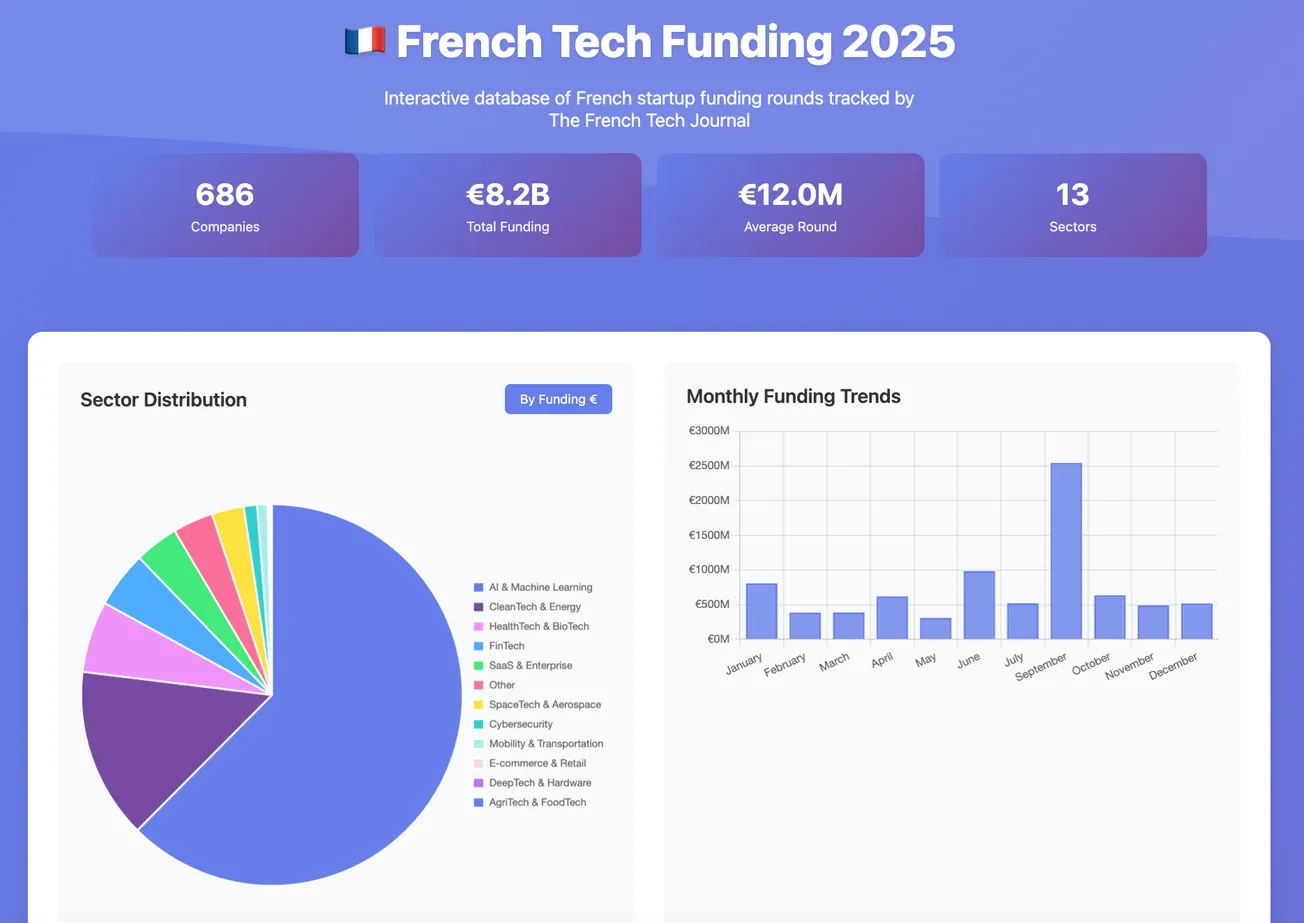

France's startup ecosystem recorded 686 funding rounds throughout 2025, collectively raising €8.2 billion, according to data tracked by The French Tech Journal.

This comprehensive dataset, covering deals from January through December, is available via our new database that lets you sort that data by company, geography, and sectors.

This first version of the database only allowed each company to be tagged with a single sector. So to get a fuller picture of a sector like "cybersecurity" or "foodtech," it's better to search under related terms such as "food." Version 2 will place companies in multiple categories for easier sorting.

