🧮 Data Point: CES 2026

France once again sent a major startup delegation to CES 2026 in Las Vegas, with at least 114 French tech companies exhibiting across 16 sectors, from AI and robotics to health and green tech. Despite the high costs, French officials and founders argue that CES remains unmatched for rapid global exposure and deal-making. The delegation is smaller than in pre-pandemic years, down from more than 300 startups in 2018–2019, reflecting tighter funding and a tougher U.S. market. Notably, 80% of the French startups this year were CES veterans, signaling a strategic shift toward experienced companies with market-ready products. Even so, France retains the largest national presence at CES in Europe, split mainly between Eureka Park and the France Automotive Pavilion.

Pulling from a variety of different sources, we put together a handy dandy database of 114 French tech companies at CES 2026.

🚀 Scaling your startup in EMEA?

Learn how high-growth French companies like Pigment use Vanta to grow fast—without compromising on security.

🔐 Turn compliance into a competitive advantage.

📈 Close deals faster with built-in trust.

💸 French Tech Funding 2025

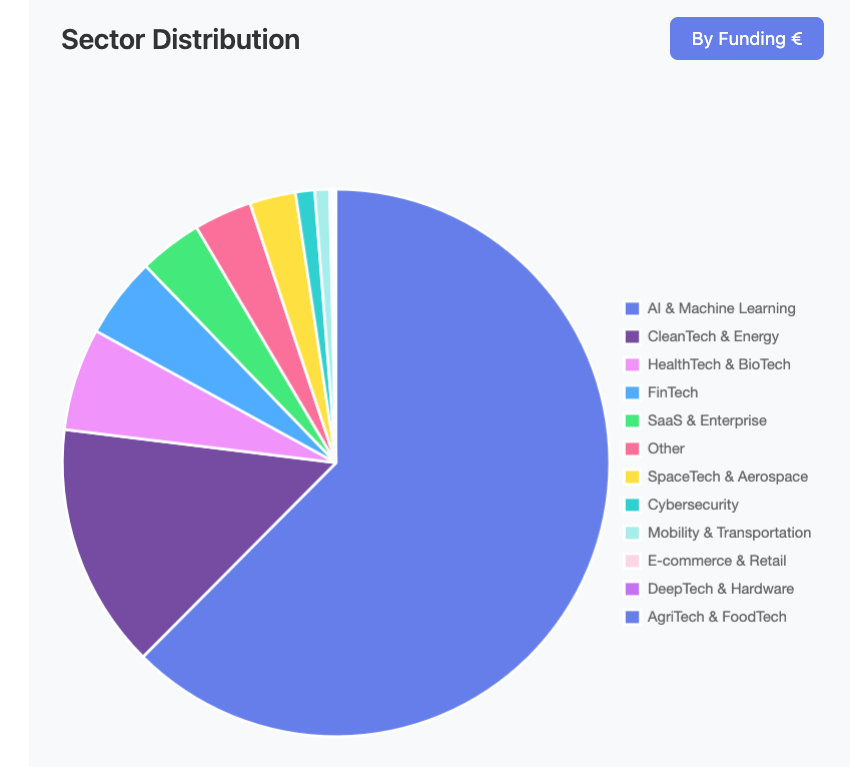

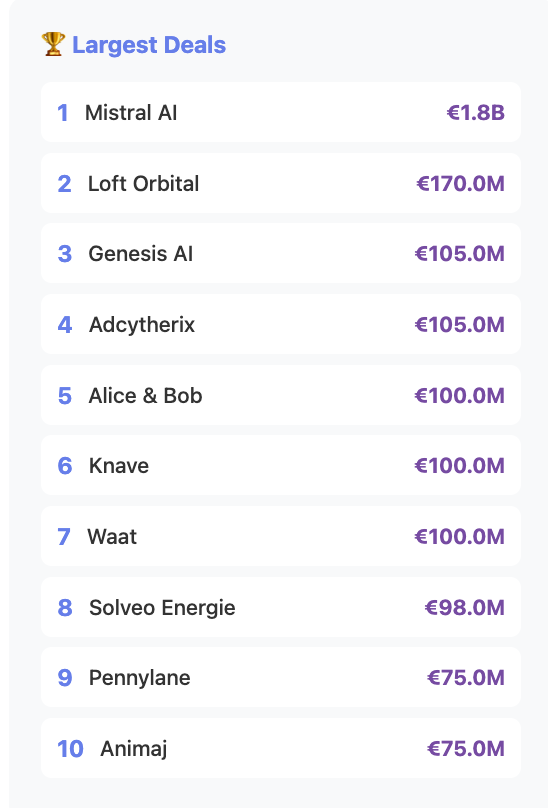

France's startup ecosystem recorded 686 funding rounds throughout 2025, collectively raising €8.2 billion, according to data tracked by The French Tech Journal.

