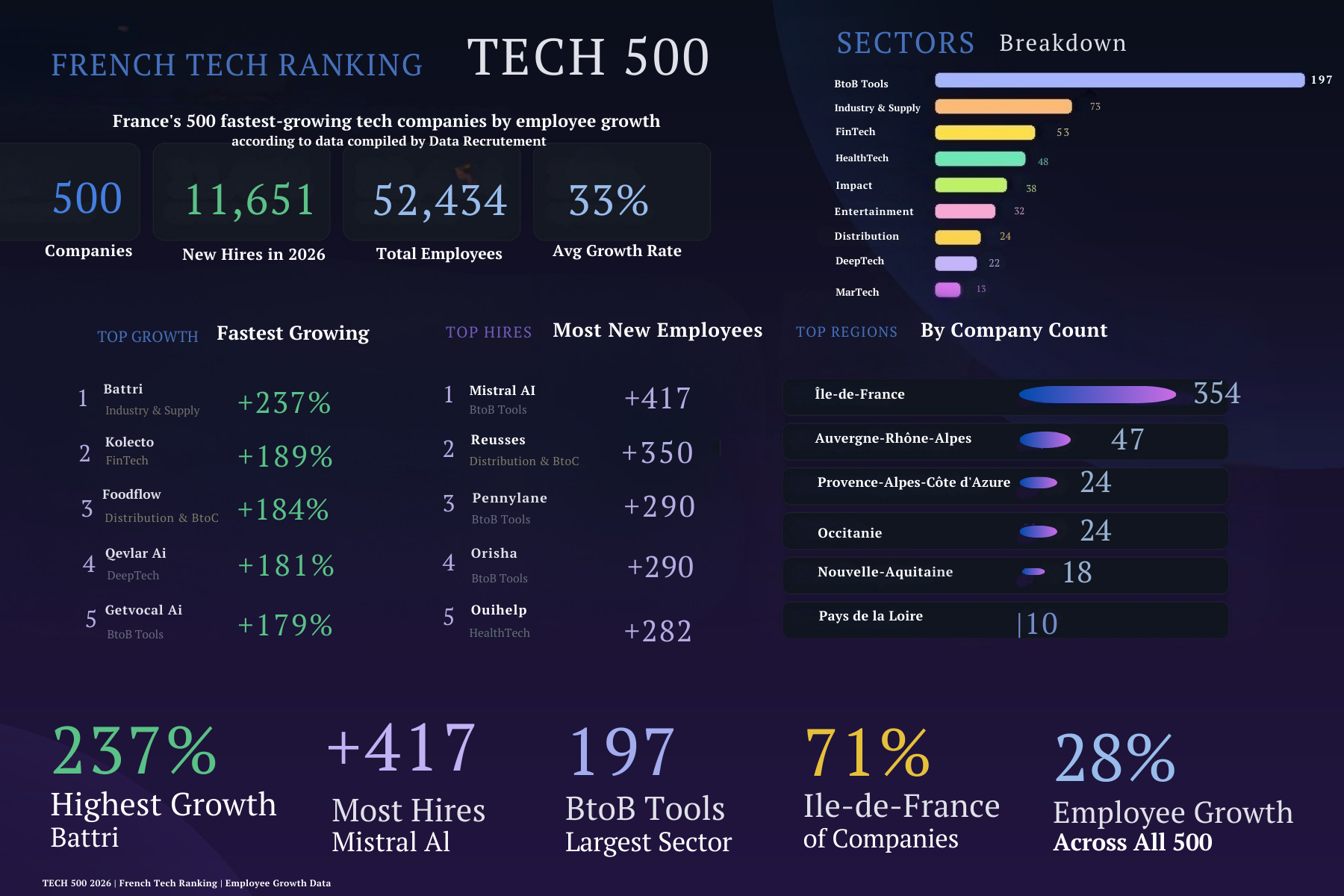

🧮 Data Point: Tech 500

The 500 fastest-growing startups in France added nearly 12,000 jobs in 2025, with average headcount growth reaching 33%, up from 27% the previous year. Not bad for an ecosystem still nursing a venture capital hangover.

