🧮 Data Point: France Plays Defense

Alexandre Dewez of 20VC released his annual orgy of data on the French tech ecosystem, more than 100 slides to sate your every desire. As usual, it contains too many notable nuggets to neatly summarize. But we're highlighting a couple that caught our eyes.

French tech is increasingly funded from abroad. According to the report, 41% of French startups raised money from at least one foreign fund in 2025. Those rounds accounted for nearly €5bn of the €6.7bn raised overall. With fewer domestic funds able to write big cheques, international investors, especially pan-European and US funds, are stepping in.

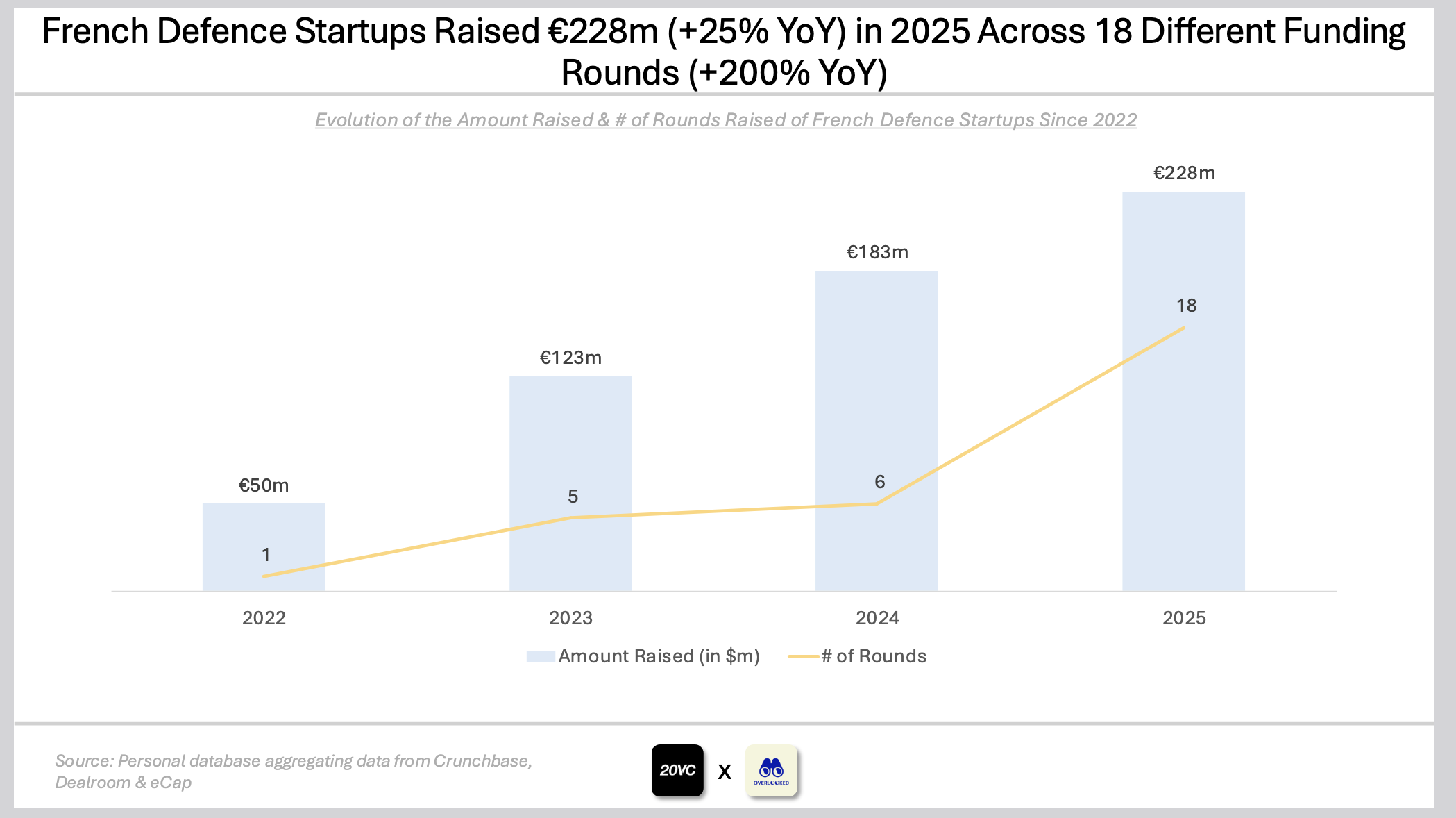

One of the Big Themes singled out by Dewez: Defense. "France has the key ingredients to become a defense tech powerhouse," he wrote.