Some key highlights from the data:

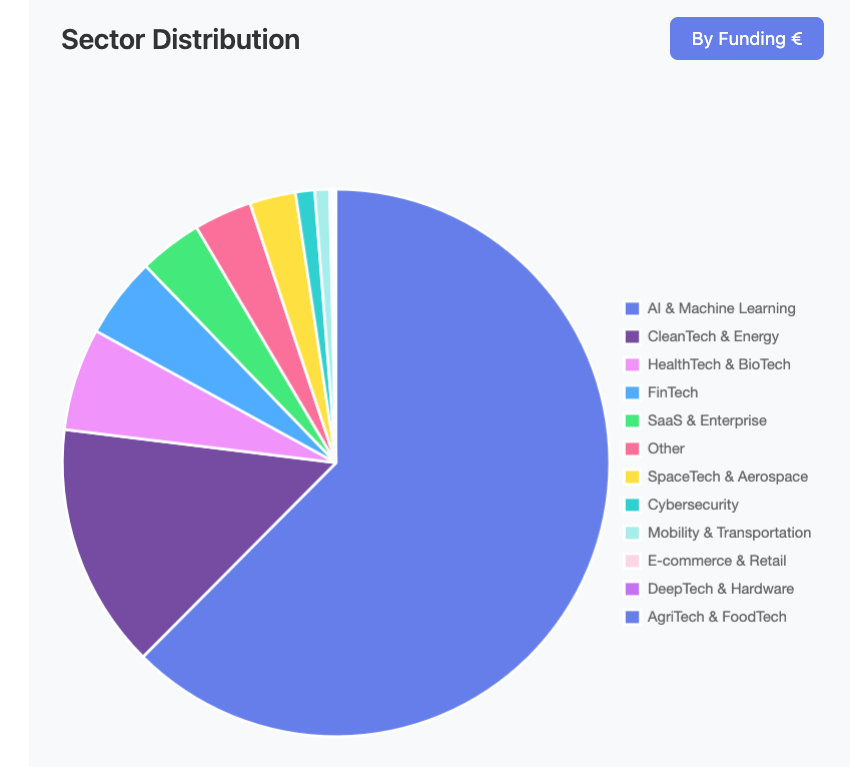

- AI and Machine Learning represented 62.5% of deal volume

- Clean Tech and Energy were second at 14.5%

- Average deal size was €12M.

- Outside of Paris, Lyon had the most startups raise (34), but Toulouse had the highest deal value (€322M)

A couple of notes:

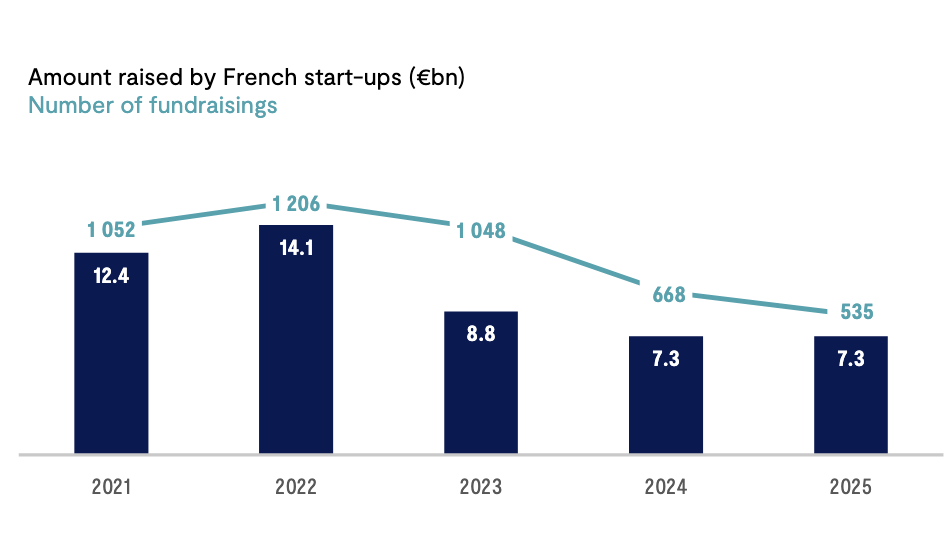

This is our first database, so we're not doing year-over-year comparisons. But you'll see plenty of those, and you'll see a lot of variation. It's important to remember that there are no clear regulations for reporting deals, and the criteria for including deals varies widely.

For instance, some year-end totals include Brevo as a €500 million fundraising, while we did not because it was primarily a PE Buyout. Likewise, one can debate whether to include Loft Orbital, a company founded in San Francisco, but with a French heritage and a major presence in Toulouse and major European funding (we did in include it).