Leading the charge was Mistral AI, which more than doubled its team in France, going from 270 to 687 employees. But the ranking's real charm is in the sleeper names that may be new to you. That's the whole point, says Thomas Bénard, CEO of Data Recrutement, whose team spent 600 hours crunching LinkedIn data, calling founders, and cross-referencing numbers to build the list. In a market where big funding rounds grab headlines, the TECH500 tracks who's actually putting people in seats.

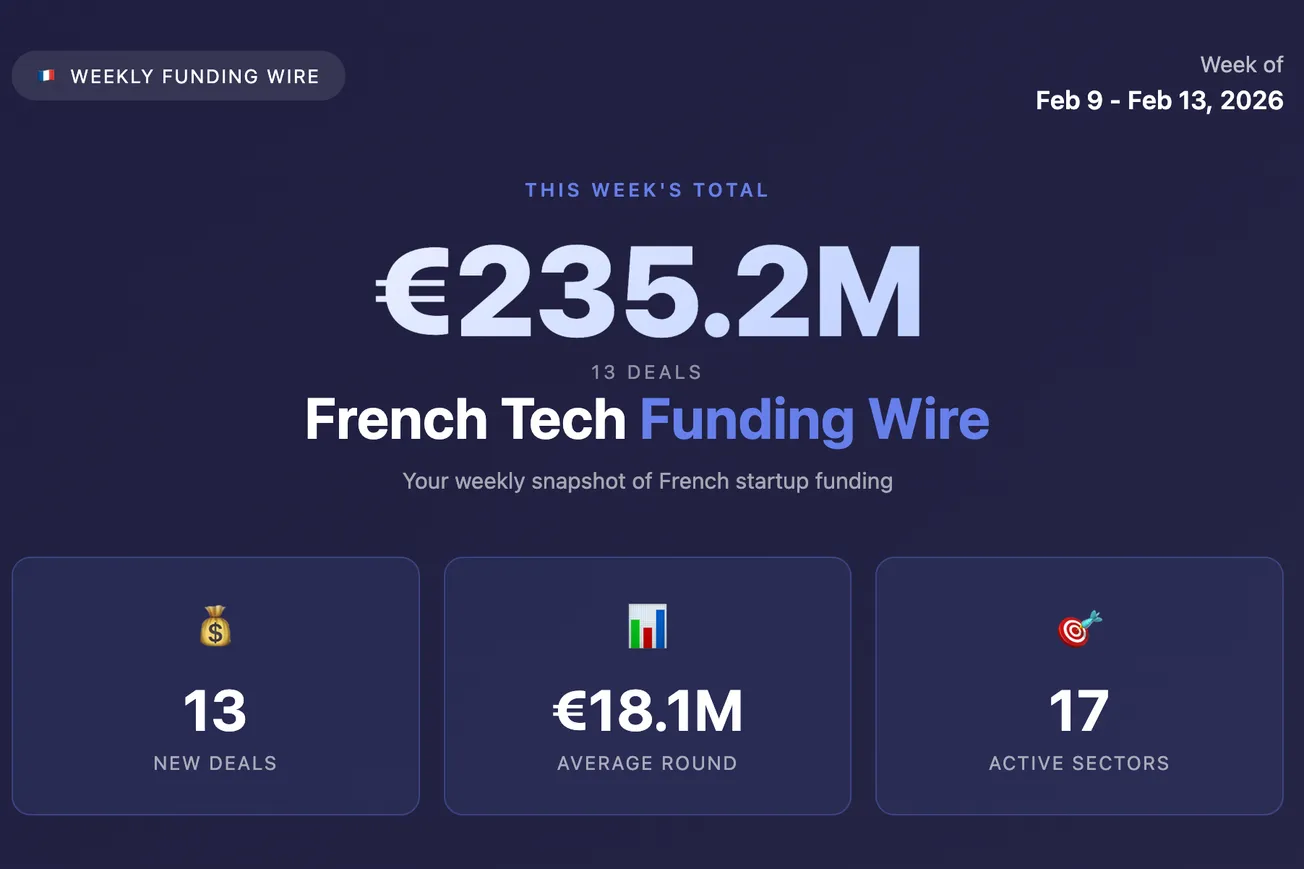

💸 Weekly Funding Recap: February 13

📇 Company: DentalMonitoring

🏷️ Sectors: HealthTech, AI & Machine Learning, Hardware

🔍 Description: DentalMonitoring develops AI-powered remote orthodontic monitoring solutions, operating as a software-as-a-medical-device (SaMD). Its platform enables orthodontists to supervise treatments remotely through AI-driven analysis of intraoral scans and patient data, improving clinical efficiency and patient experience. The company offers a suite of products, including DM Insights, ScanAssist, DM Engage, and ScanBox Pro, serving over 2 million patients globally.

💻 Website: DentalMonitoring

📍 HQ City: Paris

🧗 Round: Growth

💰 Amount Raised: €84M

🏦 Investors: Lazard Elaia Capital, ISALT

👨💼👩💼 Founders: Philippe Salah

🗞️ News: DentalMonitoring has secured €84M ($100M) to accelerate international expansion and product innovation, reinforcing its position as a global leader in AI-powered orthodontic remote monitoring. The round, led by Lazard Elaia Capital with participation from ISALT, combines equity and debt financing and follows the company’s $150M raise in 2021 that propelled it to unicorn status. Active across Europe, the US, Australia, and Japan, DentalMonitoring plans to expand into Brazil, Turkey, Southeast Asia, and the Middle East. The funding will also support AI R&D through a newly launched software development center and deepen integrations across the orthodontic ecosystem, including manufacturers, practice management software providers, and scanning hardware companies. With a treatment-agnostic platform model and growing enterprise partnerships, DentalMonitoring aims to define a new global standard of care in digital orthodontics while exploring applications beyond dentistry. | EU Startups, Maddyness

📇 Company: Naboo

🏷️ Sectors: AI & Machine Learning, SaaS & Enterprise

🔍 Description: Naboo is an AI-powered procurement platform initially focused on corporate event management (MICE) and now expanding into broader “Class C” (tail spend) categories such as travel, fragmented services, and indirect procurement. Positioned as an AI-driven operating system for event and indirect spend management, Naboo centralizes sourcing, contracting, payments, compliance, and financial visibility for large enterprises.

💻 Website: Naboo

📍 HQ City: Paris

🧗 Round: Series B

💰 Amount Raised: €60M

🏦 Investors: Lightspeed Venture Partners, Notion Capital, ISAI, Ternel

👨💼👩💼 Founders: Maxime Eduardo, Antoine Servant, Lucien Bredin, Jean-Louis Villeminot

🗞️ News: Naboo has raised €60M in a Series B led by Lightspeed to expand beyond event management into AI-driven control of “Class C” indirect spending—an often fragmented and weakly structured category covering events, travel, and miscellaneous services. Founded in 2022, Naboo positions itself not as a traditional SaaS tool but as a “service-as-software” platform that combines AI agents, procurement workflows, payment infrastructure, and supplier consolidation into a unified operating system. The company reports €125.8M in business volume to date, 3x year-over-year growth over the past three years, 0% churn among enterprise clients, and contracts with a quarter of CAC 40 companies. International expansion is accelerating, with the UK now its largest market outside France and a new North American hub in New York following its launch in Montreal. The fresh capital will fund deeper AI integration across sourcing, contracting analysis, automated tender management, and real-time compliance workflows, alongside expansion into adjacent procurement categories beyond events. Naboo aims to surpass €1B in managed business volume within two years, positioning itself as a strategic financial control tower for enterprise indirect spend in an AI-native procurement landscape. | Maddyness, FrenchWeb, EU Startups

📇 Company: GitGuardian

🏷️ Sectors: Cybersecurity, AI & Machine Learning

🔍 Description: GitGuardian is a cybersecurity company specializing in the detection and remediation of exposed secrets (API keys, tokens, credentials, certificates) and the protection of non-human identities (NHIs) within codebases and cloud environments. Its platform monitors repositories and infrastructure to identify compromised secrets, alert developers and security teams, and orchestrate remediation to prevent lateral movement and data breaches.

