If you needed a sign that France's tech ecosystem may be shaking off its post-correction malaise, here it is: the 500 fastest-growing startups in the country are hiring at an accelerating clip, adding nearly 12,000 jobs in 2025 alone.

Though, as with so much economic data in these confusing days, even that upbeat conclusion comes with some important caveats and asterisks.

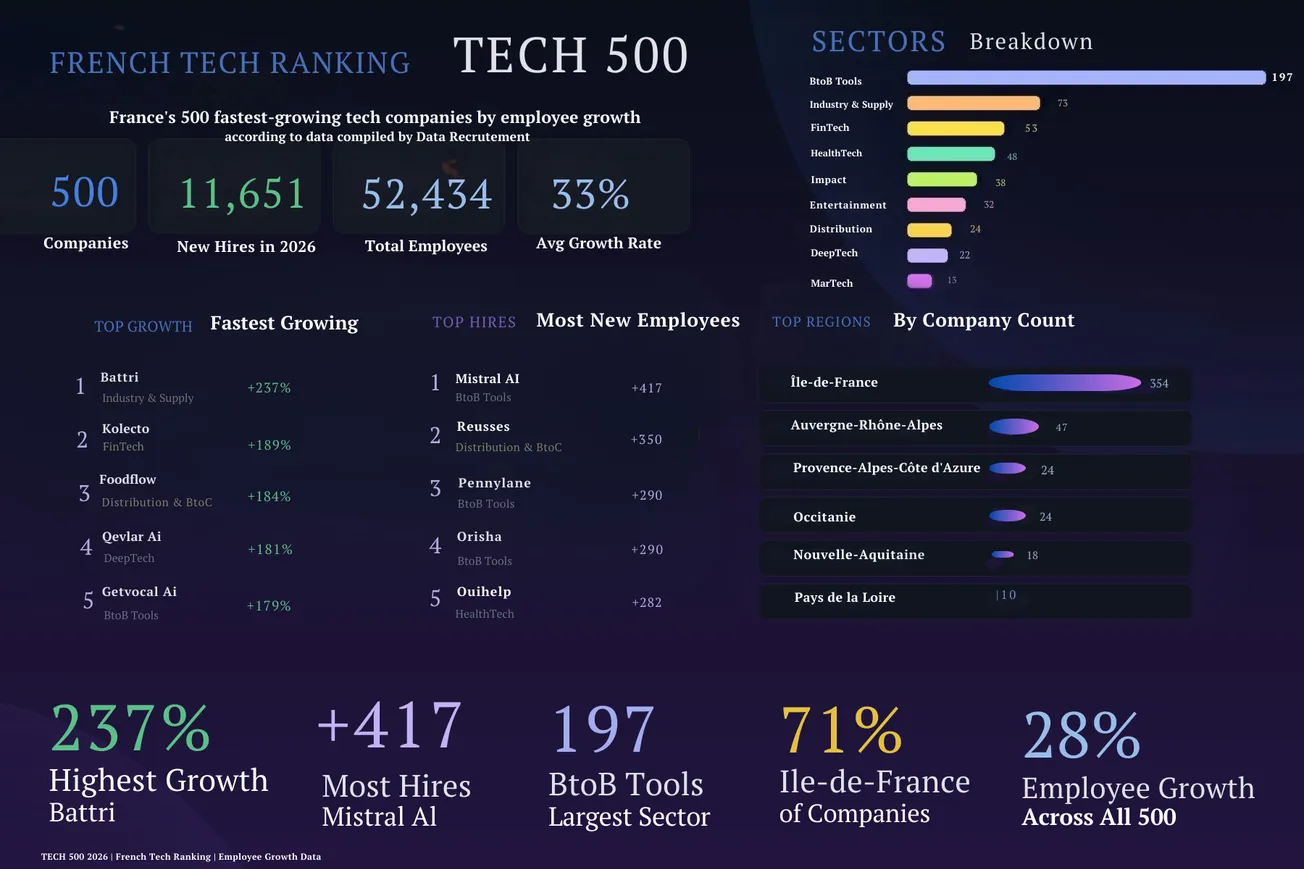

But first, let's go to the numbers. The annual TECH500 ranking, published by headhunting firm Data Recrutement, tracks workforce growth across more than 10,000 startups to identify the 500 that expanded their teams the fastest over the previous year. Now in its fourth edition, the 2026 ranking paints a cautiously optimistic picture: average headcount growth among the 500 winners hit 33%, up from 27% a year earlier and well above the estimated 16% revenue growth for French startups overall.

