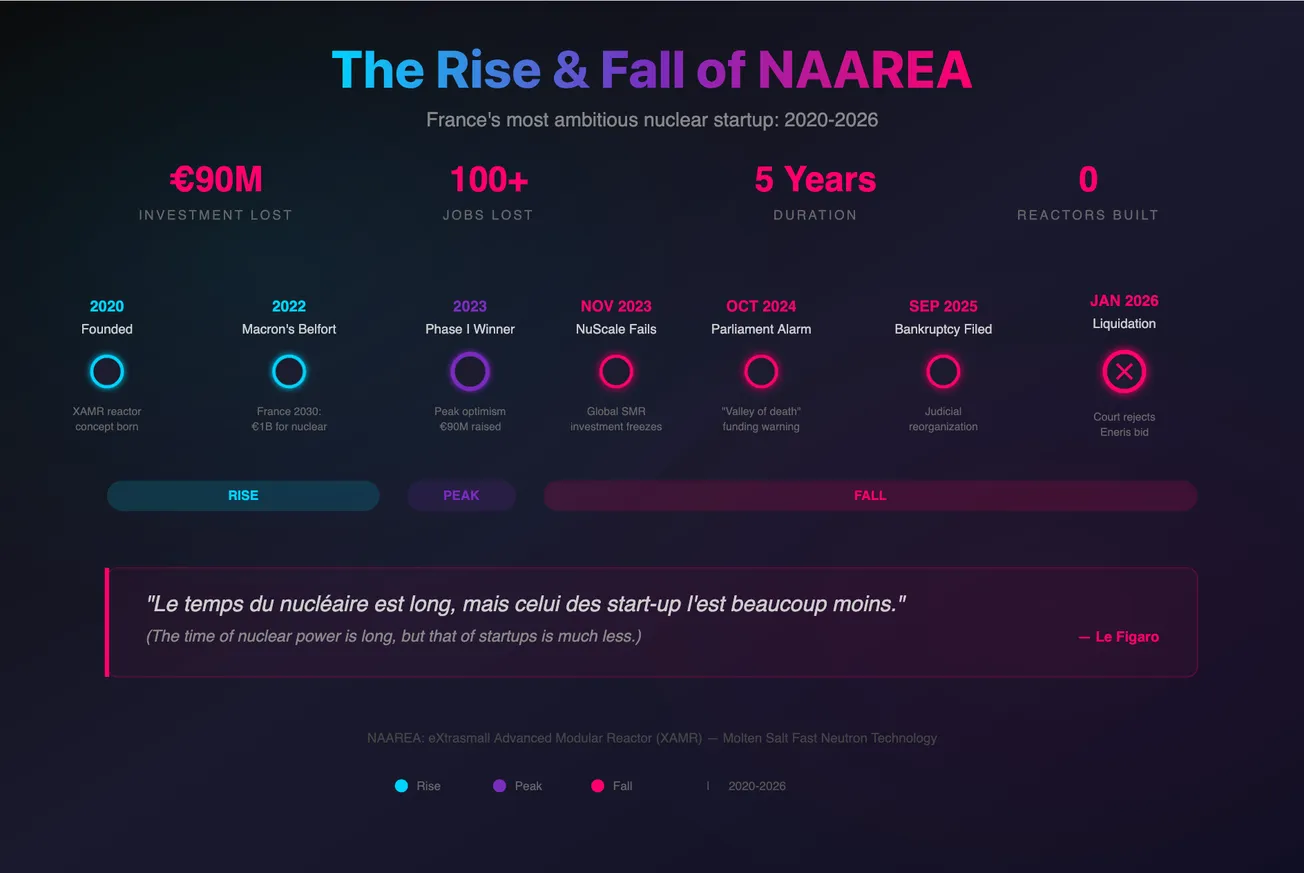

Nuclear Meltdown: How NAAREA Burned Through €90 Million and Collapsed in Spectacular Fashion

On the morning NAAREA’s employees thought they’d been saved, their would-be buyer suddenly walked away, accusing the startup of hidden problems and a reactor design stuck in a “technological impasse.”

Within days, a courtroom forced the deal through anyway, and the supposed rescuer filed for bankruptcy, ending a five-year sprint that burned through roughly €90 million, left more than 100 people without jobs, and produced exactly zero reactors.

How does a France 2030 “flagship” with government backing and heavyweight partners implode this fast and this publicly?