💻 Website: GitGuardian

📍 HQ City: Paris

🧗 Round: Growth

💰 Amount Raised: €42.1M

🏦 Investors: Insight Partners, Quadrille Capital, Eurazeo, Sapphire, Balderton, Bpifrance

👨💼👩💼 Founders: Eric Fourrier

🗞️ News: GitGuardian has raised $50M in a growth round led by Insight Partners to scale its platform amid the rapid expansion of non-human identities driven by AI agents and cloud automation. The company, founded in 2017, has become a reference player in secrets security, with over 500,000 developers using its GitHub-integrated tools and enterprise clients including Snowflake, Orange, Deutsche Telekom, and ING. In 2025 alone, GitGuardian detected and remediated 350,000 exposed secrets—five times more than the previous year—highlighting the acceleration of threat vectors as attackers increasingly leverage AI. Generating 70% of its revenues in the US and reporting annual revenues between €30M and €50M, the company aims to deepen its presence in North America while expanding into APAC, Latin America, and the Middle East. The raise positions GitGuardian to compete more aggressively against well-funded US and Israeli cybersecurity players in a market where AI-driven attacks are reshaping the threat landscape. | Les Echos, Maddyness

📇 Company: Lifeaz

🏷️ Sectors: HealthTech, Hardware

🔍 Description: Lifeaz develops connected automated external defibrillators (AEDs) designed for individuals, businesses, and public spaces. Its flagship device, Clark, combines ease of use, remote monitoring, predictive maintenance, and integrated training tools to democratize access to life-saving equipment and improve cardiac arrest survival rates.

💻 Website: Lifeaz

📍 HQ City: Paris

🧗 Round: Series B

💰 Amount Raised: €13M

🏦 Investors: Mutuelles Impact, BNP Paribas, GO Capital, Mirova

👨💼👩💼 Founders: Johann Kalchman, Martial Itty, Timothée Soubise, Jonathan Levy-Bencheton

🗞️ News: Lifeaz has raised €13M to scale production, accelerate European expansion, and strengthen its AI-enabled connected defibrillator platform. Founded in 2015, the company has installed over 25,000 devices and reports more than 100 lives saved to date. Its subscription-based rental model combines hardware, continuous connected maintenance, consumables replacement, and hybrid training (app, remote, in-person), addressing a critical gap where up to one-third of public defibrillators may be non-functional due to poor maintenance. With cardiac arrest affecting over 50,000 people annually in France—92% fatal without rapid intervention—Lifeaz aims to increase survival rates by ensuring a defibrillator is accessible within one minute wherever needed. The new funding will support the ambition to grow from 25,000 to 100,000 deployed devices and expand across Europe, with a target of saving 1,000 lives within five years. Certified under the EU’s highest medical device standards (Class III, MDR 2025), Lifeaz positions itself as a service-driven alternative to traditional equipment sales models in the medical device market. | EU Startups, Maddyness, Frenchweb

📇 Company: 4Moving Biotech

🏷️ Sectors: BioTech

🔍 Description: 4Moving Biotech is a Single Product Vehicle (SPV) created by startup studio 4P-Pharma, focused on repositioning an existing cardioprotective molecule—initially developed for diabetes and obesity—to treat knee osteoarthritis. The company aims to deliver a first-in-class therapy combining analgesic, anti-inflammatory, and joint-protective effects.

💻 Website: 4Moving Biotech

📍 HQ City: Lille

🧗 Round: Series B

💰 Amount Raised: €12M

🏦 Investors: 4P-Pharma, Fondation Arthritis, SATT Lutech, Business Angels, Family Offices

👨💼👩💼 Founders: Revital Rattenbach, Luc Boblet

🗞️ News: Lille-based 4Moving Biotech has raised €12M to advance its Phase II clinical program targeting knee osteoarthritis, bringing total funding since inception in 2020 to €30M, including a €7.3M France 2030 i-Demo grant secured in 2024. The company is currently conducting a Phase IIa trial and plans to expand to 130 patients across France, Canada, and the United States, following recent FDA approval. By repositioning a de-risked molecule with established safety data, 4Moving aims to bypass certain development stages, potentially saving years of clinical work and hundreds of millions of euros. With osteoarthritis affecting approximately 650 million people worldwide—365 million cases involving the knee—the company estimates a blockbuster market potential of €4–5B annually. A Phase IIb trial is planned next year, alongside a targeted €80–100M Series C to fund pivotal trials and move toward regulatory approval by 2029. | Les Echos

📇 Company: ISYBOT

🏷️ Sectors: Robotics, Industrial Automation, DeepTech, Manufacturing Tech

🔍 Description: ISYBOT develops Plug & Play collaborative robots (cobots) dedicated to sanding and grinding operations in heavy industry. Originating from CEA List research, its patented force-detection technology enables safe and intuitive human-machine collaboration, allowing operators without robotics expertise to automate complex, physically demanding finishing tasks while significantly increasing productivity.

💻 Website: ISYBOT

📍 HQ City: Paris

🧗 Round: Series A

💰 Amount Raised: €7M

🏦 Investors: Supernova Invest, Bpifrance

👨💼👩💼 Founders: Yvan Measson

🗞️ News: ISYBOT has raised €7M to industrialize production and accelerate its European expansion in the collaborative robotics market. Already deployed with major industrial players including Airbus, Alstom, Naval Group, and Bénéteau, the company has installed more than 70 cobots on active production lines. Its technology addresses labor-intensive and injury-prone sanding and finishing processes in sectors such as aerospace, rail, naval, and yacht construction—tripling productivity while reducing musculoskeletal risks. The funding will support scaling manufacturing capacity, strengthening B2B sales and product development teams, and expanding commercial coverage across Europe, with North America and Asia as next targets. The appointment of industry veterans Franck Guo and Michael Huemer (ex-Saint-Gobain Abrasifs and FerRobotics) signals a shift toward accelerated international commercialization. ISYBOT aims to establish itself as the European leader in Plug & Play collaborative robotics for industrial finishing before expanding globally. | Bpifrance

📇 Company: Getinside

🏷️ Sectors: E-commerce & Retail

🔍 Description: Getinside is a retail media software platform enabling mid-sized e-commerce players to monetize their audience through targeted advertising. The company provides tools that allow merchants to run sponsored placements across their websites, emails, and parcel inserts, offering advertisers simplified campaign configuration while generating incremental high-margin revenue for online retailers.

💻 Website: Getinside

📍 HQ City: Toulouse

🧗 Round: Seed

💰 Amount Raised: €3.2M

🏦 Investors: La Poste Ventures, Swiss Post Ventures, 50 Partners, Clover, Founders Future

👨💼👩💼 Founders: Maxime Garrigues

🗞️ News: Getinside has raised €3.2M in seed funding (including €1.2M in debt), following a €1.2M round in 2023, to accelerate commercialization and expand the capabilities of its retail media platform. Founded in 2022, the startup enables mid-sized e-commerce sites to generate incremental advertising revenue—claiming a 1–2% uplift in turnover with ~70% net margins. The company currently serves 250 merchants, including Boulanger, Kiabi, and Orchestra, and aims to reach 500 clients by the end of 2026. Its model combines commission-based monetization (30% of ad revenues) with optional SaaS subscriptions (€400/month for premium features). Initially focused on parcel insert advertising—still representing two-thirds of revenue—Getinside has delivered 1,200 campaigns in three years and is now integrating AI-driven targeting based on socio-demographic and purchasing data. Backed by postal and retail-focused investors, the company positions itself as a sovereign European alternative to Big Tech-dominated digital advertising, at a time when retail media ad spend is expected to surpass TV advertising in 2026. | Les Echos, Frenchweb

📇 Company: Eclore

🏷️ Sectors: DeepTech, Hardware

🔍 Description: Eclore develops high-durability protective covers for industrial robots operating in intensive environments such as food processing, pharmaceuticals, and electronics manufacturing. Its proprietary folding design increases durability by up to five times compared to conventional bellows, reducing machine downtime and improving production continuity.

💻 Website: Eclore

📍 HQ City: Nantes

🧗 Round: Seed

💰 Amount Raised: €3M

🏦 Investors: Bpifrance, UI Investissement, Sodero, Pays de la Loire Participations, Défense Angels

👨💼👩💼 Founders: Pierre Gautier-Le Boulch

🗞️ News: Founded in 2019, Eclore has raised €3M in its first funding round to industrialize production and scale commercial deployment of its advanced robot protection systems. The company has simultaneously moved into a new 700 m² manufacturing facility near Nantes, marking its transition from early-stage development to industrial scale-up. By extending the lifespan of robot protection components and minimizing costly production interruptions, Eclore positions itself as an enabling infrastructure player in high-throughput industrial automation environments. | LinkedIn

📇 Company: Archimed

🏷️ Sectors: SaaS & Enterprise

🔍 Description: Archimed is a French software publisher and integrator specializing in knowledge management solutions. Its flagship product, Syracuse, is a leading platform in the culture and education sector, while its SaaS brand Alfeo targets enterprises, public administrations, and local authorities with flexible knowledge management tools combined with integration, maintenance, and training services.

💻 Website: Archimed

📍 HQ City: Lille

🧗 Round: Seed

💰 Amount Raised: €3m

🏦 Investors: Bpifrance, IRD Invest

👨💼👩💼 Founders: Olivier Walbecq, Eric Delot

🗞️ News: Archimed has opened its capital for the first time to welcome Bpifrance and IRD Invest as minority shareholders, aiming to accelerate commercial expansion—particularly for its Alfeo SaaS knowledge management platform. Ranked 96th in the EY Top 250 French software publishers (2025), the company serves over 500 clients with a team of 70 employees. The transaction will fund recruitment and commercial scaling in a growing market increasingly shaped by AI-driven knowledge structuring. Backed by long-term R&D collaboration with Bpifrance, Archimed now seeks to position Syracuse and Alfeo as reference platforms in structured knowledge management for both public and private sector organizations. | Bpifrance

📇 Company: PGP Farmer

🏷️ Sectors: BioTech, AgriTech, HealthTech

🔍 Description: PGP Farmer is a French biotech company focused on the large-scale production of EU-GMP medical cannabis for pharmaceutical use. The company is developing a vertically integrated 9-hectare production site combining high-tech greenhouse cultivation and a pharmaceutical-grade processing laboratory, aiming to secure Europe’s medical cannabis supply chain and reduce reliance on imports.

💻 Website: PGP Farmer

📍 HQ City: Parcoul-Chenaud

🧗 Round: Seed

💰 Amount Raised: €3M

🏦 Investors: Private investors

👨💼👩💼 Founders: Brahim Sebart

🗞️ News: PGP Farmer has closed a €3M funding round to accelerate the deployment of its EU-GMP-compliant medical cannabis production platform, ahead of France’s nationwide medical cannabis rollout. As European demand grows at over 20% annually—while approximately 75% of supply is still imported, notably from Canada—the company aims to position France as a strategic production hub. With a building permit already secured, PGP Farmer plans to develop a fully integrated 9-hectare site capable of producing up to 30 tons annually at full capacity, targeting key markets such as Germany, which imported nearly 200 tons in 2025. The funding will support the construction of a GACP- and EU-GMP-compliant facility, ensuring full traceability and pharmaceutical-grade standards for a projected European patient base exceeding 1.5 million in 2026. The raise comes at a pivotal regulatory moment in France, following a successful pilot program serving over 3,000 patients. Through its involvement in UIVEC and collaboration with institutional stakeholders, PGP Farmer aims to become a leading European producer and exporter of medical cannabis raw materials and extracts. | Business of Cannabis

📇 Company: Rivage

🏷️ Sectors: FinTech, AI & Machine Learning

🔍 Description: Rivage develops an open and interoperable payroll software designed specifically for accounting firms. The platform automates and secures the entire payroll cycle, integrates with HR and accounting tools, and leverages AI to reduce operational burden while transforming payroll data into a strategic lever for HR advisory services.

