👋 Inside this week's edition:

👀 Brevo’s €1bn valuation was driven by a PE-led growth buyout: General Atlantic and Oakley take 50%, Partech exits, and the cap table resets. It’s a landmark French-tech liquidity moment that gives Brevo powerful partners for U.S. expansion, bigger M&A, and AI-powered growth. Brevo CEO and Founder Armand Thiberge and André François-Poncet, a partner at Partech who led the original investment, walk us through the details.

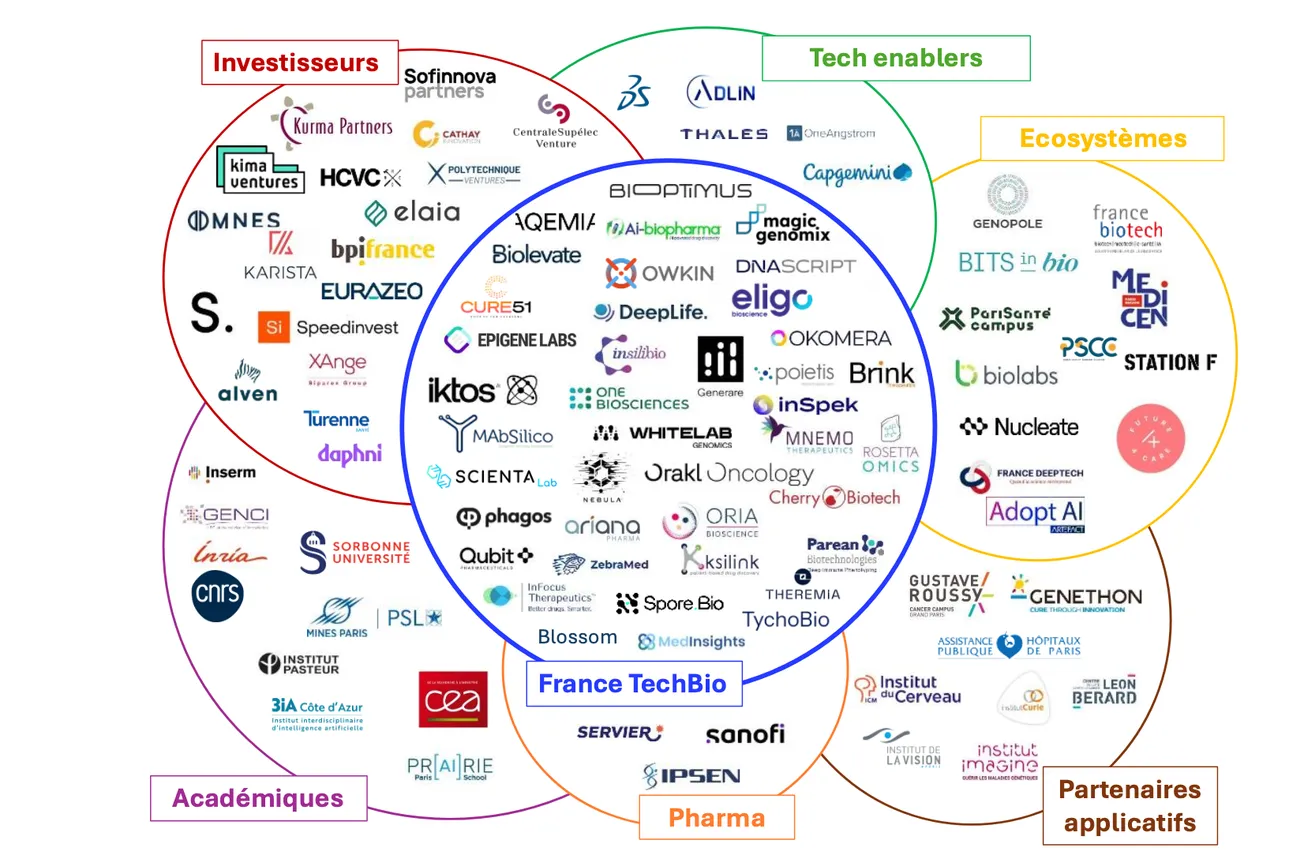

👀 A comprehensive mapping by France Biotech and France Deeptech identifies 40 companies operating at the intersection of biology and breakthrough technology, and argues that France could become a global leader in this emerging field. We look at the key takeaways.

Chris O'Brien + Helen O'Reilly-Durand

🚀 Scaling your startup in EMEA?

Learn how high-growth French companies like Pigment use Vanta to grow fast—without compromising on security.

🔐 Turn compliance into a competitive advantage.

📈 Close deals faster with built-in trust.

Tech Talk

💵 🐎 Fintech Pennylane just crossed €100M ARR, officially joining the “centaurs” club, the mythical beasts of revenue reality. With 700k clients, 6k accounting firms on board, and electronic invoicing mandates in France and Germany acting like rocket boosters, Pennylane is riding a very favorable regulatory wave. The company is now rumored to be prepping a $200M raise at a $4–5B valuation, with TCV and Sequoia lurking in the wings. Not profitable yet (maybe next year), but with 900 employees and big ambitions, Pennylane wants to become the financial OS for every European SME. | Maddyness, Les Echos

🚚🥫 Le Fourgon Gobbles La Tournée to Build France’s Zero-Waste Delivery Empire. The two online zero-waste supermarkets just merged in a share swap to convert France back to the gospel of reusable glass. The combo now covers 45% of the country, with Le Fourgon’s bright yellow vans and La Tournée’s fresh-produce chops joining forces to “kill plastic.” As we reported earlier this year, Le Fourgon has been scaling fast. The new group of 410 employees wants to snag 2% of France’s grocery market and hit profitability within 12 months. | Les Echos, Maddyness

🪰⚰️ Ÿnsect Squashed. Once the poster child of French agritech, the former unicorn is RIP, tagged for liquidation, leaving 43 employees and a giant insect “giga-farm” in Poulainville behind. After rounds of emergency funding (check out our Ynsect deep dive), layoffs, a new CEO, and a desperate pivot to cheaper, less-automated farming, the company still couldn’t raise the cash needed to continue. Its €100M+ mega-factory never ran at full speed, and the global insect-protein market proved far less mature (and far more competitive) than investors once dreamed. With Agronutris and Innovafeed also wobbling, the entire insect-protein sector is entering its winter. | Les Echos, Maddyness

💰🛠️ ISAI just launched ISAI Venture IV, a new early-stage fund with a €75M first closing (heading to €100M), aimed at startups with real traction, plus a 10% “super-angel” pocket for pre-seed bets. The plan is to invest mostly in France, but also hunt down French founders in the US who are quietly building empires. True to form, ISAI wants to back the “pickaxe sellers” (infrastructure, SaaS, marketplaces) rather than chase whatever gold-rush AI meme is trending this week. Despite the macro gloom, ISAI’s JD Chamboredon says he feels a “business rebound” and insists now is a prime moment to seize opportunities. | Maddyness

🏥🧬 Villejuif is building a “Station F” for Cancer Startups. The word on the street is that a new 100,000 m² campus is set to open in 2026 near Gustave-Roussy, gathering 60 companies, mostly startups, alongside big pharma and CROs. Funded with €165M (France 2030 + corporate philanthropy), each team gets 25 m² of lab + 25 m² of office. That's enough space to prototype, test, and scale treatments under one roof. The goal is to create Europe’s largest oncology innovation hub where collaboration is built into the walls. | Les Échos

🦹♀️🕵️♂️ Speaking of Station F, Paris' startup mega-campus has quietly launched a new program: “Mafia” for Multi-Entrepreneurs. It's legal (we hope), not listed publicly, but visible on resident cards. Designed for founders who’ve already launched multiple startups, it offers the usual perks plus a heavy dose of community, mentorship, and peer experience-sharing. Multi-founder culture is strong: in the latest Future40 cohort, 42% of founders had already started two companies, and nearly a third have launched even more. Station F is doubling down on serial entrepreneurship. Leave the pitch deck; take the cannoli. | Les Échos

💸📊 More Than Half of French Entrepreneurs Don’t Pay Themselves. A new barometer from Dougs reveals that 53% of French founders went unpaid in 2024, proving that entrepreneurship is mostly sweat, not salary. Among those who do pay themselves, the median income is just €21,631/year, with huge gaps by sector and experience: IT founders earn the most, BTP and commerce the least. The picture is a fragile but structured ecosystem, where early-stage founders rely on public support, dividends, and careful financial engineering to survive. Dougs' Founder Patrick Maurice sums it up: “Five years is the adolescence of an entrepreneur - learning, failing, and finally structuring their life around the business rather than the other way around.” | Maddyness

Brevo’s €500M Deal Delivers Historic Liquidity Event for French Tech

Brevo just joined France’s unicorn club with a splashy €500 million announcement, the kind that sends French Tech LinkedIn into victory-lap mode. But beneath the confetti, this wasn’t a stereotypical late-stage VC mega-round.