Thomas Bénard, CEO of Data Recrutement and the architect behind the ranking, said the uptick was a welcome development. With venture capital still tumbling and bankruptcies still chugging along, the nation's tech ecosystem is still going through a recalibration that is testing its resilience.

"Right now, it's tough," Bénard said. "And to see that there are still 500 companies that are growing strongly is positive. It means that maybe the rest of the companies could follow suit."

The list is a closely watched barometer because it's compiled with a fair degree of rigor. While the initial data is collected from LinkedIn, the numbers are then confirmed by direct follow-up with companies. Bénard estimates that compiling the ranking took roughly 600 hours, including contacting companies, cross-referencing LinkedIn data, and, in many cases, verifying figures directly with founders via calls, emails, and even text messages.

The methodology is deliberately simple: one criterion, headcount growth, measured by the change in permanent employees (CDIs) in France between January 1, 2025, and January 1, 2026. Companies must have between 10 and 5,000 employees, be headquartered in France, and fall into one of nine sector categories.

One important element of context, because the index measures hiring growth, the total number of jobs on the list can vary from year to year. If a company such as Doctolib has a slow hiring year, that can reduce the overall number. In this case, the total number of jobs in the TECH500 was 52,433, compared with 69,751 last year. But this year, companies on the TECH500 hired 11,643 (up 33%), compared with 10,685 last year (up 27%).

Ultimately, the firm sees the list as a tool for job seekers looking for fast-track career opportunities. And the data reveal a landscape where familiar names sit alongside startups that even seasoned ecosystem watchers may never have heard of.

Big names and surprises

The list can be sorted by absolute number of hires, and percentage hiring growth. You can open it in full screen here.

At the top of the absolute hiring charts, Mistral AI added a staggering 417 people, growing from 270 to 687 employees, a 154% increase that reflects the AI lab's extraordinary trajectory. Behind Mistral in raw headcount additions were Reusses, a clothing resale marketplace that added 350 new hires, followed by Electra, the EV charging network, with 129.

By percentage growth, the number one spot goes to Battri, a lithium-ion battery recycling startup based in Hauts-de-France, which grew from 11 employees to 26 — a 237% jump. Kolecto, a fintech serving France's small businesses, surged from 47 to 136 employees (189% growth). Foodflow, a food distribution platform, tripled its user base from 19 to 54. And Qevlar AI, a cybersecurity startup building what it calls a SOC platform that doesn't hallucinate, grew from 16 to 45.

While some of the names, like Mistral, are headline grabbers, many others are not. That's precisely the value Bénard sees in the ranking.

"We headhunt all day long, but there were companies that I didn't know at all," he said. Even Orisha, with 1,646 employees, the largest company on the entire list, was a new discovery for him.

"When you look at large-scale recruitment, you find well-known companies," Bénard said. "And the more we look at growth, the more we discover new companies. That's what's fun."

Lessons About French Tech Labels

Of the 40 companies in the prestigious Next40 program, selected based on fundraising and revenue, 14 had enough headcount growth to qualify for the TECH500. The Next40 companies that made the cut included Mistral AI, Pennylane, Voodoo, Electra, and Pigment. Of the FT120, 120 of its 80 additional companies appear.

"This proves that the TECH500 brings something else to candidates," Bénard said, "by bringing in companies that are growing their workforce and therefore synonymous with great careers for them."

The disconnect highlights a tension that has long simmered in the ecosystem: raising big rounds and growing revenue don't always translate into expanding teams. The TECH500, by contrast, specifically captures which companies are actually adding people on the ground in France.

B2B dominates, but industry and health are gaining

The sector breakdown confirms what anyone following French tech already suspects: B2B software remains the backbone of the ecosystem, accounting for about 39% of the entire ranking (197 out of 500 companies). That share dipped slightly from 2025, when it was even higher, but it remains overwhelmingly the largest category.

The more notable shifts happened elsewhere. Industry and supply chain companies gained 35 additional spots compared to the previous year, while HealthTech added 18 and FinTech gained 12. These sectors are clearly absorbing more talent, even as their individual growth rates cluster in a similar range — all hovering around 30%.

Bénard said he was initially surprised that no single sector dramatically outpaced the others.

"I really thought that deep tech and B2B tools would have stronger than average growth," he said. "And I was surprised that the impact sector was still so strong." Neither assumption held up. Impact companies, spanning greentech, decarbonation, and energy, remained strong recruiters, and the growth rates across sectors were remarkably even.

Size no longer matters

Last year's TECH500 carried a clear message: small is beautiful. The smallest startups were growing fastest. This year, that dynamic shifted. Companies of all sizes, from those with 50 or fewer employees to those with 500 to 1,000 employees, posted similar growth rates in the 30% to 40% range. Larger companies, in particular, recruited more aggressively than they had the year before.