And so, you can get outcomes where Avolta reports French tech startup funding was slightly up last year:

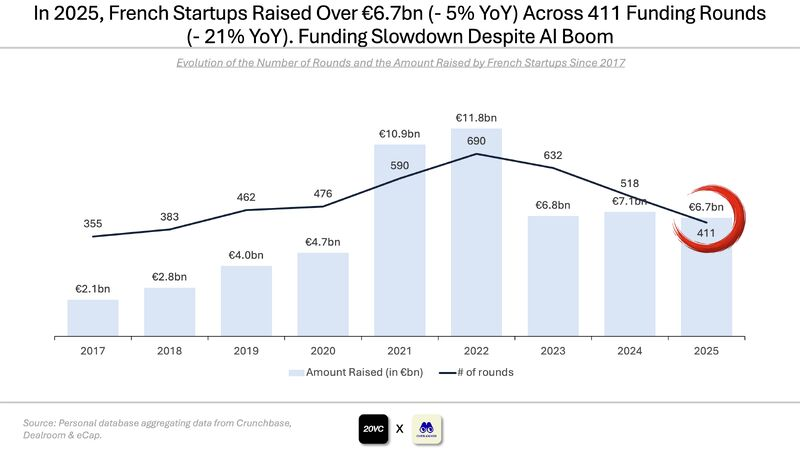

And Alexandre Dewez of 20VC, who is in the process of releasing excerpts of his upcoming annual French Tech ecosystem report, reports that the numbers were down for 2025:

In the end, I don't think it's useful to quibble about "up or down" because again, that's a matter of semantics and accounting, rather than who was writing checks and actually raising money.

I think it's safe to say that there is a pretty broad consensus on the most essential element: AI continues to massively transform the fundraising picture.

Exactly how is being widely debated.

Before we look more closely at the numbers in France for 2025, let's also set them against the broader global context.

