Every year, billions of euros slip through the cracks of the global music economy. This includes unclaimed royalties due to misattributed metadata and “black box” payments that vanish into opaque databases.

For decades, this has been the industry’s open secret: The harder it’s become to track where a song is played, streamed, or remixed, the easier it’s been for money to go missing.

Now, a new French startup believes it can finally close that gap. Claimy, founded in Paris in 2023, has developed an AI-powered platform designed to locate and recover missing royalties at scale. The company, which recently raised a €1.5 million pre-seed round, is betting that smarter data and machine learning can bring long-overdue transparency and efficiency to one of the entertainment world’s most chaotic accounting systems.

And in the process, it can put much-needed money directly into the pockets of artists.

“The money is there,” said Claimy Co-Founder and CEO Pierre-Alban Mulliez. “It’s just got to be chased down.”

A Broken System in a Booming Market

You've probably heard for a long time that the music industry is dying. And for a long time, that appeared to be the case. However, it's now experiencing explosive growth. At least, in some aspects.

The gloomy music industry talk tends to revolve around traditional record sales. However, the music business is an incredibly complex and multi-layered beast. As it has become more so, it has expanded and grown rapidly overall in recent years.

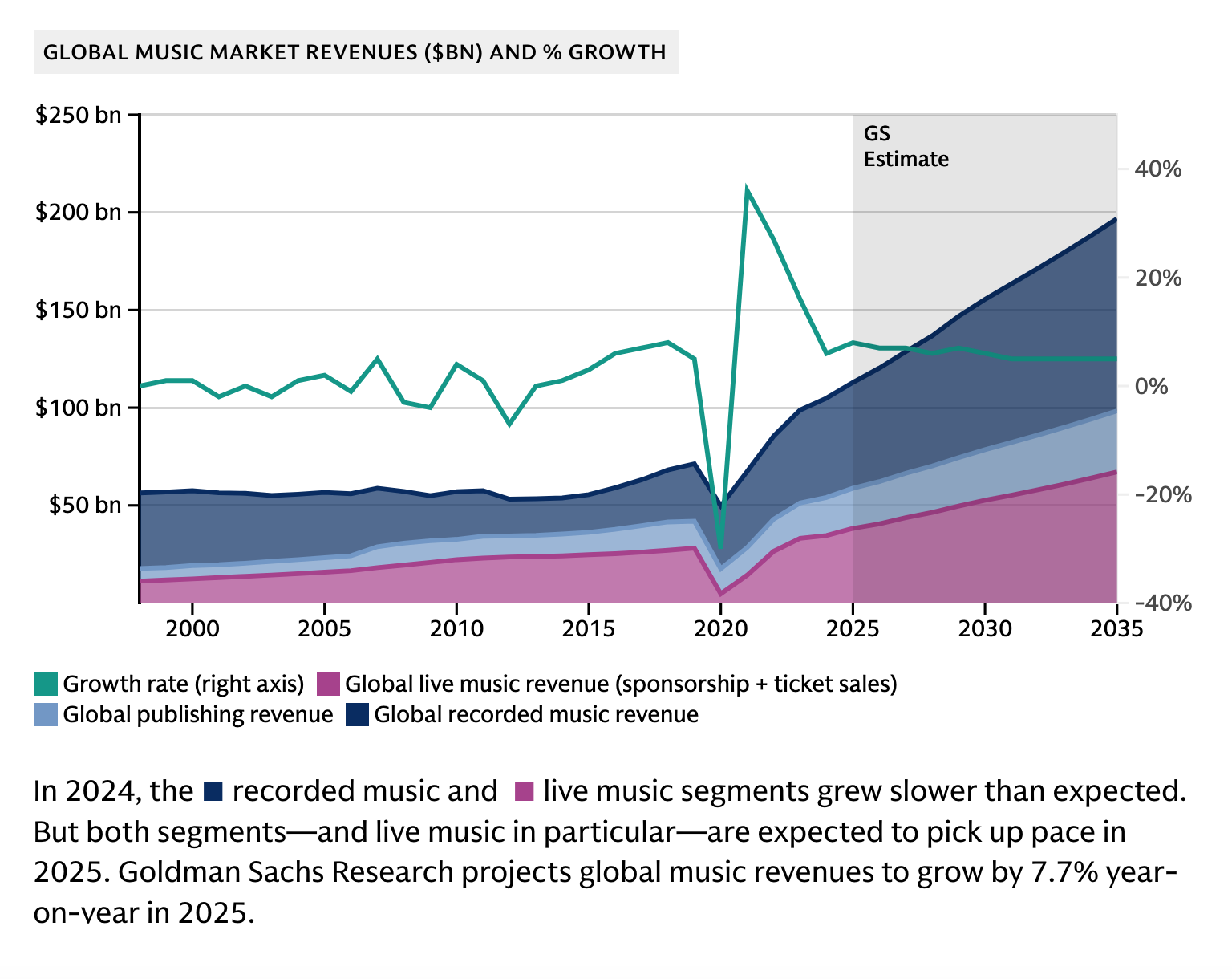

According to a closely watched annual "Music In The Air" report from Goldman Sachs released in August, estimates are that industry revenues will grow from $105 billion in 2025 to $200 billion 2035.

Streaming revenues are rising, catalog acquisitions are surging, and investment funds are buying rights from legacy acts to emerging creators alike.

Good news, right? For some, yes. But for many artists, well, no.

The infrastructure underpinning all of that growth remains archaic. The rights to various aspects, such as publishing, are highly fragmented, spawning what insiders call the industry’s “data crisis.” The global web of performing-rights organizations — ASCAP, BMI, SACEM, PRS, GEMA, and many others — maintain separate and often incomplete databases. Each uses different standards for identifying works. For creators, that means payments are often delayed, misrouted, or never sent at all. Keeping track of where music is played and who is owed what is chaotic.

To fix this, the U.S. Congress passed the Music Modernization Act in 2019, which helped create the Mechanical Licensing Collective (MLC), a nonprofit organization established to facilitate the payment of royalties to songwriters, composers, and music publishers.

Just to give you a sense of the scope of the problem, back in 2o22, the MLC said it had identified $424 million in "black box" royalties. That refers to money collected on behalf of publishers and songwriters who cannot be tracked down. That money just sits in a "black box." Historically, after unsuccessful attempts to determine who should rightfully receive this money, it is typically then redistributed to publishers rather than the artists. Despite some progress, by early 2024, MLC had whittled that down to $397 million in total royalties still pending distribution.

And that's just the U.S. Claimy estimates that 30 percent of global music rights go missing or are misallocated each year, representing roughly $15 billion in lost income.

The causes are manifold: mismatched databases between collection societies, inconsistent metadata, and the explosion of new formats such as remixes, sped-up tracks, and AI-generated songs that don’t map neatly to existing identifiers.

The lack of standardized metadata across the music industry means information gets lost as it passes through an unstandardized network of databases from labels to distributors, from distributors to digital service providers (DSPs), and from DSPs to performing rights organizations (PROs). When metadata is incomplete—missing songwriter names, publisher information, ISRC codes, or ISWC codes—royalties cannot be properly allocated.

Mulliez said that managing that complexity manually is impossible. Finding a solution presents both an administrative and technical challenge.

“When you’re a music publisher today, you’re probably registered in the U.S. with ASCAP," Mulliez said. "But the music is used and consumed worldwide on thousands of platforms in 200 countries, and every country has its own equivalent of ASCAP.”

Deep Music-Tech DNA

In addition to Mulliez, Claimy’s other co-founders are Gustave Larrouturou and Guillaume de Lavenère. The trio all emerged from MWM, the Paris-based startup behind the DJ app edjing Mix and one of France’s most successful creative-tech companies.

Their time there gave them firsthand exposure to both the promise and dysfunction of music technology: a world where millions make and distribute songs easily, but few can track how those songs generate revenue.

Mulliez, a graduate of ESCP Business School and Bocconi University, rose through MWM’s ranks to become head of operations before launching Claimy in late 2023. Larrouturou, with data-science training from HEC Paris and École Polytechnique, leads the technical side. De Lavenère brings product and growth expertise from gaming and app marketing.

AI-Powered Rights Administration Platform

The company was incubated at Agoranov, the science and tech incubator, and the HEC Incubator at Station F, and partnered early with Télécom Paris’s Listen Lab, Europe’s leading research group for audio signal processing and machine learning.

At the heart of Claimy’s platform is a rights-intelligence engine that cross-references data from multiple sources: collection societies such as SACEM and PRS for Music, monitoring services like BMAT that detect real-world song usage, and clients’ own catalog and payment files.

Claimy's core technology combines AI-powered analysis with comprehensive data integration to identify and recover missing royalties. The platform's approach involves several sophisticated components:

- Data Aggregation and Cross-Referencing: Claimy's system cross-references metadata, royalty rates, and collection data from collection societies like PRS for Music and SACEM with usage information from monitoring services like BMAT, a music tech company that tracks music ownership and usage, identifying 80 million songs daily and matching 27 billion tracks for collective management organizations, publishers, record labels, broadcasters, and DSPs globally. By combining these data sources, Claimy can identify discrepancies between what rightsholders should receive based on actual usage and what they're actually being paid.

- Audio Signal Processing and Machine Learning: Through its strategic partnership with Télécom Paris' Listen Lab, Claimy leverages cutting-edge research in machine listening. The Listen Lab is a joint laboratory launched by Télécom Paris with partners including Valeo, Bruitparif, and Music World Media, focused on developing AI systems to extract fundamental characteristics from sound signals useful for understanding them. The lab's research focuses on frugal learning based on scarce data, multi-view/multi-task/distributed learning, model-based deep learning, self-supervised learning, and learning of deep generative models.

- Automated Claims Generation: Claimy's algorithm compares a label's payment reports and catalog, then automatically generates claims for any discrepancies. This automation dramatically reduces the manual work typically required to identify and pursue missing royalties. The platform also analyzes revenue in real-time, allowing rightsholders to determine when payments are expected.

- Detection of Transformed Content: A particularly innovative aspect of Claimy's technology is its ability to identify altered audio versions across databases. The platform can detect remixes, covers, and even AI-generated tracks that may have been derived from original copyrighted works. This capability addresses an emerging challenge as AI music generation tools proliferate.

- Dashboard and Forecasting Tools: Claimy provides rightsholders with insights on where and when their works were played, along with revenue forecasting capabilities. The platform offers real-time dashboard access showing catalog exploitation, making the traditionally opaque process of royalty collection transparent and actionable.

Claimy’s system automates that workflow. It audits catalogs to ensure they’re correctly registered, identifies discrepancies between expected and received payments, and generates claims with “clear proof of usage.” The company’s machine-learning models also detects transformed content, such as remixes, covers, live recordings, and increasingly, AI-modified tracks.

“One big reason for missing rights,” Mulliez explained, “is that there are a lot of modified [songs], especially on forums like TikTok … sped-up, slowed-down versions, live videos … and the industry standard for music detection is still an algorithm called audio fingerprinting, which has been popularized by Shazam 25 years ago.”

Claimy’s more advanced signal-processing approach, developed with Télécom Paris, goes beyond simple fingerprinting to recognize these altered uses.

The Business Model

Claimy operates as a B2B SaaS platform for the intermediaries that handle the bulk of royalty accounting, such as publishers, labels, and rights-management firms. The company charges subscription fees for access to its platform and takes a success-based commission on royalties it helps recover.

As of this fall, Claimy has around 40 clients and manages over €6 million in music rights across 160,000 assets. Its roster spans global stars such as Céline Dion, David Guetta, and Aya Nakamura, as well as major European rights holders.

“We work with companies that own and manage music rights, publishers, labels, or more and more, investment funds that acquire music-rights catalogs,” said Mulliez. “They’re very good at acquiring and selling assets, but they’re not that great at managing their assets, especially in the music industry.”

For all the tech being developed, the music industry remains a closed community, based on tight relationships. The co-founders had already established their reputation to some degree in this world from working at MWM. But the funding round was as much about expanding those networks as it was about the cash.

Claimy’s €1.5 million Pre-Seed round came primarily from music-tech insiders. That starts with their former boss, Jean-Baptiste Hironde, founder and CEO of MWM, which he founded in 2012 and built into the world's largest publisher of creative music apps with over 600 million downloads in 182 countries. In addition to angel investors Flavien Kulawik and Ludwig Sels, the round also included money from Julien Codorniou, now at 20VC and formerly a vice-president at Facebook.

The company also secured public financing from Bpifrance and the Centre National de la Musique (CNM), France’s state-backed music-industry fund. Still, the market tailwinds are strong. France’s government has pledged €500 million in music-industry investment via Bpifrance by 2030, and global publishing revenues are projected to keep growing through the next decade. For investors, Claimy represents both a moral and economic play — a chance to align technology with fairness.

The presence of figures like Hironde and Codorniou signals strong confidence from executives who have seen both the consumer and enterprise sides of music tech. Their networks also give Claimy entrée to the major platforms, such as YouTube, Meta, and TikTok.

He added that the next round will likely include a venture fund “to really scale on the business side.” As Mulliez noted in the interview, the decision to raise exclusively from individuals rather than funds was deliberate.

“Our first round was really done exclusively with business angels. No funds got in. It’s only people that know the industry, that know the pain that we’re addressing,” he said.

Scaling Beyond France and the UK

With streaming volumes exploding and generative-AI music multiplying variations of existing songs, the complexity of royalty tracking will only increase. Claimy’s bet is that automation and data science can outpace that complexity — turning what has long been a reactive, manual process into a proactive, predictive one.

Its roadmap includes expanding detection to AI-generated and derivative audio, enhancing forecasting dashboards for clients, and broadening coverage to neighboring rights (for performers and labels, not just publishers). The company also sees potential in licensing its technology as white-label infrastructure for collection societies or catalog funds.

Yet challenges remain. Claimy must negotiate data-access agreements with collection societies and navigate privacy and copyright regulations, especially as the EU moves toward stricter AI and data-protection laws. Competitors such as Kobalt, Songtrust, and Orfium are also racing to integrate more AI into their platforms.

Today, Claimy is operational in France and the United Kingdom, integrated with SACEM and PRS for Music. The next step is global expansion, including the USA, Germany, and then eventually Japan, Korea, and Australia.

The company currently employs 10 people, including seven in Paris, three in London, and plans to grow cautiously.

“We don’t think we need to scale too much on the technical side,” Mulliez said. “We prefer to hire very key people with experience, and we’re working with three ambassadors, music rights experts who have been working in the industry for 20 or 30 years, who are helping us target the right people at the right time so that we can penetrate markets.”