The deal is closer to a private-equity growth buyout paired with a secondary sale that quietly resets the cap table and marks one of the largest liquidity events in French startup history.

We dig into the details, break down the financing, and talk to Brevo CEO and Founder Armand Thiberge about the motivation behind the deal and how he hopes the company's new PE partners will help them conquer the U.S. and invest in AI.

"Our ambition remains unchanged: to build a global European CRM leader capable of competing with US players through product excellence," Thiberge said.

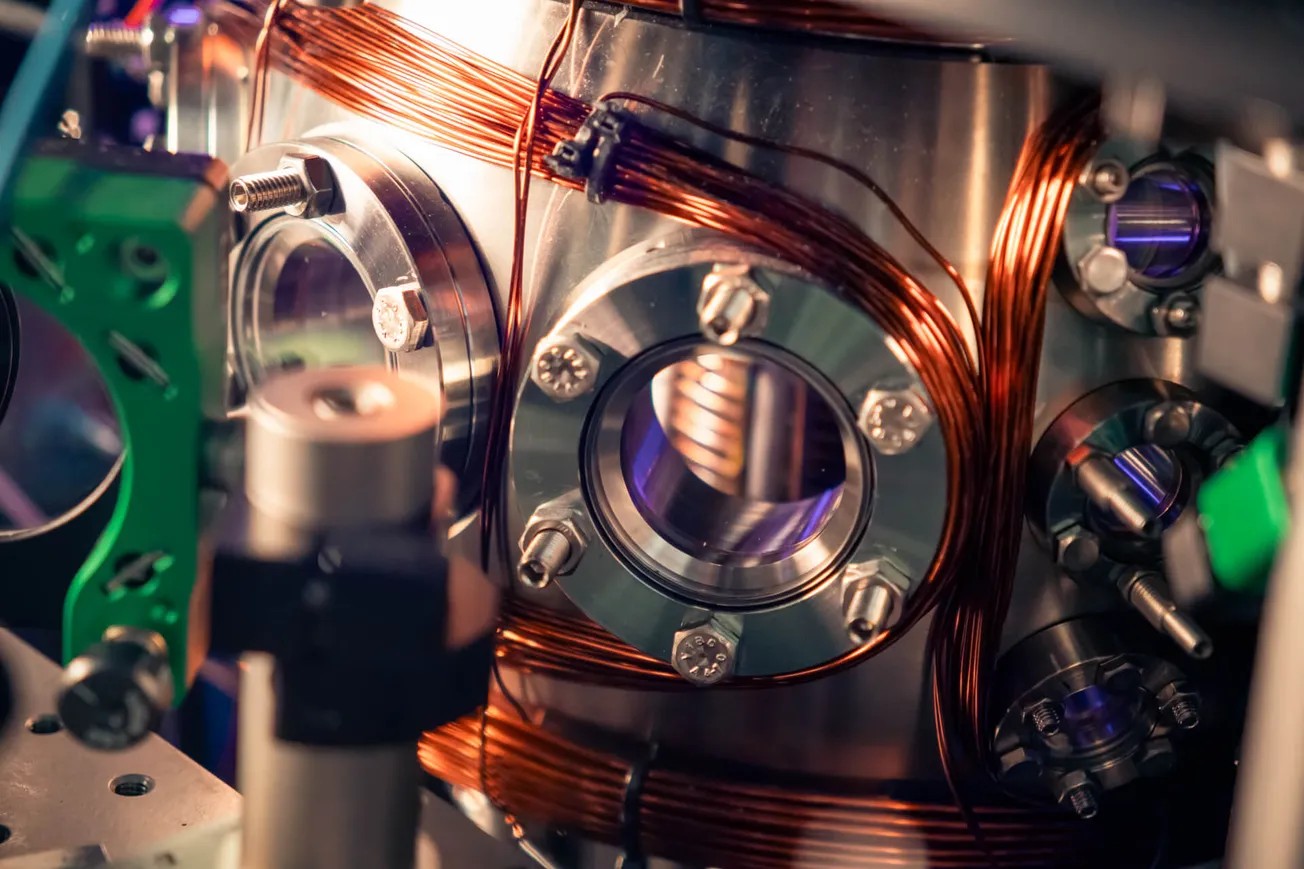

Mapping French TechBio: 40 Companies Mixing Biology, Data, and AI

France's TechBio ecosystem is having a moment. In just under a year, the number of identified TechBio companies in the country has nearly doubled, jumping from 22 to 40 startups and scale-ups, according to a new report by the TechBio France Commission. The report was released on Thursday at the second edition of the TechBio France Conference held at the Future4Care office in Paris.