All Around The World

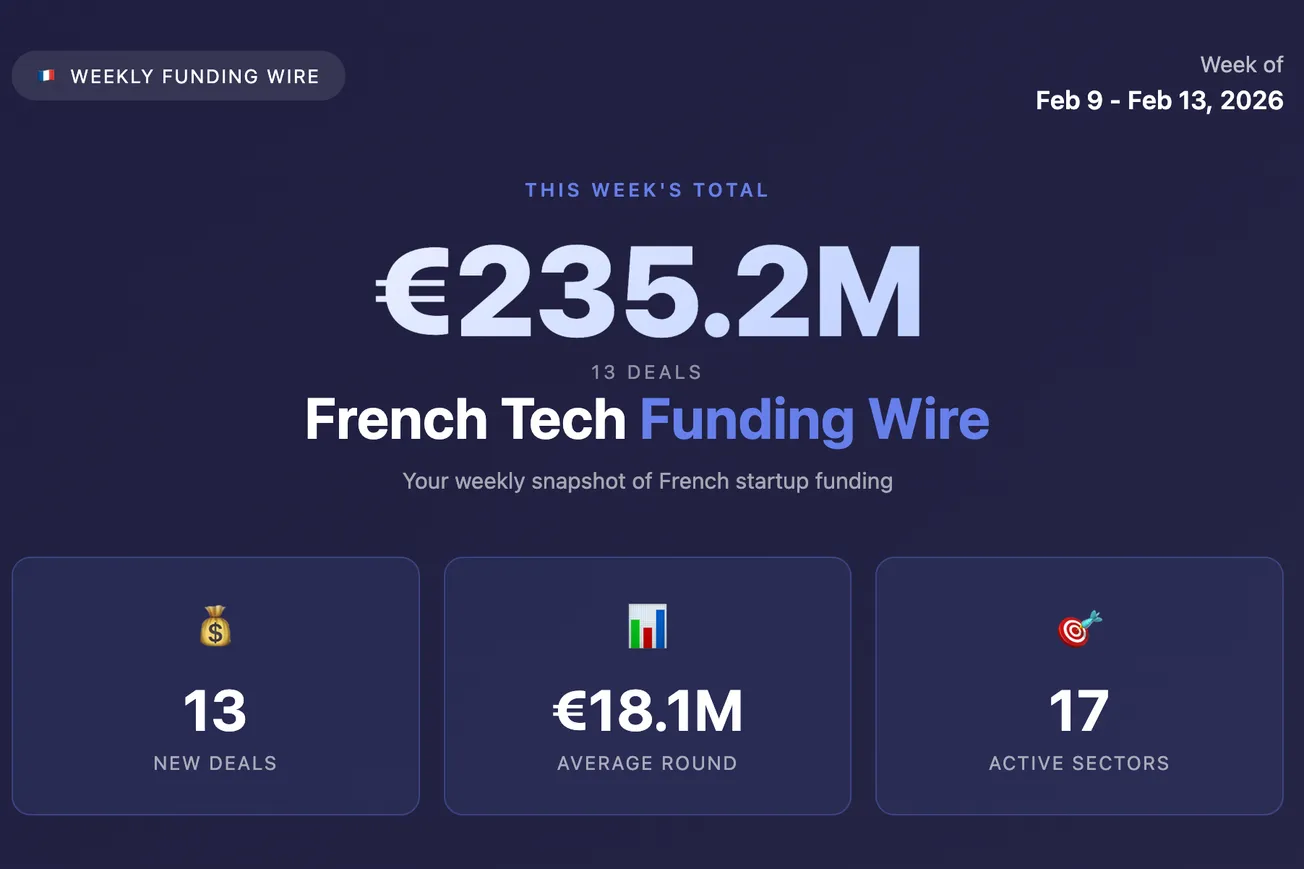

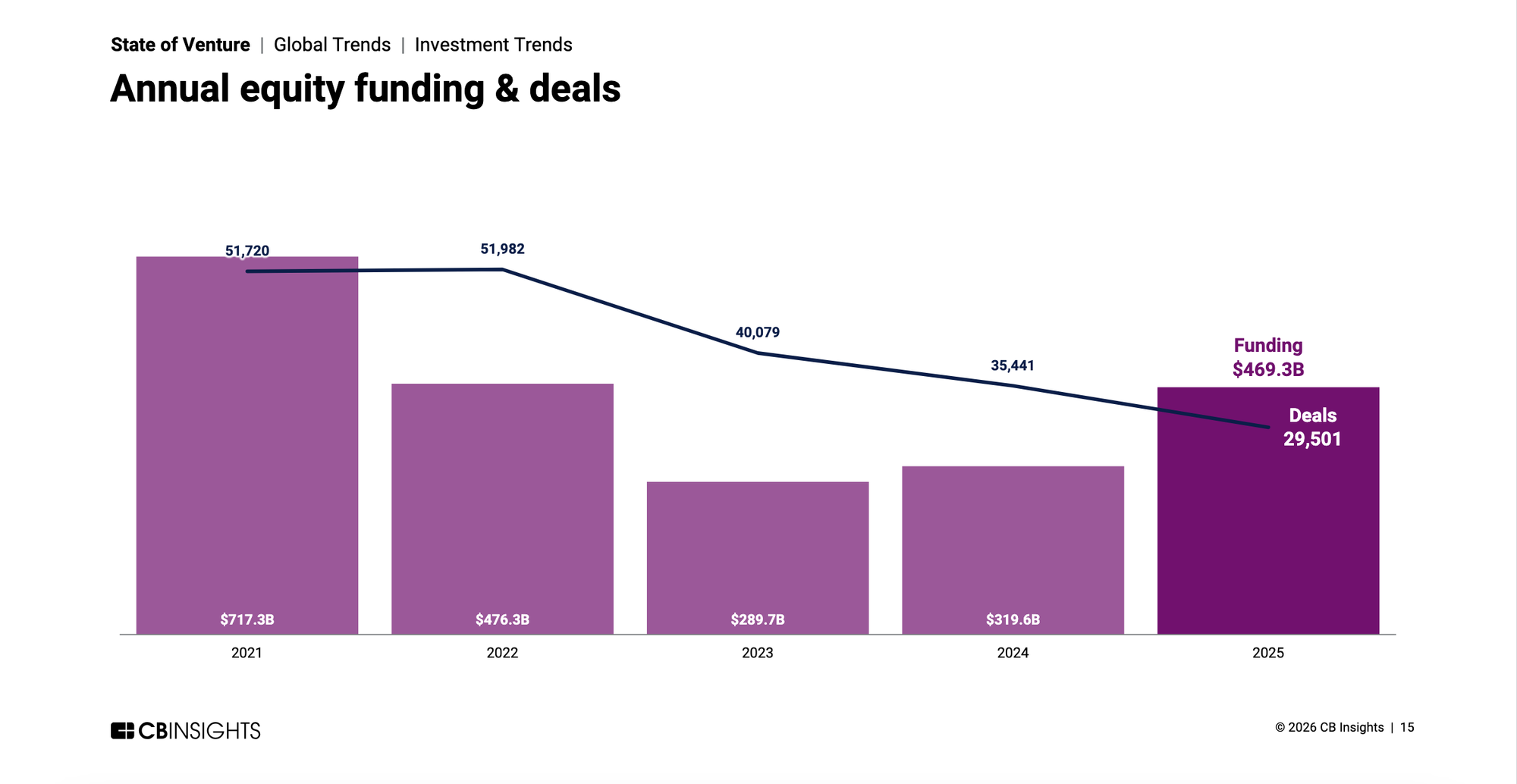

CB Insights just released its State of Venture 2025, and the final numbers reflect what we've seen across the year: Funding is up while deal count is down.

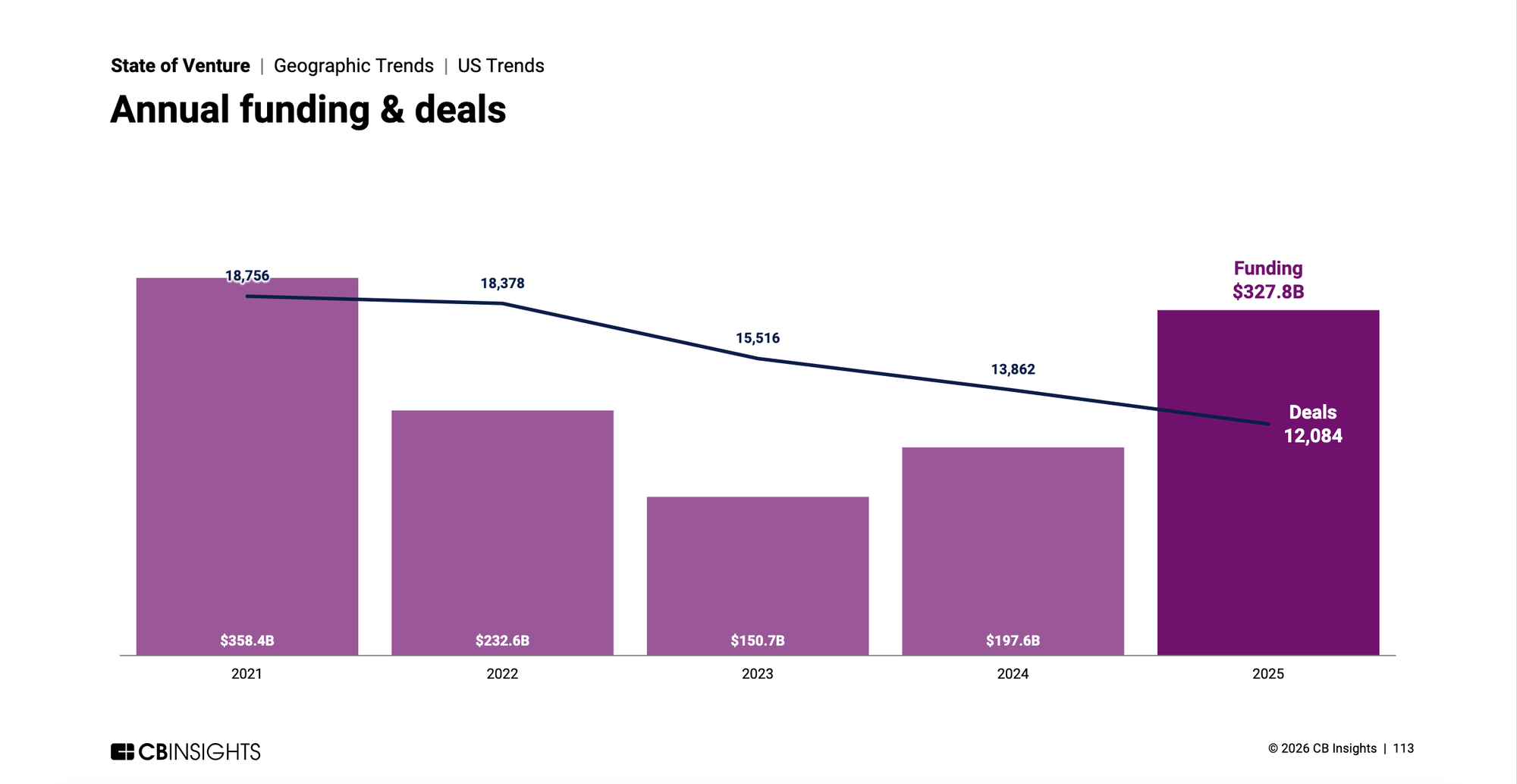

That's true in the US:

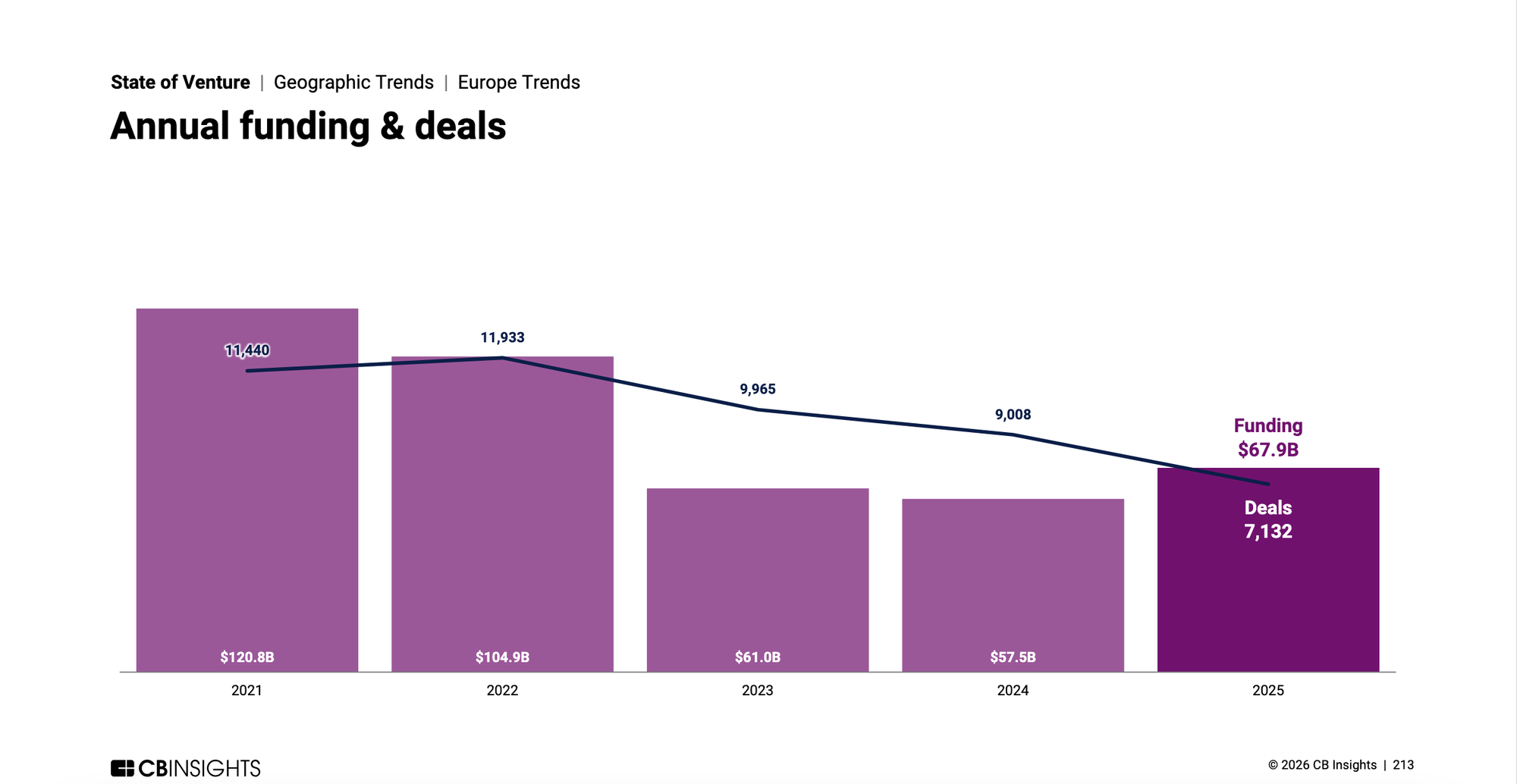

And it's true in Europe:

What varies is the degree. But the massive funding gap the U.S. currently enjoys is largely driven by the handful of mega funding deals by the large LLMs.

Artificial Intelligence Takes Center Stage

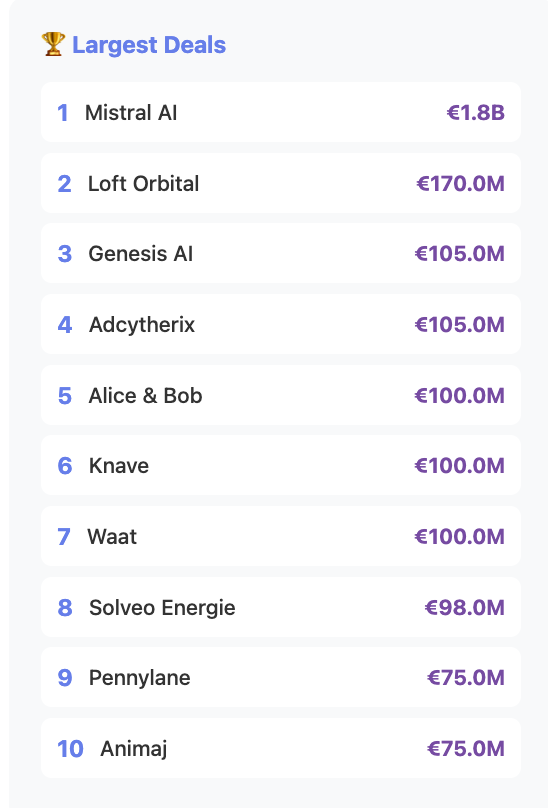

Coming back to France, AI is also the engine driving the VC funding train. It accounted for €5.18B or 62.5% of all funding in 2025.

Out of that, Mistral AI represented the lion's share. Take away Mistral, and the year in French tech funding looks very different, which is again why I don't think it's worth fussing too much with the "up or down" issue. If you are not a giant LLM, life looks very different at the other end of the funding telescope.

Still, the good news is that French AI companies are attracting substantial capital, not just early-stage experimentation. The data indicates that France has moved beyond simply participating in the AI revolution to becoming a meaningful player in the space.

This likely won't stop the ongoing debate among founders and VCs about whether they need to relocate to San Francisco, but with some of the recent high-profile AI startup launches in Paris, France is certainly demonstrating some resilience.

CleanTech and Health: Strong Secondary Sectors

Beyond AI, two sectors showed substantial activity:

- CleanTech and Energy companies raised €979.4 million (11.9%) across 109 deals, making it the second-largest sector by both deal count and total funding. With an average round size of €8.98 million, these companies are attracting meaningful capital as France positions itself as a leader in the energy transition.

- HealthTech and BioTech companies completed 56 funding rounds totaling €496.9 million (6.1%). The sector's average round size of €8.9 million suggests that investors see significant potential in French health innovation. This is particularly relevant given Europe's strong position in medical research and the ongoing digitization of healthcare.

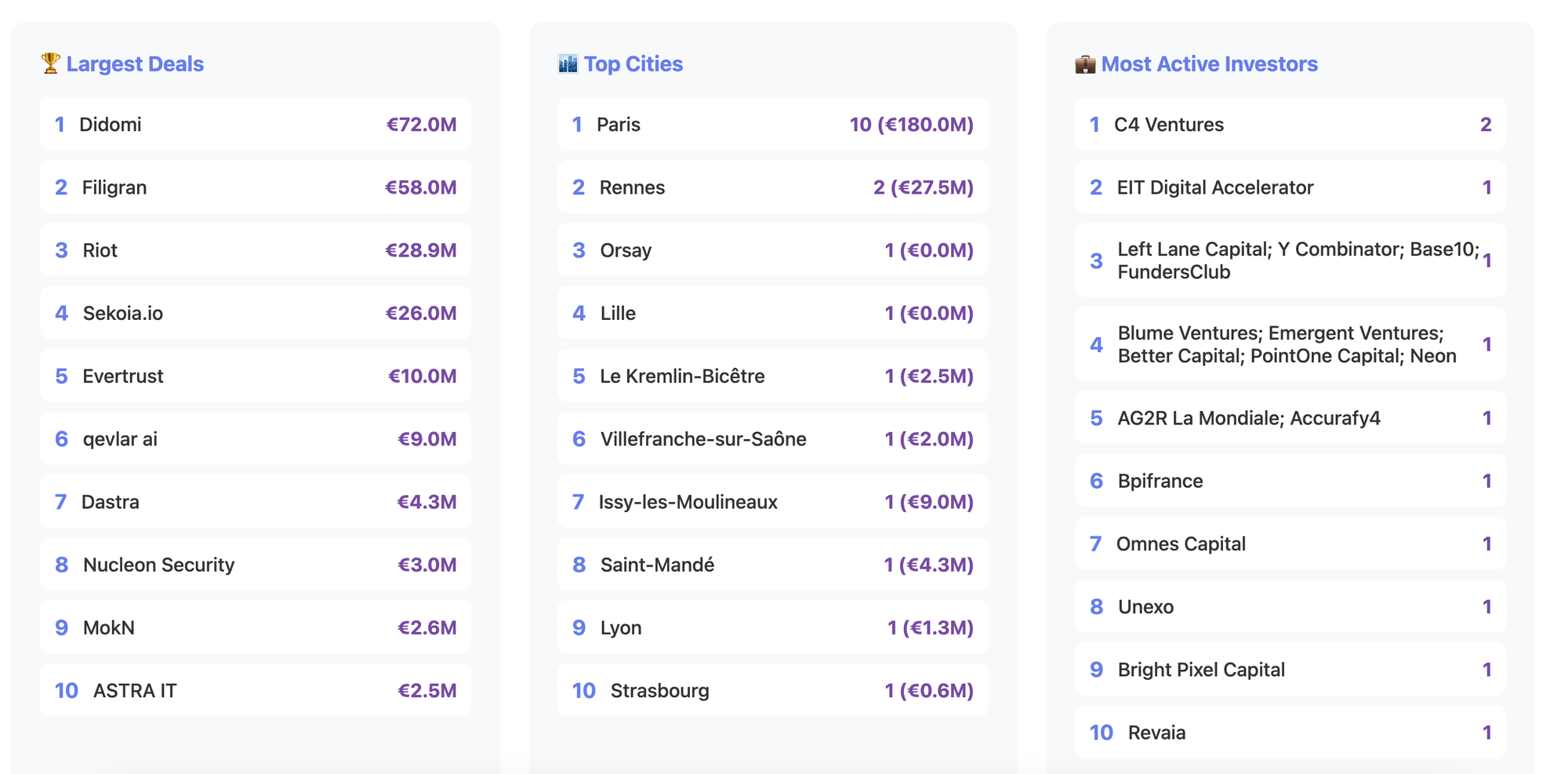

Paris: Still Ground Zero

The geographic distribution of funding reveals an interesting subtlety.

Overall, France's stark VC concentration hasn't shifted much. Paris dominated with 325 rounds or 47% of all deals, accounting for €5.4 billion or 64% of total funding.

However, this also means that Paris accounts for less than half of deal volume. It captures nearly two-thirds of capital, suggesting that larger, more mature companies still tend to cluster in the capital.