On May 7-8, Malta will transform into the main meeting point for Europe’s most ambitious founders and investors as we host the 12th edition of the EU-Startups Summit. The event will gather around 2,500 founders, startup enthusiasts, corporates, angel investors, VCs, and media from across Europe – all united by a focus on startups with global ambitions.

We’ll have two stages, great networking opportunities, workshops, a buzzing exhibition hall, and a super exciting Pitch Competition featuring 15 most promising early-stage startups from across Europe! Each finalist will have three minutes to pitch their idea on the main stage in front of a large audience of investors, media, and startup enthusiasts, followed by questions from our panel of high-profile VC judges.

💸 Weekly Funding Recap: January 23

📇 Company: Pennylane

🏷️ Sectors: Fintech, AI & Machine Learning

🔍 Description: Pennylane is a unified financial and accounting operating system designed for accounting firms and their SME clients. The platform combines accounting production, financial management, electronic invoicing, and integrated financial services, with a strong focus on collaboration between accountants and business leaders. Founded in 2020, Pennylane positions itself as a sovereign, product-led alternative to legacy accounting software, increasingly powered by AI.

💻 Website: Pennylane

📍 HQ City: Paris

🧗 Round: Growth

💰 Amount Raised: €175M

🏦 Investors: TCV, Blackstone Growth, Sequoia Capital, DST Global, CapitalG, Meritech Capital

👨💼👩💼 Founders: Arthur Waller, Tancrède Besnard, Félix Blossier, Thierry Déo, Édouard Mascré, Quentin de Metz

🗞️ News: Pennylane has secured a €175M funding round led by TCV, with participation from Blackstone Growth and all major historical investors. The round was completed with limited dilution and under a strict governance charter guaranteeing founder control, no price increases, and continuity of product strategy. The company is experiencing growth well above initial forecasts, serving more than 6,000 accounting firms and 800,000 businesses, with a team of 1,000 employees and near-term profitability. The funding is primarily strategic, aimed at securing long-term independence, accelerating AI-driven product development, and anticipating consolidation in the European accounting and fintech software market—particularly in light of the upcoming mandatory electronic invoicing reforms. Capital will be deployed across four main priorities: building an AI-powered analytical copilot for accountants, localizing the product for European expansion, ÉdouardGermany, scaling infrastructure for electronic invoicing as an approved platform, and expanding embedded financial services, such as payments and real-time cash management. Pennylane aims to establish itself as the European leader in financial and accounting operating systems for SMEs and their advisors. | EU Startups

📇 Company: Stoïk

🏷️ Sectors: Cybersecurity, AI & Machine Learning

🔍 Description: Stoïk is a European cyber insurtech combining cyber insurance, proactive security software, and 24/7 incident response into a single integrated offering. Founded in 2021, the company targets SMEs and mid-sized enterprises (up to €1bn in revenue) with an AI-powered, full-stack cyber risk model covering prevention, detection, insurance coverage, and post-incident recovery. Stoïk positions itself as the “CISO of Europe,” embedding cybersecurity operations directly into insurance products.

💻 Website: Stoik

📍 HQ City: Paris

🧗 Round: Series C

💰 Amount Raised: €20M

🏦 Investors: Impala, Opera Tech Ventures, Alven, Andreessen Horowitz (a16z)👨💼👩💼 Founders: Jules Veyrat, Alexandre Andreini, Nicolas Sayer, Philippe Mangematin

🗞️ News: Stoïk has raised a €20M Series C to accelerate its European expansion and deepen its proprietary AI-driven cyber prevention, detection, and incident response capabilities. The company now insures over 10,000 businesses across six European countries and generated nearly €50M in gross written premiums in 2025, with over 200% year-on-year growth. The round follows four prior fundraises in five years and will support scaling to 200 employees, reinforcing Stoïk’s ambition to become a continent-wide cyber risk operating partner rather than a pure insurance provider. | The French Tech Journal

📇 Company: ErVimmune

🏷️ Sectors: HealthTech & BioTech

🔍 Description: ErVimmune is a Lyon-based immuno-oncology biotech developing off-the-shelf cancer vaccines and cell therapies targeting so-called “cold tumors” that do not respond to current immunotherapies. The company leverages proprietary antigen discovery based on human endogenous retroviruses (HERVs) to create shared, non-personalised vaccines designed for broad patient populations. Its lead candidate, ErVac01, targets major unmet needs, including triple-negative breast cancer (TNBC) and ovarian cancer.