We break down the key takeaways in the report on this emerging sector.

💸 Top Funding Deals 💸

📇 Company: Gradium

🔍 Description: Paris-born voice AI startup spun out of non-profit research lab Kyutai. Gradium develops next-generation “audio language models” enabling real-time, low-latency conversational voice interactions across multiple languages. The company commercializes Kyutai’s cutting-edge research—including the speech-to-speech model Moshi—to power applications ranging from gaming characters to medical transcription and live interpretation.

💻 Website: Gradium

📍 HQ City: Paris (spinout from Kyutai)

🧗 Round: Seed

💰 Amount Raised: €60M (≈ $70M)

🏦 Investors: FirstMark Capital (lead), Eurazeo (lead), DST Global Partners, Korelya Capital, Amplify Partners, Xavier Niel, Rodolphe Saadé, Eric Schmidt, Liquid 2 Ventures, Drysdale Ventures, plus participation from tech leaders including Yann LeCun, Olivier Pomel, Ilkka Paananen (Illusian Founder Office), Thomas Wolf, Guillermo Rauch, and Mehdi Ghissassi (Tiny Supercomputer Investment Company)

👨💼👩💼 Founders: Neil Zeghidour, Laurent Mazaré, Alexandre Défossez, Olivier Teboul

🗞️ News: Gradium emerges from stealth with a landmark €60M Seed round—one of Europe’s largest—to commercialize Kyutai’s breakthrough speech-to-speech models and build real-time, multilingual conversational AI. Backed by a rare coalition of global tech figures (Niel, Saadé, Schmidt, LeCun), the startup aims to compete with giants like OpenAI and ElevenLabs by offering low-latency, high-quality voice interaction at scale. Early traction includes a dozen paying customers in gaming, healthcare, and language services, with plans to become the leading real-time voice interface layer for next-generation AI agents. | Sifted, FrenchWeb, Maddyness

📇 Company: Axoltis Pharma

🔍 Description: French BioTech developing innovative therapies for neurodegenerative and neurotraumatic diseases. Its lead candidate, NX210c—a cyclic peptide targeting blood-brain barrier repair, neuroprotection, and neurotransmission—has entered Phase 2 clinical trials in ALS/Lou Gehrig’s disease.

💻 Website: Axoltis Pharma

📍 HQ City: Clermont-Ferrand

🧗 Round: Series A

💰 Amount Raised: €18M (≈ $20.9M), in two tranches

🏦 Investors: FIDAT Ventures (co-lead), Cenitz (co-lead), crowdfunding investors via Capital Cell, business angels, Le Cercle de Chiron; plus legacy investors: Norfoalk, Fonds Régional Avenir Industrie Auvergne Rhône-Alpes, FaDièse 3, Simba Santé 2 (Angelor), and the CEO of Axoltis

👨💼👩💼 Founders: Not specified — CEO: Dr. Yann Godfrin

🗞️ News: Axoltis Pharma closes an €18M Series A to advance NX210c through its Phase 2 “SEALS” clinical trial in 82 ALS patients, with results expected in Q2 2026. The raise comes amid strong European investor interest in neuro-focused BioTech, following €133M in sector funding in 2025 from Augustine Therapeutics, TRIMTECH Therapeutics, and EG 427. The investment will also support research into additional neurological indications where NX210c’s blood-brain barrier repair mechanism could provide major therapeutic impact. | EU-Startups, PR

📇 Company: Bitstack

🔍 Description: French Bitcoin investment app with 300,000+ users, known for its automatic roundup savings feature (“arrondi automatique”). The company is now launching its first Visa debit card featuring “stackback,” a Bitcoin-based cashback system.

💻 Website: Bitstack

📍 HQ City: Paris

🧗 Round: Series A

💰 Amount Raised: €15M

🏦 Investors: 13books Capital (lead), AG2R LA MONDIALE, Plug and Play Ventures, Serena, Stillmark, Y Combinator

👨💼👩💼 Founders: Alexandre Roubaud, Kabir Seti

🗞️ News: Bitstack raises €15M to accelerate its European expansion and launches its first Visa debit card, introducing “stackback”—a 1% cashback in Bitcoin credited directly to users’ accounts. The card will be available in January 2026 to the first 5,000 beta testers. With MiCA approval secured in June, Bitstack will expand into 10 European countries, including Germany, the Netherlands, and Italy, and plans to hire around 20 new team members in France. | Maddyness, PR, EU-Startups

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