This comprehensive dataset, covering deals from January through December, is available via our new database, which allows you to sort the data by company, geography, and sector.

This first version of the database only allowed each company to be tagged with a single sector. So to get a fuller picture of a sector like "cybersecurity" or "foodtech," it's better to search under related terms such as "food." Version 2 will place companies in multiple categories for easier sorting.

Some key highlights from the data:

- AI and Machine Learning represented 62.5% of deal volume

- Clean Tech and Energy were second at 14.5%

- Average deal size was €12M.

- Outside of Paris, Lyon had the most startups raise (34), but Toulouse had the highest deal value (€322M), which allows you to sort the data by company, geography, and sector

AI Takes Center Stage

Coming back to France, AI is also the engine driving the VC funding train. It accounted for €5.18B or 62.5% of all funding in 2025.

Out of that, Mistral AI represented the lion's share. Take away Mistral, and the year in French tech funding looks very different, which is again why I don't think it's worth fussing too much with the "up or down" issue. If you are not a giant LLM, life looks very different at the other end of the funding telescope.

Still, the good news is that French AI companies are attracting substantial capital, not just early-stage experimentation. The data indicates that France has moved beyond simply participating in the AI revolution to becoming a meaningful player in the space.

This likely won't stop the ongoing debate among founders and VCs about whether they need to relocate to San Francisco, but with some of the recent high-profile AI startup launches in Paris, France is certainly demonstrating some resilience.

CleanTech and Health: Strong Secondary Sectors

Beyond AI, two sectors showed substantial activity:

- CleanTech and Energy companies raised €979.4 million (11.9%) across 109 deals, making it the second-largest sector by both deal count and total funding. With an average round size of €8.98 million, these companies are attracting meaningful capital as France positions itself as a leader in the energy transition.

- HealthTech and BioTech companies completed 56 funding rounds totaling €496.9 million (6.1%). The sector's average round size of €8.9 million suggests that investors see significant potential in French health innovation. This is particularly relevant given Europe's strong position in medical research and the ongoing digitization of healthcare.

💸 European VC 2025: France Raised More New Funds Than the UK

For much of 2025, the narrative around European venture capital fundraising was bleak. But according to Dealroom, European venture capitalists raised $20.5bn across 247 new funds in 2025. That’s down from the $27.1bn raised in 2024, but hardly a freefall.

The headline story, however, is that for the first time in recent memory, France overtook the UK in VC fundraising.

💸 Weekly Funding Recap: January 9

📇 Company: BrightHeart

🔍 Description: Paris-based medtech startup specializing in AI-powered prenatal ultrasound. BrightHeart assists obstetricians by analyzing ultrasound images in real time—particularly complex organs like the fetal heart—to improve early detection of congenital malformations, reduce diagnostic errors, and streamline clinical workflows.

💻 Website: BrightHeart

📍 HQ City: Paris

🧗 Round: Series A

💰 Amount Raised: €11M

🏦 Investors: Odyssée Venture (lead), GO Capital; participation from Sofinnova Partners, clinicians, and medical technology experts

👨💼👩💼 Founders: Cécile Dupont (CEO)

🗞️ News: BrightHeart raised €11M in a Series A to accelerate its expansion in the United States, strengthen its European presence, and continue improving its AI-powered prenatal ultrasound platform. Founded in 2022, the company previously raised €2M in seed funding from Sofinnova Partners. In 2025, BrightHeart secured five FDA authorizations, enabling future clinical deployment in the US and reinforcing its regulatory and scientific credibility. | Maddyness

📇 Company: Quideos

🔍 Description: French fintech specializing in protecting farmers, cooperatives, and agri-food companies against agricultural price volatility. Quideos designs price-hedging contracts that allow clients to fix purchase or sale prices in advance, improving margin visibility while avoiding speculative use.

💻 Website: Quideos

📍 HQ City: France

🧗 Round: Series A

💰 Amount Raised: €5.2M

🏦 Investors: Demeter (lead), Breega; participation from Groupe Crédit Agricole, Clint Capital, and business angels

👨💼👩💼 Founders: Gaël Pagès, Mickaël Delmas (CEO)

🗞️ News: Quideos raised €5.2M to scale the commercial deployment of its agricultural price-protection solutions, convert existing commercial leads into active clients, and prepare team expansion from 2026. Founded in 2023, the startup operates under a regulated investment firm license obtained after 18 months of approval by the ACPR and AMF. The company aims to cover €1B in agricultural transactions by 2029, with initial growth focused on France before expanding across Europe. | Maddyness

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