That said, the average company on this year's list is smaller than in previous editions. Total headcount across the 500 companies came to about 52,400, down from roughly 58,000 previously. The threshold for making the list also rose: last year, 6% growth was enough to sneak in. This year, the minimum was 11%. That higher bar meant established names like Doctolib, Qonto, and BlaBlaCar, which appeared last year, no longer qualified.

The Paris question

Île-de-France accounts for 71% of the companies on the list, up from 66% last year. But that figure is somewhat misleading because it reflects where headquarters are registered, not where employees actually work. LinkedIn data shows that only about 45% of employees at TECH500 companies are actually based in the Paris region, with 55% spread across other parts of France.

Still, Paris remains disproportionately home to the country's fastest-growing companies, given its 20% share of the national population.

The AI factor

One detail stood out to Bénard as he compiled this year's edition: when his team added descriptions pulled from each company's website, AI showed up almost everywhere. From cybersecurity to HR tools to radiology, companies across every sector are now positioning themselves around artificial intelligence.

It's a reminder that AI isn't just a sector. It's becoming the default language of ambition for France's entire startup ecosystem. But in terms of sectors, the list doesn't break out AI as a distinct category.

Two other interesting, if not exactly shocking nuggets.

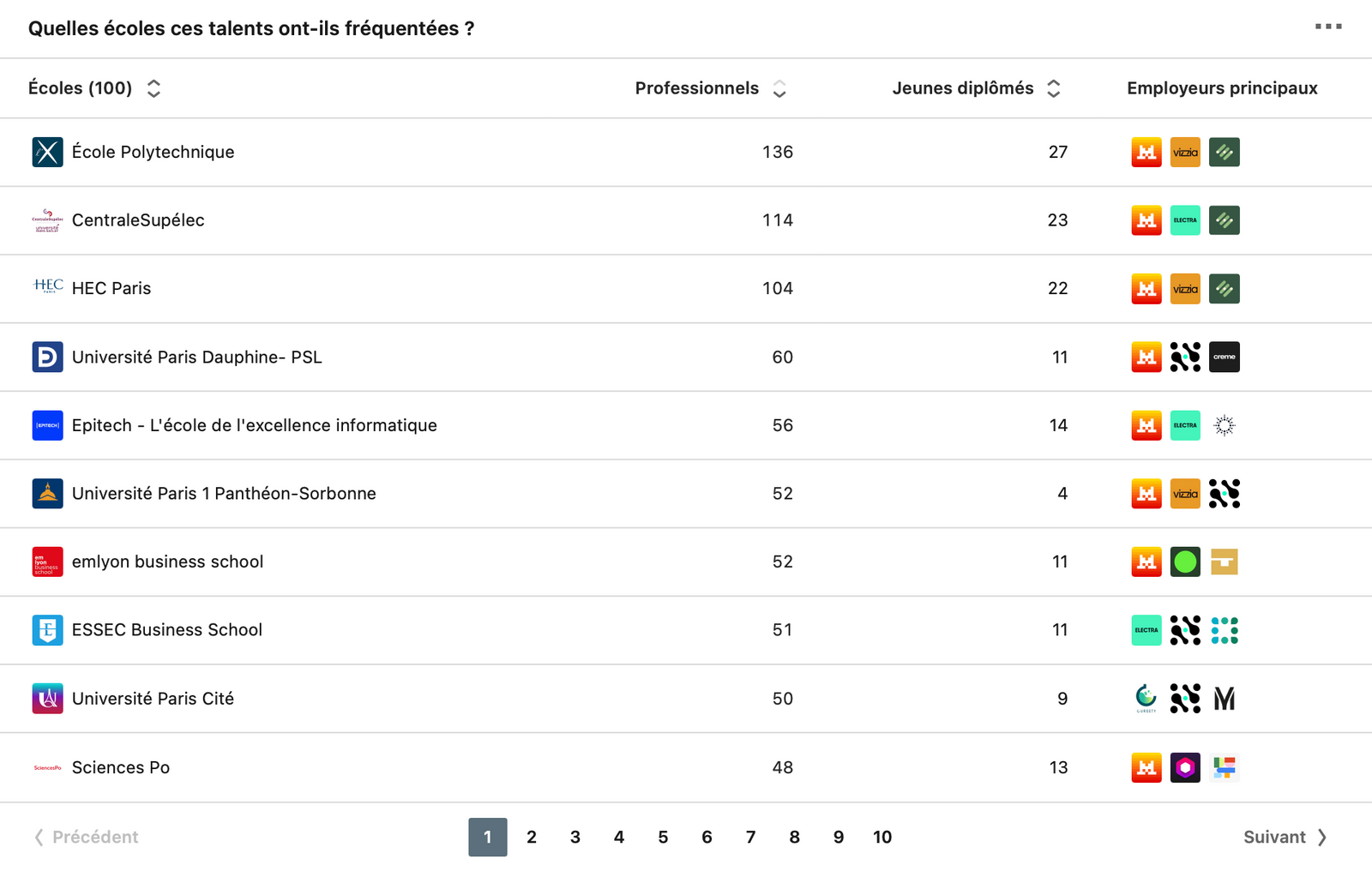

First, the universities that are the source of employees:

