🧮 Data Point: Angel Suprême

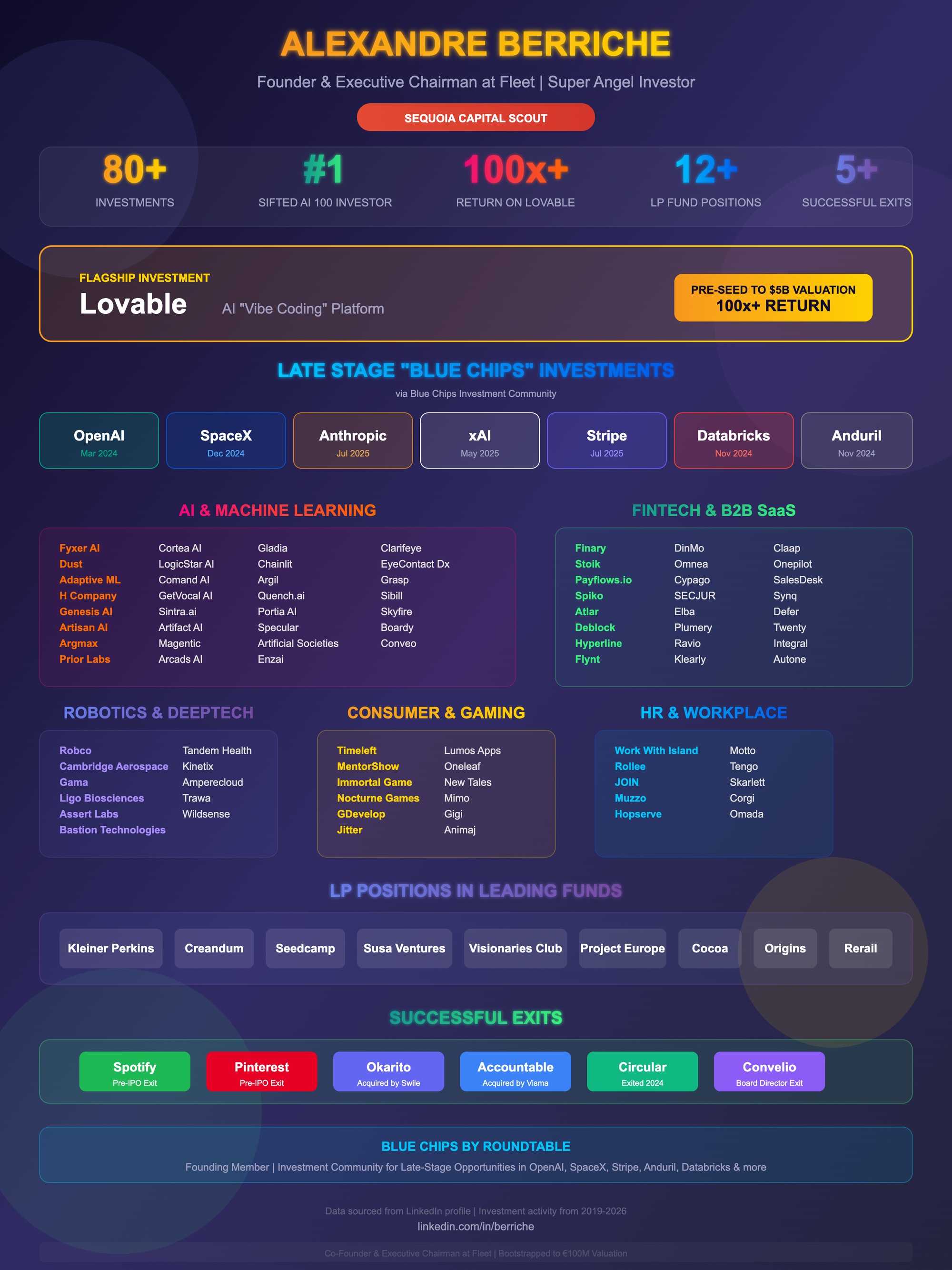

Famed French bootstrapped startup success Fleet announced a financial deal today that values the company at €100 million. (See our story here.) That's good news for its employees and co-founders Sevan Marian and Alexandre Berriche. But it's also potentially very good news for France's and Europe's entrepreneurs because Berriche has become one of France's most active (according to Sifted, THE #1 Most Active) business angels. Now he's reloading.

Since becoming a Sequoia Capital scout in 2021, Berriche has made more than 80 investments. His flagship bet, a pre-seed investment in Swedish AI startup Lovable, has returned more than 100 times his initial stake as the company rocketed to a $5 billion valuation. But Berriche isn't content playing exclusively in the early-stage sandbox. Through Blue Chips by Roundtable, an investment community he co-founded, he has secured stakes in some of the world's most sought-after private companies: OpenAI, SpaceX, Anthropic, xAI, Stripe, Databricks, and Anduril. He's also an LP in elite funds, including Kleiner Perkins, Creandum, and Seedcamp, positioning himself at virtually every stage of the venture capital food chain.