💻 Website: Rivage

📍 HQ City: Paris

🧗 Round: Pre-Seed

💰 Amount Raised: €2.6M

🏦 Investors: Partech, Business Angels

👨💼👩💼 Founders: Ayoub Saidane, Hector Vergeron, Paul Lemoine, Tancrède d’Hauteville

🗞️ News: Founded in July 2025, Rivage has raised €2.6M in pre-seed funding led by Partech to accelerate the deployment of its next-generation payroll software across accounting firms. Already live in 8 partner firms and covering 40 national collective agreements (CCNs), Rivage aims to expand to 150+ CCNs by the end of 2026—representing over 90% of the French workforce—while integrating with 10+ HR and accounting ecosystem tools. Positioning itself as a modern alternative to legacy payroll monopolies, Rivage focuses on interoperability, full auditability of payroll and DSN calculations, and AI-powered automation to streamline compliance-heavy workflows. In a market where more than half of French employees rely on accounting firms or outsourcing providers for payroll processing, Rivage targets a strategic infrastructure layer in a large but technologically underserved segment. The funding will support product development, regulatory coverage expansion, and scaling deployments in 2026 as the company seeks to reshape payroll management for accounting firms. | The French Tech Journal

📇 Company: Solaya

🏷️ Sectors: AI & Machine Learning

🔍 Description: Solaya develops AI-powered 3D perception technology that converts simple mobile videos of real-world objects into high-fidelity 3D models—without requiring specialized hardware. Positioned as a horizontal 3D data platform, Solaya aims to democratize structured 3D asset creation for use cases spanning e-commerce, industrial digitalization, digital twins, and robotics.

💻 Website: Solaya

📍 HQ City: Nice

🧗 Round: Pre-Seed

💰 Amount Raised: €1.68M

🏦 Investors: Betaworks, Business Angels

👨💼👩💼 Founders: Massimo Moretti

🗞️ News: Solaya has raised $2M in a pre-seed round led by NYC-based Betaworks and simultaneously launched its mobile 3D perception app. The platform enables users—particularly SMBs—to generate high-quality 3D models from smartphone videos at a cost reportedly 5–10x lower than competing solutions. Already working with early enterprise clients including LVMH, Mattel, Karl Lagerfeld, SNCF, and Dassault Systèmes, Solaya targets high-value applications such as 3D commerce, industrial simulation, robotics R&D, and digital twins. A laureate of the France 2030 “Convergence AI” program, the company strengthens its governance with former Allegorithmic (Adobe Substance 3D) executives joining its advisory board, signaling ambitions to scale in the fast-growing physical AI and 3D infrastructure market—projected to reach $188B by 2030. | Team Nice

📇 Company: Greez

🏷️ Sectors: Circular Economy, RetailTech, BeautyTech, Sustainability

🔍 Description: Greez operates a platform dedicated to reducing waste in the cosmetics industry by enabling brands and manufacturers to valorize unsold products. The solution helps companies manage excess inventory in compliance with financial and regulatory constraints, including France’s AGEC anti-waste legislation, while lowering their environmental footprint.

💻 Website: Greez

📍 HQ City: Chartres

🧗 Round: Pre-Seed

💰 Amount Raised: €627K

🏦 Investors: Fonds Région Centre-Val de Loire Amorçage, Crédit Agricole Régions Investissement, Bpifrance, Roundtable

👨💼👩💼 Founders: Noémie Arnal, Logan Favier

🗞️ News: Founded in September 2023, Greez has raised €627K to accelerate its national rollout and prepare for European expansion. The startup addresses a structural challenge in the cosmetics sector: managing unsold inventory while complying with tightening environmental regulations such as AGEC. By positioning itself as a compliance-driven resale and valorization platform, Greez aims to expand into pharmacy and mass retail channels across France before scaling internationally. With only two employees to date, this funding marks a key step in structuring operations and building commercial traction in a regulatory-driven circular economy niche. | J'aime les startups

📇 Company: Linkeat

🏷️ Sectors: FoodTech, SaaS & Enterprise

🔍 Description: Linkeat develops a SaaS platform dedicated to professionals in the food industry, offering digital tools to streamline operations, management, and subscription-based services within B2B food ecosystems.

💻 Website: Linkeat

📍 HQ City: Bordeaux

🧗 Round: Seed

💰 Amount Raised: €280K

🏦 Investors: Kolibri, Crowdfunding

👨💼👩💼 Founders: Frederic Montier, Marc Bouguié

🗞️ News: Founded in 2024, Linkeat has raised €280K in a seed round via Kolibri crowdfunding to accelerate the development and deployment of its SaaS platform for food industry professionals. Positioned as a B2B subscription-based software solution, the company aims to digitize operational workflows in a sector increasingly adopting cloud-based management tools.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