💻 Website: ErVimmune

📍 HQ City: Lyon

🧗 Round: Series A

💰 Amount Raised: €17 million

🏦 Investors: Seventure Partners, SPRIM Global Investments, Bpifrance, France 2030

👨💼👩💼 Founders & Leadership: Stéphane Depil, Nathalie Donne, Eric Halioua

🗞️ News: ErVimmune announced the first closing of its €17M Series A to advance its lead cancer vaccine ErVac01 into first-in-human clinical trials. Founded in 2019 as a spin-off from Centre Léon Bérard, the company focuses on HERV-derived tumor antigens that mimic viral proteins, making them highly visible to the immune system. Unlike personalised therapies, ErVac01 is designed as a ready-to-use vaccine covering the majority of global HLA alleles (>95% in Europe, >80% in Asia). The funding will support clinical development in TNBC and ovarian cancer, strengthen governance, and validate ErVimmune’s broader HERV-based therapeutic platform. The round remains open to additional investors as the company enters a pivotal clinical and value-creation phase within a strong European oncology funding environment. | EU Startups

📇 Company: Symbiotic Security

🏷️ Sectors: Cybersecurity, AI & Machine Learning

🔍 Description: Symbiotic Security is building the world’s first AI code generation agent designed to produce secure code only. Its flagship product, Symbiotic Code, embeds security directly into the code generation process through enforced prehooks, automated verification, and agentic remediation — eliminating security debt at the moment code is written. Model-agnostic by design, the platform supports leading LLMs across cloud and on-prem environments, enabling enterprises to scale AI-driven development without compromising security.

💻 Website: Symbiotic Security

📍 HQ City: New York City, Paris

🧗 Round: Seed

💰 Amount Raised: $10M

🏦 Investors: Alven, Drysdale Ventures, Lerer Hippeau, Axeleo Capital, Factorial Capital

👨💼👩💼 Founders: Jérôme Robert, Édouard Viot

🗞️ News: Symbiotic Security announced the launch of Symbiotic Code, the first secure-by-design AI code generation agent, alongside a $10M Seed round led by Alven. The platform addresses a growing enterprise risk as AI-generated code — now used by ~75% of developers — is shown by academic research to contain vulnerabilities in up to 90% of cases. Funding will support product acceleration, go-to-market expansion, and the commercial rollout ahead of a full launch in March. Prominent angels include Thomas Wolf (Hugging Face) and Julien Launay (Adaptive ML). | Sifted, LinkedIn, Blog post

📇 Company: Eclaircie

🏷️ Sectors: CleanTech & Energy, AgriTech & FoodTech

🔍 Description: Eclaircie is a Lorient-based developer and installer of agricultural photovoltaic power plants, specializing in rooftop solar installations ranging from 100 to 500 kWc. The company designs, finances, builds, and operates solar-equipped agricultural buildings, supporting farm modernization while enabling long-term renewable energy production.

💻 Website: Eclaircie

📍 HQ City: Lorient

🧗 Round: Crowdfunding

💰 Amount Raised: €6.9M

🏦 Investors: Arkéa Banque Entreprises et Institutionnels (ABEI), Enerfip

👨💼👩💼 Founders: Nicolas Bergeron

🗞️ News: Founded less than two years ago, Eclaircie has completed its first major financing operation, securing €6.9M to launch its initial photovoltaic construction program, Caliaco 1. The financing combines senior debt from Arkéa Banque Entreprises et Institutionnels with participatory financing raised via Enerfip. The funding will support the construction of 17 rooftop solar plants across agricultural sites in western France, representing an initial targeted capacity of 5.8 MW. The projects involve newly built farm structures or refurbished roofs on existing buildings, which are leased by Eclaircie. The solar installations will be operated for 30 years, after which ownership will fully transfer to the farmers. All projects have secured building permits and grid connection approvals, with construction expected to begin within the coming weeks. The company, which employs around a dozen people, aims to build a stable, recurring-revenue model and is already considering a refinancing of its bank debt by 2029, highlighting the robustness of its projects amid a highly selective financing environment. | Les Echos