Here's an overview of his portfolio, based on his extensive LinkedIn profile and other public statements:

🚀 Scaling your startup in EMEA?

Learn how high-growth French companies like Pigment use Vanta to grow fast—without compromising on security.

🔐 Turn compliance into a competitive advantage.

📈 Close deals faster with built-in trust.

💸 Weekly Funding Recap: 30

📇 Company: Aviwell

🏷️ Sectors: AgriTech, FoodTech, HealthTech, BioTech, AI & Machine Learning

🔍 Description: Aviwell is a deep-tech animal nutrition company developing AI-driven, microbiome-based solutions to improve animal health, growth, and resilience. Built on decades of microbiome research, the company leverages its proprietary Aneto™ platform to design native bacterial ecologies with defined modes of action, enabling antibiotic-free, sustainable nutrition for poultry and aquaculture.

💻 Website: Aviwell

📍 HQ City: Toulouse

🧗 Round: Series A

💰 Amount Raised: €11M

🏦 Investors: Blue Revolution Fund, Blast.Club, SWEN Capital Partners, Elaia, MFS Investment Management

👨💼👩💼 Founders: Rémy Burcelin, Mouli Ramani

🗞️ News: Aviwell closed an €11M Series A to scale its AI-powered Aneto™ microbiome discovery platform and advance nature-based biological solutions for animal nutrition. The funding will support the progression of poultry and aquaculture microbial ecologies from discovery through validation and industrial scale-up, expand platform services, and deepen commercial partnerships. Led by Blue Revolution Fund, the round underscores growing investor conviction in AI-enabled, sustainable alternatives to antibiotics amid rising global protein demand and tighter environmental constraints. | LinkedIn

📇 Company: Twin

🏷️ Sectors: AI & Machine Learning

🔍 Description: Twin is an AI platform that lets non-technical users build fully autonomous agents capable of running entire businesses end-to-end — from planning and decision-making to execution. Using browser control, self-correction, long-term memory, and a hybrid model stack (high-reasoning models to plan, lightweight models to execute), Twin enables complex operational workflows to be created in minutes without writing code. During its beta, users deployed over 100,000 autonomous agents, including fully automated trading systems, service businesses, retail arbitrage operations, and wholesale import companies.

💻 Website: Twin

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: €8.4M

🏦 Investors: LocalGlobe, Kima Ventures, betaworks, Irregular Expressions, Motier Ventures, Andrena Ventures, Drysdale Ventures

👨💼👩💼 Founders: Hugo Mercier, João Justi

🗞️ News: Twin publicly launched on January 27 following a one-month beta in which users deployed more than 100,000 autonomous agents. The company announced a $10M seed round led by LocalGlobe to support its vision of becoming the “AI company builder,” enabling anyone to create self-sufficient AI-run businesses. Orrick Paris Tech Studio advised Twin on the financing. Early adopters praise the platform’s ease of use and power, while observers note upcoming challenges around reliability and enterprise-grade adoption as Twin scales. | LinkedIn

📇 Company: Atlas V Group

🏷️ Sectors: Gaming

🔍 Description: Atlas V is a European leader in VR and immersive content, known for premium narrative experiences developed with top-tier creative talent and global entertainment IPs. The studio is now diversifying into free-to-play immersive gaming and location-based VR, building a vertically integrated model spanning creation, production, and publishing of scalable XR experiences.

💻 Website: Atlas V

📍 HQ City: Paris

🧗 Round: Series A

💰 Amount Raised: €5M

🏦 Investors: HTC

👨💼👩💼 Founders: Antoine Cayrol, Arnaud Colinart,

🗞️ News: Founded in 2017, Atlas V has built a strong reputation producing critically acclaimed VR experiences such as Spheres: Songs of Spacetime (Darren Aronofsky), Gloomy Eyes, Battlescar, Wallace & Gromit: The Grand Getaway (with Aardman and Meta), and Mobile Suit Gundam: Silver Phantom (with Bandai Namco). Its works have premiered at Sundance, Tribeca, Venice, and Cannes. With this €5M raise led by strategic investor HTC, Atlas V is accelerating its diversification into social and casual free-to-play VR gaming and location-based immersive experiences. The company has grown to 55 employees, including talent from leading gaming studios such as Ubisoft, and is currently developing per year. Atlas V will also extend existing IPs into location-based formats and deepen partnerships with major entertainment franchises, while leveraging HTC’s XR ecosystem to scale distribution and adoption. | Variety

📇 Company: Recupere Metals

🏷️ Sectors: DeepTech, Hardware, CleanTech, Energy

🔍 Description: Recupere Metals is a French industrial startup developing a patented mechanical process to transform copper waste directly into high-performance copper wires, without melting or refining. By bypassing energy-intensive steps of traditional copper production, the company offers a low-carbon, locally sourced alternative for industrial copper supply, addressing Europe’s growing exposure to copper shortages driven by electrification, renewables, data centers, and AI infrastructure.

💻 Website: Recupere Metals

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: €5M

🏦 Investors: SistaFund, Endgame Capital, Ring Capital, Triple Impact Ventures, Business Angels, Sake Bosch

👨💼👩💼 Founders: Katie Marsh, Julien Vaïssette

🗞️ News: Founded in March 2025, Recupere Metals raised €5M just months after launch to transition from R&D to industrial production. The funding will be used to scale manufacturing capacity and tailor its recycling process to industrial customer needs. The company targets applications in electric motors, data centers, and digital infrastructure, with pilot testing underway. Against a backdrop of a projected 30% global copper supply gap by 2035 (per IEA estimates), Recupere Metals aims to build a resilient European copper recycling value chain and reach 6,000 tons of annual copper wire production by 2028. | Maddyness

📇 Company: AYAQ

🏷️ Sectors: E-commerce & Retail

🔍 Description: French technical apparel brand focused on high-performance outdoor clothing, built on field-tested functionality, durability, and a long-term product vision. Founded by Olympic gold medalist Vincent Defrasne, AYAQ combines elite performance standards with premium positioning, supported by a senior advisory board drawn from the retail and luxury industries.

💻 Website: Ayaq

📍 HQ City: Paris

🧗 Round: Growth

💰 Amount Raised: €3.2M

🏦 Investors: Mike Horn

👨💼👩💼 Founders: Vincent Defrasne

🗞️ News: AYAQ has raised €3.2M in equity, complemented by non-dilutive financing, bringing total capital mobilized to over €5M to accelerate international expansion and strengthen its product roadmap. The round welcomes renowned explorer Mike Horn as a shareholder, while the management team retains majority ownership, ensuring continuity of governance and long-term strategic vision. The funding will support intensified product development, industrial scaling, and a disciplined international rollout. AYAQ is already established in Switzerland and Austria and reached a major milestone with its entry into the Japanese market in September 2025 via leading department stores. The brand has also laid the groundwork for expansion into the UK. | Sport Eco

📇 Company: GoCanopy

🏷️ Sectors: PropTech & Real Estate, AI & Machine Learning

🔍 Description: AI-native operating system for institutional real estate investors, enabling teams to transform fragmented internal data into compounding institutional intelligence. GoCanopy uses human-in-the-loop agentic AI workflows to ingest unstructured documents (PDFs, Excel files, offering memoranda, rent rolls, asset management reports) into a single system of record that supports both investment and asset management workflows.

💻 Website: GoCanopy

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: €2.1M

🏦 Investors: ISAI, BNP Paribas Développement, Yellow, Andrew Baum, Ludovic Jacquot

👨💼👩💼 Founders: William He, Yash Pabbisetti

🗞️ News: GoCanopy has raised €2.1M in seed funding to build the AI operating system for institutional real estate investors. Founded in 2023 and bootstrapped until this round, the company already counts major asset managers among its users, including Brookfield and certain Apollo-managed funds. The platform addresses a core industry pain point: the fragmentation of deal, asset, tenant, and financial data across inboxes, PDFs, spreadsheets, and internal silos. By creating a shared AI-driven extraction layer and a living institutional memory, GoCanopy enables investment teams to improve deal screening, underwriting, and investment committee preparation, while empowering asset management teams with proactive portfolio execution tools such as lease expiry detection and rent review tracking. The funding will be used to accelerate enterprise-grade product development and support international expansion, including scaling teams across Paris and London. | EU Startups

📇 Company: Radiant

🏷️ Sectors: Energy, CleanTech

🔍 Description: Radiant is an industrial climate tech startup developing high-temperature solar thermal solutions designed to decarbonise industrial heat. Its system combines next-generation heliostats, a proprietary receiver, and thermal energy storage to replace fossil-fuel-based equipment such as gas burners and oil-fired boilers across heat-intensive industrial processes.