In this special report, we trace the chain reaction: a founder’s COP21-born vision of a molten-salt, fast-neutron microreactor in a shipping container; a business model that promised selling clean power like a service; and the brutal collision between venture timelines, nuclear physics, and state bureaucracy. Along the way: the “NuScale shockwave” that froze investor appetite, a Phase II funding bottleneck that never arrived, and a final due diligence knife fight that raises uncomfortable questions about France’s nuclear innovation strategy, and even its AI ambitions, which increasingly depend on delivering abundant power.

💸 Top Funding Deals 💸

📇 Company: Aviwell

🏷️ Sectors: AgriTech & FoodTech, HealthTech & BioTech, AI & Machine Learning

🔍 Description: Aviwell is a deep-tech animal nutrition company developing AI-driven, microbiome-based solutions to improve animal health, growth, and resilience. Built on decades of microbiome research, the company leverages its proprietary Aneto™ platform to design native bacterial ecologies with defined modes of action, enabling antibiotic-free, sustainable nutrition for poultry and aquaculture.

💻 Website: Aviwell

📍 HQ City: Toulouse

🧗 Round: Series A

💰 Amount Raised: €11M

🏦 Investors: Blue Revolution Fund, Blast.Club, SWEN Capital Partners, Elaia, MFS Investment Management

👨💼👩💼 Founders: Rémy Burcelin, Mouli Ramani

🗞️ News: Aviwell closed an €11M Series A to scale its AI-powered Aneto™ microbiome discovery platform and advance nature-based biological solutions for animal nutrition. The funding will support the progression of poultry and aquaculture microbial ecologies from discovery through validation and industrial scale-up, expand platform services, and deepen commercial partnerships. Led by Blue Revolution Fund, the round underscores growing investor conviction in AI-enabled, sustainable alternatives to antibiotics amid rising global protein demand and tighter environmental constraints. | LinkedIn

📇 Company: Twin

🏷️ Sectors: AI & Machine Learning

🔍 Description: Twin is an AI platform that lets non-technical users build fully autonomous agents capable of running entire businesses end-to-end — from planning and decision-making to execution. Using browser control, self-correction, long-term memory, and a hybrid model stack (high-reasoning models to plan, lightweight models to execute), Twin enables complex operational workflows to be created in minutes without writing code. During its beta, users deployed over 100,000 autonomous agents, including fully automated trading systems, service businesses, retail arbitrage operations, and wholesale import companies.

💻 Website: Twin

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: $10M

🏦 Investors: LocalGlobe, Kima Ventures, betaworks, Irregular Expressions, Motier Ventures, Andrena Ventures, Drysdale Ventures

👨💼👩💼 Founders: Hugo Mercier, João Justi

🗞️ News: Twin publicly launched on January 27 following a one-month beta in which users deployed more than 100,000 autonomous agents. The company announced a $10M seed round led by LocalGlobe to support its vision of becoming the “AI company builder,” enabling anyone to create self-sufficient AI-run businesses. Orrick Paris Tech Studio advised Twin on the financing. Early adopters praise the platform’s ease of use and power, while observers note upcoming challenges around reliability and enterprise-grade adoption as Twin scales. | LinkedIn

📇 Company: AYAQ

🏷️ Sectors: E-commerce & Retail

🔍 Description: French technical apparel brand focused on high-performance outdoor clothing, built on field-tested functionality, durability, and a long-term product vision. Founded by Olympic gold medalist Vincent Defrasne, AYAQ combines elite performance standards with premium positioning, supported by a senior advisory board drawn from the retail and luxury industries.

💻 Website: Ayaq

📍 HQ City: Paris

🧗 Round: Growth

💰 Amount Raised: €3.2M

🏦 Investors: Mike Horn

👨💼👩💼 Founders: Vincent Defrasne

🗞️ News: AYAQ has raised €3.2M in equity, complemented by non-dilutive financing, bringing total capital mobilized to over €5M to accelerate international expansion and strengthen its product roadmap. The round welcomes renowned explorer Mike Horn as a shareholder, while the management team retains majority ownership, ensuring continuity of governance and long-term strategic vision. The funding will support intensified product development, industrial scaling, and a disciplined international rollout. AYAQ is already established in Switzerland and Austria and reached a major milestone with its entry into the Japanese market in September 2025 via leading department stores. The brand has also laid the groundwork for expansion into the UK.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