📇 Company: The Sanctuary Group

🏷️ Sectors: E-commerce & Retail

🔍 Description: The Sanctuary Group is a French studio-based fitness platform operating discipline-specific, immersive sports studios. As a holding company, it brings together several branded concepts—such as Le Cercle (boxing), Poses (yoga), and Decibel (dance)—each focused on a single practice, with curated coaching, scheduled sessions, and immersive environments combining music, lighting, and scenography.

💻 Website: The Sanctuary Group

📍 HQ City: Paris

🧗 Round: Growth

💰 Amount Raised: €4.7M

🏦 Investors: Blast, Seventure Partners, M Capital, Smalt Capital

👨💼👩💼 Founders: Renaud Nataf, Alexandre Wilhem

🗞️ News: Founded in 2013, The Sanctuary Group has closed a €4.7M funding round led by Blast, the private investment club founded by entrepreneur Anthony Bourbon. Existing investors Seventure Partners, M Capital, and Smalt Capital also participated, renewing their support following an initial investment in 2023. The funds will be used to accelerate the rollout of the group’s studio concepts across France and internationally, expand its network, and launch a selective franchise model. The company currently operates 15 studios in Paris and Île-de-France, with additional locations in Strasbourg, Nice, Marseille, Bordeaux, Geneva, and Barcelona, and reports 600,000 visits per year. In 2025, The Sanctuary Group generated €10M in revenue. Franchise openings are expected to begin in Q1, with initial projects already underway in Lyon and Levallois, ahead of broader European expansion. | Maddyness

📇 Company: Neo Xperiences

🏷️ Sectors: E-commerce & Retail

🔍 Description: Neo Xperiences is a French technology scale-up specializing in immersive and interactive leisure experiences. Its proprietary technology turns any wall into an interactive play surface, combining physical activity, gaming, and phygital experiences. Initially focused on indoor entertainment, the company is now expanding into health and rehabilitation use cases, including deployments in nursing homes and specialized care facilities, supported by scientific research.

💻 Website: Neo Xperiences

📍 HQ City: Caen

🧗 Round: Series A

💰 Amount Raised: €3.6M

🏦 Investors: Go Capital, Bpifrance, Normandy Development Agency

👨💼👩💼 Founders: Boris Courté

🗞️ News: Founded in 2018, Neo Xperiences has raised €3.6M to accelerate its expansion in France and internationally across the indoor leisure market, including amusement parks, sports centers, tourism complexes, and cultural venues. The funding will support product industrialization, increased R&D investment, and team expansion, with plans to hire 30 additional employees by 2028. The company reports more than 15 million players and over 500 interactive screens deployed across 40 countries on five continents. Neo Xperiences has also gained international recognition through high-profile projects such as a custom immersive attraction developed for MrBeast’s Beastland park in Riyadh. Backed by strong post-pandemic growth in indoor leisure and active entertainment, the company targets annual revenue doubling and a tenfold increase by 2028. | AFJV

📇 Company: Anodine

🏷️ Sectors: DeepTech, CleanTech & Energy

🔍 Description: Anodine is a Grenoble-based industrial deeptech startup developing rechargeable catalytic coatings for mixed metal oxide (MMO) electrodes used in electrolysis systems. Originating from more than ten years of academic research at Université Grenoble Alpes and CNRS, the company has developed a patented technology that reduces the use of critical metals by over 50% while enabling electrode reuse and recharging. Its process supports eco-design, circularity, and the relocalization of a strategic industrial know-how currently dominated by international players.