💻 Website: Radiant

📍 HQ City: Massy

🧗 Round: Seed

💰 Amount Raised: €2M

🏦 Investors: Tiresias Angels, Selim Cherif, Business Angels, Hexa,

👨💼👩💼 Founders: Thomas Delhon, Alexandre Meurisse

🗞️ News: Radiant has been selected for Hexa’s Carbon Zero acceleration programme and closed a €2M funding round to support the industrialisation of its solar thermal technology. Built on over 15 years of R&D conducted at the German Aerospace Center (DLR), Radiant’s solution can deliver industrial heat between 200°C and 1,000°C, with thermal power outputs ranging from 2 to 50 MW, while maintaining precise operational control. The technology targets sectors such as cement, glass, and asphalt, where industrial heat represents more than 70% of energy consumption and remains heavily reliant on fossil fuels. The new funding will finance Radiant’s first industrial demonstrator in Le Mans, validating scalability and deployment efficiency, ahead of broader international expansion to support the decarbonisation of industrial heat at scale. | Tech EU

📇 Company: Evolutive Agronomy

🏷️ Sectors: AgriTech, BioTech

🔍 Description: Evolutive Agronomy develops biological crop protection solutions that are both high-performance and easy to deploy, helping farmers protect crops sustainably. The company’s approach focuses on soil pests, leveraging beneficial organisms to reduce reliance on chemical inputs while improving agronomic outcomes.

💻 Website: Evolutive Agronomy

📍 HQ City: Sophia Antipolis

🧗 Round: Pre-Seed

💰 Amount Raised: €1.8M

🏦 Investors: 50 Partners, Business Angels

👨💼👩💼 Founders: Antoine Pasquier, Lucie Monticelli

🗞️ News: Evolutive Agronomy raised €1.8M to accelerate the field deployment of its first commercial product, ByeNematode®, a biological solution based on predatory mites targeting root-knot nematodes. The funding will also support the scale-up of production capacities and continued R&D closely aligned with real-world farm needs, with a strong focus on soil-borne pests. The round marks a key milestone in the company’s mission to deliver practical, sustainable crop protection tools for farmers. | Nice Matin

📇 Company: Dowgo

🏷️ Sectors: FinTech, Web3

🔍 Description: Dowgo is a French fintech building a blockchain-based investment infrastructure dedicated to financing private impact assets. The platform is designed to connect professional and institutional investors with project developers through a secure, transparent, and liquid digital marketplace, covering the full investment lifecycle from primary issuance to secondary trading.

💻 Website: Dowgo

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: €2M

🏦 Investors: Bpifrance, 50 Partners, Cube Accelerator, Emmanuel Picot, Damien Guermonprez

👨💼👩💼 Founders: Oscar Dumant, Romain Menetrier

🗞️ News: Dowgo announced a €2M funding round to finalize the deployment of its blockchain-based platform for financing impact-driven private assets. Developed over more than three years by finance and investment professionals, the platform aims to become a reference European infrastructure for impact private markets, combining regulatory-grade security, transparency, and continuous liquidity. Dowgo’s solution enables institutional and professional investors to access impact projects previously reserved for large players, with full visibility on financial performance, environmental impact, and CO₂ avoided. For project developers (SMEs, infrastructure developers, local authorities), the platform promises faster, lower-cost, and better-adapted financing through a fully digital infrastructure. A built-in secondary market will allow continuous liquidity and simplified execution across the asset lifecycle. The platform relies on blockchain technology and is pending regulatory approval as an investment firm, alongside an exemption under the EU Pilot Regime. Dowgo’s application is currently under review by the AMF, Banque de France, and ACPR. Ahead of the regulated launch, Dowgo has already released a sovereign, AI-connectable dataroom, compliant with ISO 27001 and DORA standards, hosted in France, and featuring immutable audit trails. The solution supports secure document analysis and audit preparation via AI connectors, while preserving strict read-only data integrity. More than €300M worth of impact projects are already identified and awaiting distribution on the platform, signaling strong early demand for a new generation of compliant, liquid private-market infrastructure in Europe. | Finyear

📇 Company: ATOBA Energy

🏷️ Sectors: ClimateTech, SpaceTech & Aerospace

🔍 Description: ATOBA Energy is a midstream Sustainable Aviation Fuel (SAF) aggregator designed to unlock industrial-scale growth of SAF by resolving the financial deadlock between airlines and producers. By aggregating upstream and downstream offtake portfolios, ATOBA enables long-term SAF contracts with optimized pricing indexes, mitigating technology and pricing risk across production pathways and accelerating final investment decisions.

💻 Website: ATOBA Energy

📍 HQ City: Lyon

🧗 Round: Pre-Seed

💰 Amount Raised: €1.265M

🏦 Investors: 👨💼👩💼

👨💼👩💼Founders: Arnaud Namer

🗞️ News: ATOBA Energy raised an oversubscribed $1.5M pre-seed round to scale its SAF aggregation platform and expand short- and long-term offtake agreements with producers, airlines, and jet fuel resellers. The company addresses a critical bottleneck in the SAF market, where producers require long-term price stability to finance projects while airlines seek market-linked pricing with reduced execution risk. By unifying the SAF financial value chain, ATOBA enables bankable long-term offtake contracts—key to scaling SAF from a ~$2B market today toward a projected $400B+ market by 2050. | Atoba

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