Beyond Paris, France's regional ecosystems showed meaningful but significantly smaller activity. Lyon recorded 34 deals totaling €177 million, while Toulouse's 17 companies raised €322 million. The latter was driven to a large degree by Loft Orbital, which, again, one can debate as to whether to include or not.

Bordeaux and Lille each saw 17 deals as well, raising €68 million and €75 million respectively. Overall, the database tracked startup activity across 148 French cities, demonstrating that innovation extends well beyond the capital, even if capital concentration remains high.

Emerging Sectors

Several smaller sectors showed some strength.

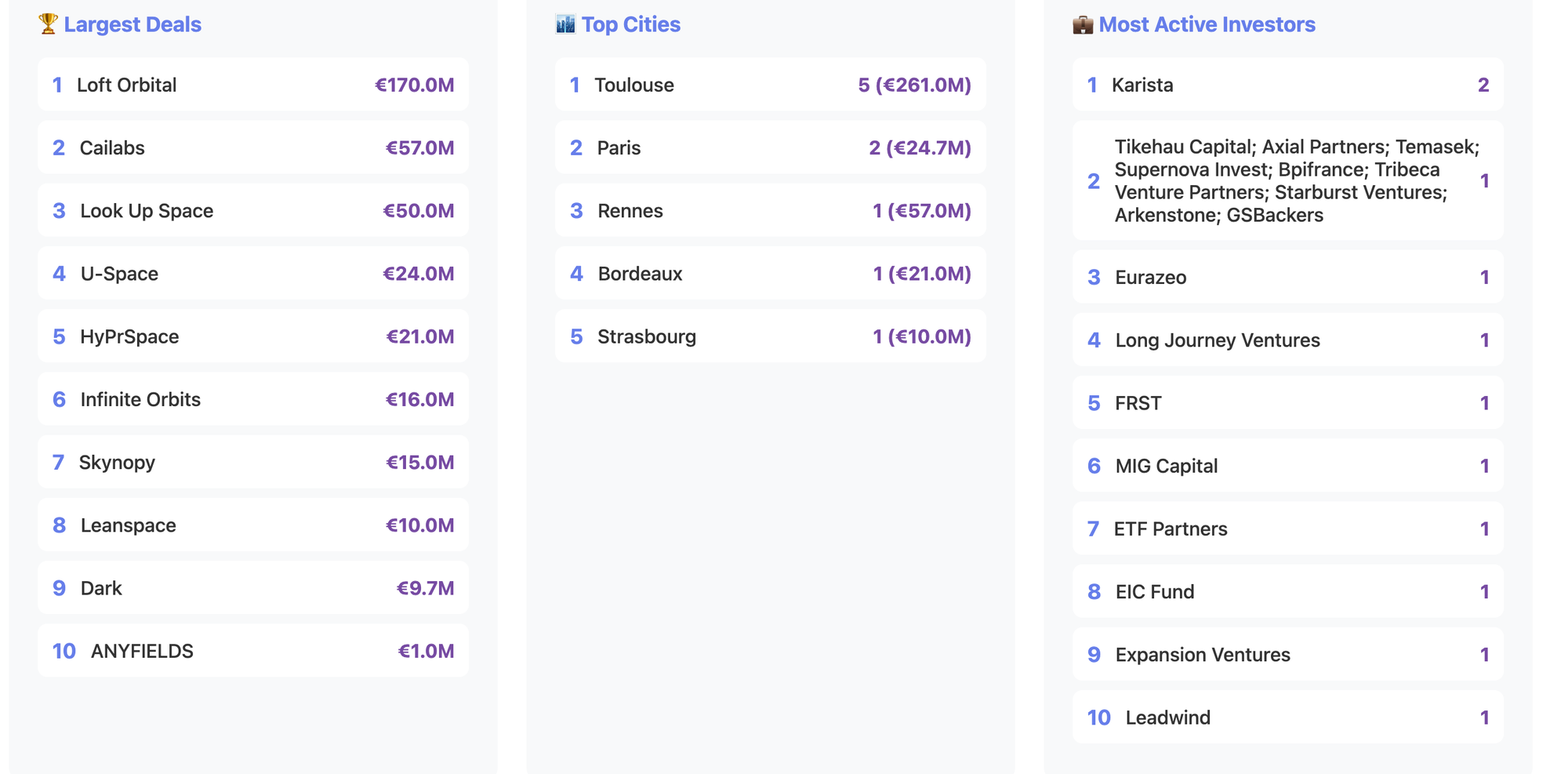

Cybersecurity saw 21 companies raise €227.7M, more than half of those having some kind of AI-related component.

SpaceTech and Aerospace companies saw 10 companies raise €373.7M.

We'll continue to update the database, and we'll start work on the 2026 one. Naturally, if you see anything amiss, mislabeled, etc., just drop us a note.