💻 Website: Anodine

📍 HQ City: Grenoble

🧗 Round: Seed

💰 Amount Raised: €2.5M

🏦 Investors: Sowefund, Grenoble Angels, Business Angels, Bpifrance, Banque Populaire Auvergne-Rhône-Alpes, Crédit Agricole Sud Rhône Alpes, SATT Linksium

👨💼👩💼 Founders: Damien Mouchel dit Leguerrier

🗞️ News: Anodine has raised €2.5M to prepare its industrial scale-up phase and accelerate commercial deployment. The round was led by Sowefund and Grenoble Angels alongside private business angels, with additional backing from public and regional financial partners. Founded in 2024 and incubated by SATT Linksium, Anodine is industrializing a proprietary dip-coating process combined with frugal formulations and a removable electrode connection system, enabling up to 100% rechargeability. The technology targets strategic applications including water treatment systems, salt electrolysis, nuclear infrastructure, and PFAS depollution, while significantly reducing dependence on critical metals such as ruthenium and reinforcing European industrial sovereignty. | LinkedIn

📇 Company: Notom

🧭 Sectors: AI & Machine Learning

🔍 Description: Notom is a French industrial software startup developing a platform that modernizes legacy factory automation systems without replacing existing machines. Its solution connects industrial equipment to modern IT systems, enabling data exploitation and gradual integration of AI to improve production efficiency.

💻 Website: Notom

📍 HQ City: Saint-Ouen

🧗 Round: Seed

💰 Amount Raised: €2M

🏦 Investors: SistaFund, Kima Ventures, Olympe Capital, Business Angels, Aude Guo

👨💼👩💼 Founders: Paola Fedou, Jean-Philippe Gross

🗞️ News: Founded in 2025 by former Innovafeed engineers, Notom has raised €2M just months after launch to accelerate development of its industrial automation software. The funding will support product development, expansion of its technical team, and deployment with early industrial clients—primarily in the agri-food sector. Notom targets both SMEs and large industrial groups, positioning itself as a key enabler of AI adoption in factories by upgrading legacy systems without costly equipment replacement. | Maddyness

📇 Company: Windcoop

🏷️ Sectors: CleanTech & Energy

🔍 Description: Windcoop is a Lorient-based maritime cooperative structured as a Société Coopérative d’Intérêt Collectif (SCIC), developing low-carbon maritime freight services powered by wind propulsion. The cooperative brings together citizens, companies, and partners under a shared-governance model applied to container shipping.

💻 Website: Windcoop

📍 HQ City: Lorient

🧗 Round: Crowdfunding

💰 Amount Raised: €1.4M

🏦 Investors: Crowdfunding

👨💼👩💼 Founders: Alice de Cointet de Fillain, Matthieu Brunet-Kimmel, Nils Joyeux-Zylberman, Francois Harary, Victor Depoers, Julien Noe, Amaury Bolvin, Louise Chopinet

🗞️ News: Windcoop closed its third citizen funding round on December 31, 2025, significantly exceeding its €500k target by raising €1.4M. Since its creation in 2022, the cooperative has raised a total of €7.7M. The funding coincides with the start of construction of its first wind-powered container ship, Miaraka, at RMK Marine shipyard in Turkey, where the first steel cut took place on December 19. The 91-meter vessel, equipped with 1,500 m² of sails, is designed to operate a direct shipping route between France and Madagascar starting in summer 2027, with a 30-day transit time and an estimated 60% reduction in CO₂ emissions compared to conventional maritime transport. The funds will support final vessel financing and preparation for commercial operations. | Mer et Marine

📇 Company: checkDPE

🏷️ Sectors: CleanTech & Energy, AI & Machine Learning, PropTech & Real Estate

🔍 Description: checkDPE is a digital platform designed to improve the reliability and usability of the Diagnostic de Performance Énergétique (DPE), a key regulatory metric impacting real estate value and compliance in France and Europe. The solution analyzes the quality of existing DPEs, simulates post-renovation energy performance, and helps quantify, prioritize, and manage renovation actions through an intuitive dashboard. Built on proprietary AI modules, checkDPE aims to become the reference tool for accelerating residential energy renovation for both individuals (B2C) and professionals (B2B), including real estate agencies, property managers, renovation players, and banks.

💻 Website: checkDPE

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: €1.2M

🏦 Investors: Demea Sustainable Investment, Bpifrance

👨💼👩💼 Founders: Emmanuel Blanchet, Germain Blanchet

🗞️ News: checkDPE has raised €1.2M in a funding round led by Demea Sustainable Investment through its newly launched IAM fund, dedicated to climate adaptation and mitigation technologies. The capital will be used to deploy the platform to the general public, initiate B2B market entry, strengthen teams, and accelerate product development. Positioned at the intersection of regulation, AI, and energy efficiency, checkDPE targets a multi-billion-euro renovation market driven by tightening climate regulations and carbon-neutrality objectives in France and across Europe. | Demea

📇 Company: AI Verse

🏷️ Sectors: AI & Machine Learning

🔍 Description: AI Verse is a deeptech company specialising in the generation of high-fidelity synthetic datasets for training computer vision models. Its proprietary platform procedurally creates fully annotated, photorealistic image datasets with pixel-level precision and full control over scenes, objects, and conditions. Designed for environments where real-world data is scarce, costly, or impossible to collect, AI Verse serves mission-critical use cases across autonomous systems, robotics, defence, smart cities, and industrial inspection. The platform is available in SaaS and on-premise deployments to meet strict confidentiality, performance, and security requirements.

💻 Website: AI Verse

📍 HQ City: Biot

🧗 Round: Seed

💰 Amount Raised: €5M

🏦 Investors: Supernova Invest, Creazur, Innovacom, Bpifrance

👨💼👩💼 Founders: Benoît Morisset, Arnauld Lamorlette

🗞️ News: AI Verse has completed a strategic fundraising round advised by Avolta to support its next phase of growth. The funding will be used to strengthen technical, product, and commercial teams, accelerate platform deployment, and support international expansion across defence, robotics, industrial inspection, and other safety-critical AI applications. | Les Echos

📇 Company: Obside

🏷️ Sectors: Fintech, AI & Machine Learning

🔍 Description: Obside is a French fintech platform that democratizes automated trading by allowing users to create and execute algorithmic trading strategies using natural language—either typed or spoken. Instead of coding or configuring complex parameters, users simply describe their intent (e.g. “buy if this stock drops for three consecutive days”), and Obside’s multi-agent AI system translates it into executable logic across financial markets. The platform supports lightning-fast backtesting, an AI trading playground, and automation across stocks, forex, and crypto, with predictive markets planned next. Founded in 2018, Obside’s mission is to remove technical barriers and make market automation accessible to anyone.

💻 Website: Obside

📍 HQ City: Laval

🧗 Round: Seed

💰 Amount Raised: €500K

🏦 Investors: Business Angels

👨💼👩💼 Founders: Thibaud Sultan, Benjamin Sultan, Florent Poux

🗞️ News: Obside has raised €500K from private investors, bringing total seed funding to €515K and valuing the company at €2.5M. The funds will be used to expand the engineering team and accelerate international growth. Positioning itself as the first platform to convert plain-language instructions into executable trading actions via a multi-agent AI architecture, Obside aims to fundamentally break the automation barrier in financial markets—unlocking a level of accessibility and flexibility previously reserved for hedge funds and professional trading desks. | Tech Funding News,

Other Funding

The French government announced the five winners of the FASEP 2025 call for projects dedicated to digital infrastructure, unveiled on 19 January 2026 at Bercy by Minister Anne Le Hénanff. Launched in summer 2025, this call marks the first time the FASEP programme has focused specifically on the digital sector, reflecting the strategic importance of digital infrastructure for technological sovereignty, public service modernisation, and digital inclusion in partner countries.

With a total budget of €2.5 million, the program supports mainly French SMEs and specialized infrastructure players in deploying innovative digital solutions abroad. The selected projects span the full digital infrastructure value chain—from cloud and high-speed networks to satellites, cybersecurity, and data-driven infrastructure monitoring—and are largely focused on African countries, with one project in Southeast Asia. Together, the projects aim to reduce the digital divide, strengthen digital sovereignty, and showcase French technological expertise internationally.

FASEP 2025 Digital Infrastructure Winners

- Qualisteo: Improving the performance of drinking water plant equipment in Kenya

- Skynopy & Safran: Digitisation of an Earth observation antenna for the Kenya Space Agency

- EHO Link & AGS: Deployment of cybersecurity solutions in Côte d’Ivoire

- Abeeway: Infrastructure for riverbank monitoring and flood prevention in the Philippines

- Eutelsat: High-speed satellite internet access for isolated areas in Côte d’Ivoire

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: chris@frenchtechjournal.com / helen@frenchtechjournal.com 👋🏻