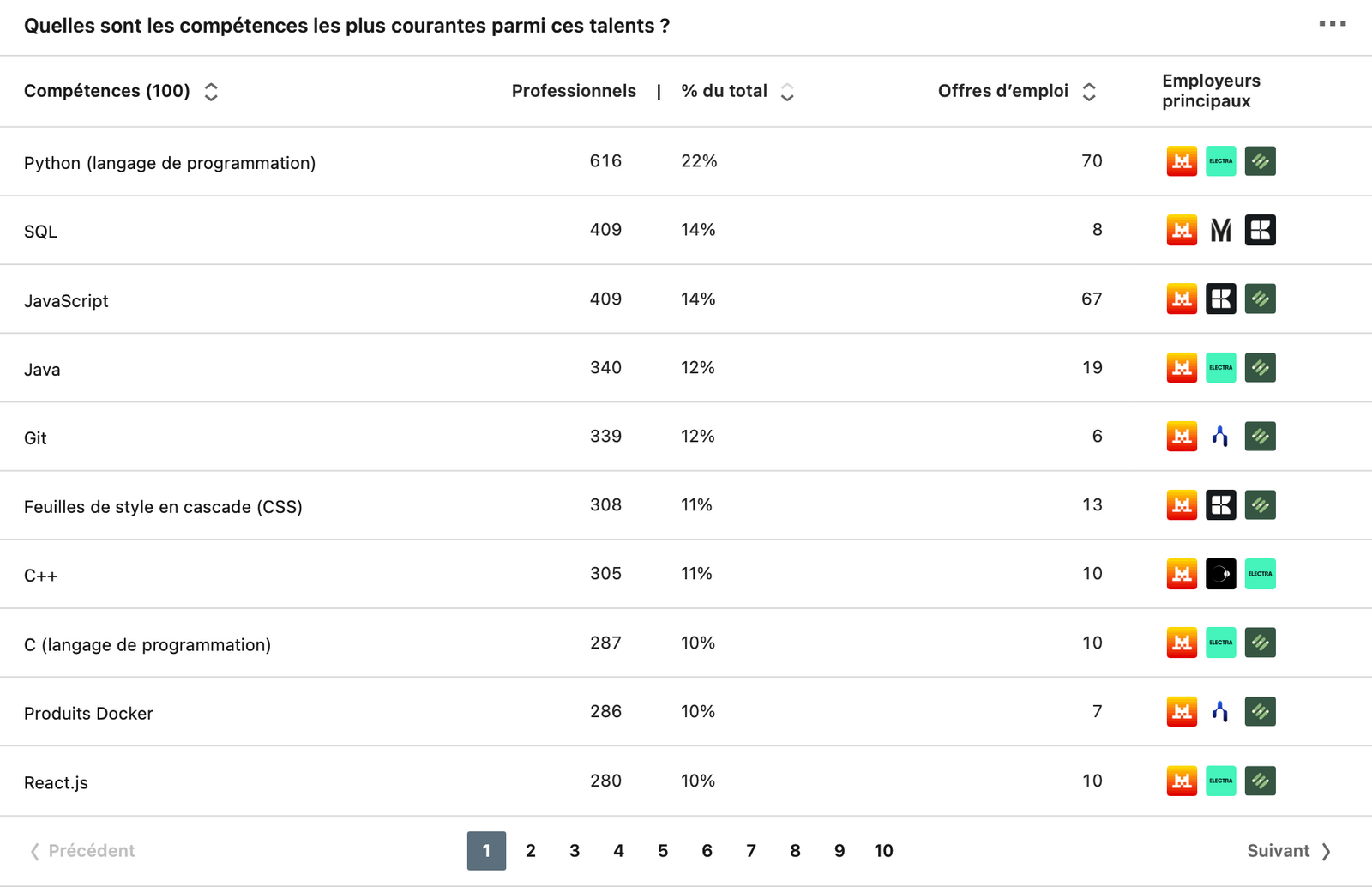

Second, the top coding skills: